State Tax Withholding Forms Self Employed – There are a variety of reasons why a person could choose to submit a withholding application. Withholding exemptions, documentation requirements as well as the quantity of the allowance requested are all factors. No matter the reason someone chooses to file an Application, there are several things to remember.

Exemptions from withholding

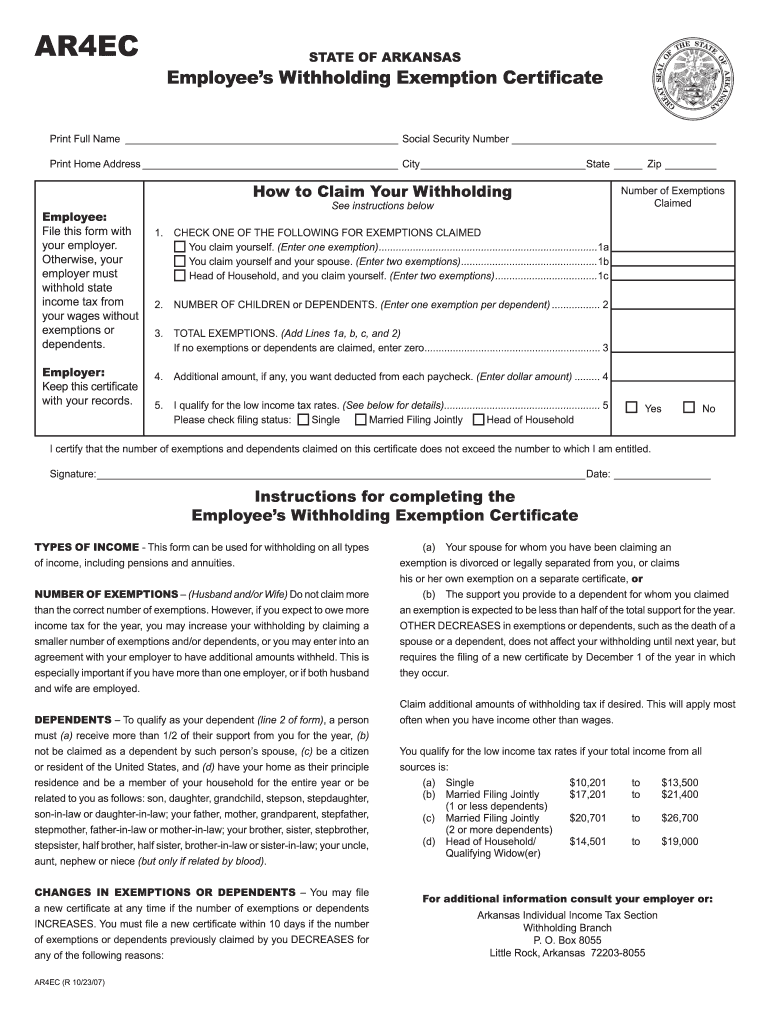

Non-resident aliens must complete Form 1040-NR every year. If you fulfill the minimum requirements, you could be able to submit an exemption from withholding form. The exclusions are accessible to you on this page.

The first step in submitting Form 1040 – NR is to attach the Form 1042 S. This document is required to record the federal income tax. It provides the details of the withholding of the withholding agent. Complete the form in a timely manner. One person may be treated differently if this information is not provided.

Non-resident aliens have to pay 30 percent withholding. Exemption from withholding could be possible if you’ve got a the tax burden lower than 30 percent. There are a variety of exemptions. Some of them are for spouses, dependents, or children.

In general, you’re eligible for a reimbursement under chapter 4. Refunds can be claimed under Sections 1401, 1474 and 1475. Refunds are given to the agent who withholds tax that is the person who collects the tax at the source.

relational status

An official marital status form withholding forms will assist both of you get the most out of your time. You’ll be amazed by the amount of money you can deposit to the bank. It can be difficult to decide which of the many options is most attractive. There are certain things that you shouldn’t do. Making the wrong decision will cost you dearly. However, if you adhere to the directions and keep your eyes open for any potential pitfalls, you won’t have problems. If you’re lucky enough, you might find some new friends while driving. Today is your anniversary. I’m hoping you’ll utilize it in order to find that elusive diamond. To complete the task correctly, you will need to get the help of a tax professional who is certified. The little amount is worthwhile for the life-long wealth. You can get a lot of information on the internet. TaxSlayer is a well-known tax preparation firm, is one of the most useful.

