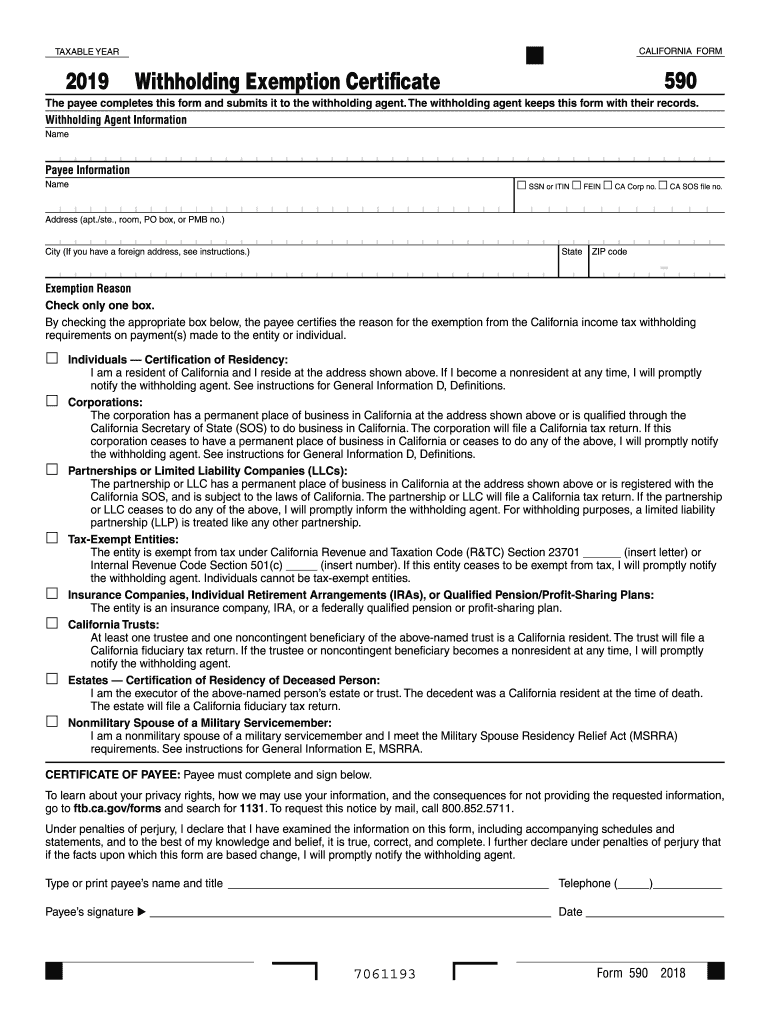

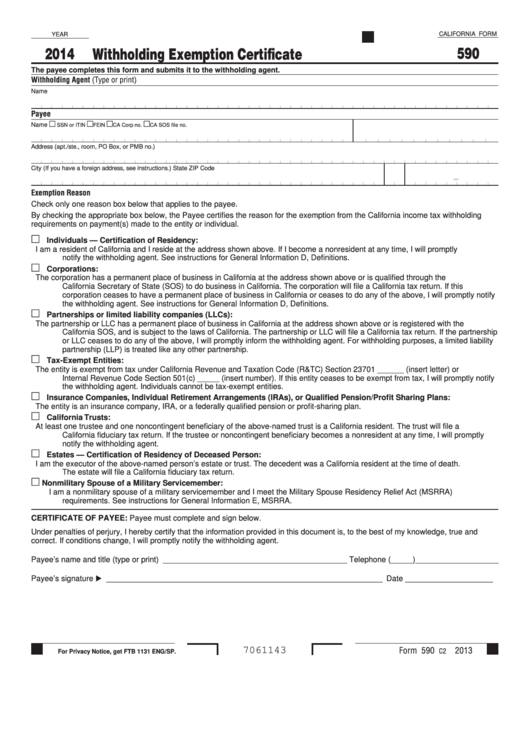

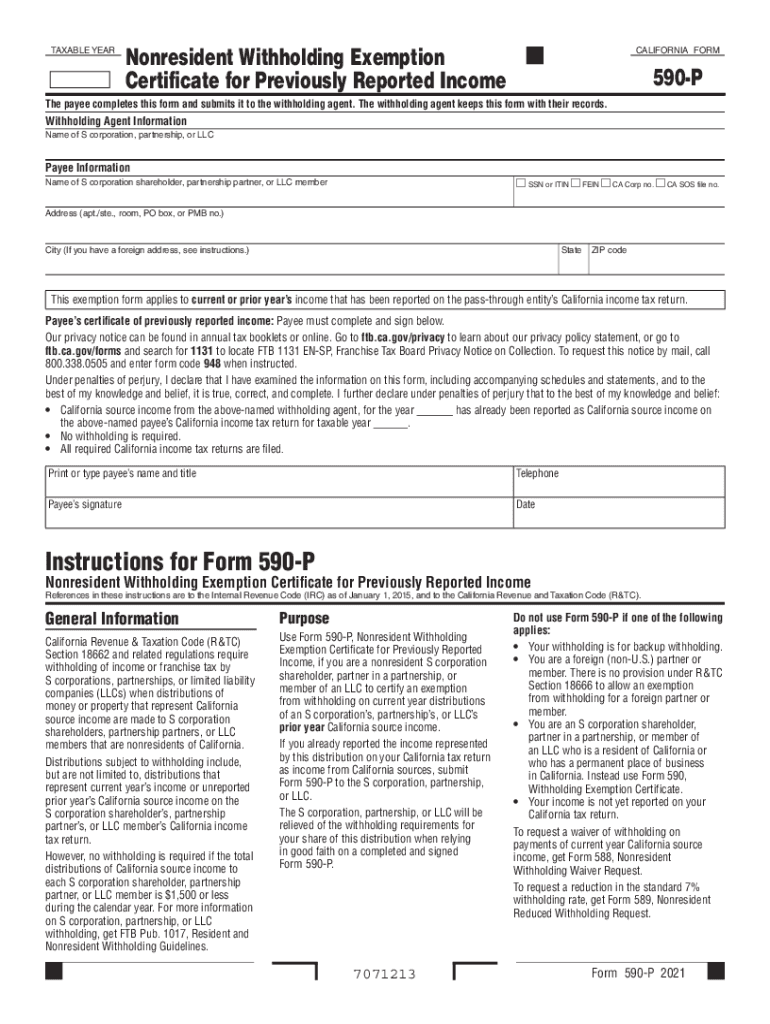

California Form 590 Who Is The Withholding Agent – There are many reasons that one could fill out the form to request withholding. This is due to the requirement for documentation, exemptions to withholding, as well as the amount of required withholding allowances. It doesn’t matter what reasons someone is deciding to file an Application There are a few things to remember.

Withholding exemptions

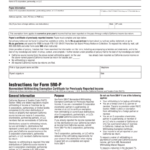

Non-resident aliens must submit Form 1040 NR at least once every year. However, if your requirements meet, you may be eligible to request an exemption from withholding. The exemptions you will find here are yours.

To complete Form 1040-NR, add Form 1042-S. This document is required to declare the federal income tax. It provides the details of the amount of withholding that is imposed by the tax withholding agent. When you fill out the form, ensure that you provide the accurate information. The information you provide may not be provided and could result in one individual being treated.

The withholding rate for nonresident aliens is 30 percent. Non-resident aliens may be qualified for exemption. This is the case if your tax burden less than 30 percent. There are many exclusions. Some of them are for spouses or dependents like children.

Generally, withholding under Chapter 4 entitles you for an amount of money back. Refunds can be claimed under sections 1401, 1474, and 1475. Refunds are to be given by the withholding agents who is the person who withholds taxes at source.

relational status

A form for a marital withholding can simplify your life and aid your spouse. You’ll be surprised by how much you can deposit to the bank. It is difficult to decide which of the many options you’ll choose. You must be cautious in when you make a decision. Making a mistake can have expensive negative consequences. It’s not a problem if you just adhere to the instructions and pay attention. If you’re lucky you may even meet acquaintances on your travels. Today is your birthday. I’m hoping you’ll use it against them to secure the sought-after diamond. In order to complete the job correctly, you will need to seek the assistance of a tax professional who is certified. It’s worthwhile to create wealth over the course of a lifetime. Online information is easy to find. TaxSlayer is a reputable tax preparation firm.