Number of claimed withholding allowances

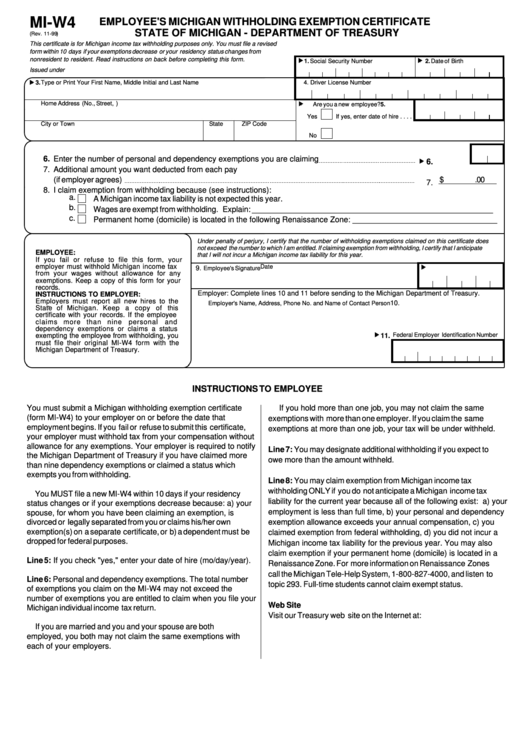

The Form W-4 must be completed with the amount of withholding allowances you wish to claim. This is critical as your paychecks may depend on the tax amount you pay.

Many factors affect the amount you are eligible for allowances. The amount of allowances you are eligible for will be contingent on the income you earn. If you have a high income, you can request an increase in your allowance.

A tax deduction appropriate for you could help you avoid large tax payments. You may even get a refund if you file your annual tax return. However, you must choose the right method.

Research as you would in any financial decision. Calculators will help you determine the amount of withholding that should be demanded. You may also talk to an expert.

filing specifications

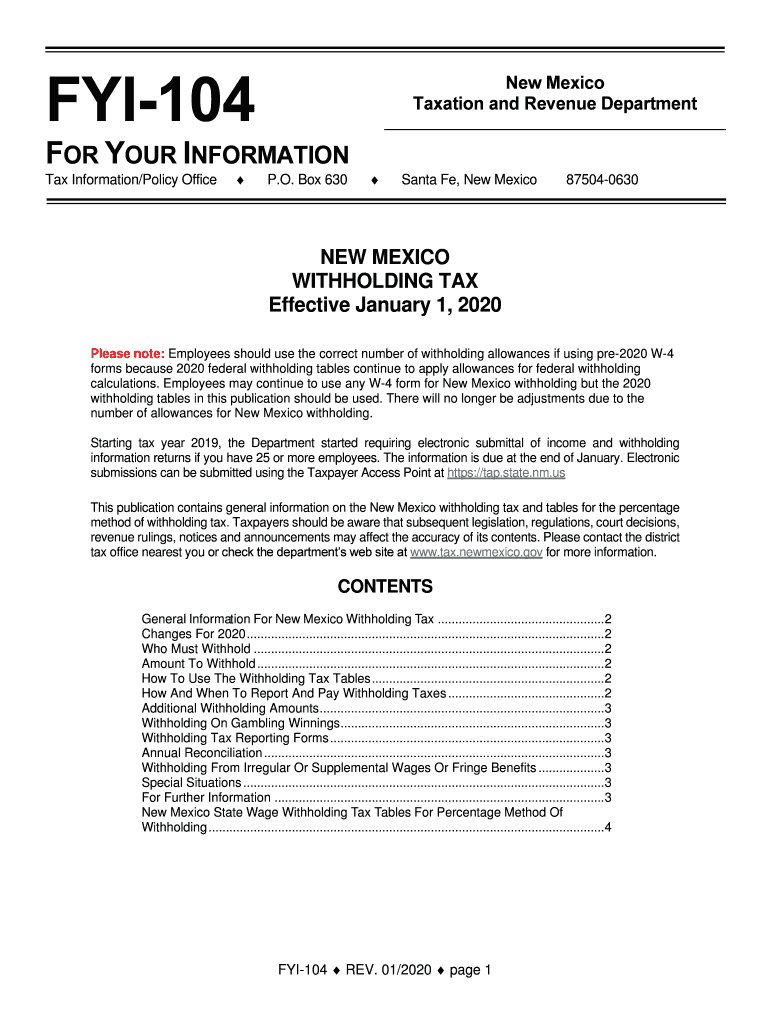

Withholding taxes from your employees must be reported and collected when you’re an employer. For a limited number of these taxes, you may provide documentation to the IRS. You may also need additional forms that you could require like the quarterly tax return or withholding reconciliation. Here are some details regarding the various forms of withholding tax forms and the deadlines for filing.

To be qualified for reimbursement of tax withholding on compensation, bonuses, salary or any other earnings received from your employees, you may need to file a tax return for withholding. Also, if your employees receive their wages on time, you may be eligible to get reimbursement of withheld taxes. Be aware that certain taxes may be taxes imposed by the county, is important. There are special methods of withholding that are suitable in certain situations.

The IRS regulations require that you electronically submit withholding documents. Your Federal Employer Identification number must be included when you submit your national tax return. If you don’t, you risk facing consequences.