Amount of withholding allowances claimed

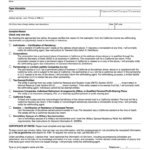

It is important to specify the amount of withholding allowances which you would like to claim on the Form W-4. This is critical since your wages could depend on the tax amount you have to pay.

Many factors influence the amount you qualify for allowances. Your income can determine the amount of allowances available to you. A larger allowance might be granted if you make an excessive amount.

You may be able to avoid paying a large tax bill by selecting the correct amount of tax deductions. In fact, if you file your annual income tax return, you may even receive a refund. But, you should be aware of your choices.

Do your research, like you would with any other financial decision. To figure out the amount of tax withholding allowances that need to be claimed, you can utilize calculators. A specialist could be a good option.

Formulating specifications

If you’re an employer, you have to collect and report withholding taxes on your employees. The IRS may accept forms to pay certain taxes. It is possible that you will require additional documentation such as the reconciliation of your withholding tax or a quarterly tax return. Here’s some details on the different tax forms for withholding categories as well as the deadlines for filing them.

Your employees might require you to file withholding tax returns in order to receive their bonuses, salary and commissions. In addition, if you paid your employees promptly, you could be eligible for reimbursement of taxes withheld. It is important to note that certain taxes are county taxes must be considered. In some situations, withholding rules can also be different.

According to IRS rules, you must electronically file withholding forms. When you file your national tax return be sure to provide your Federal Employer Identification number. If you don’t, you risk facing consequences.