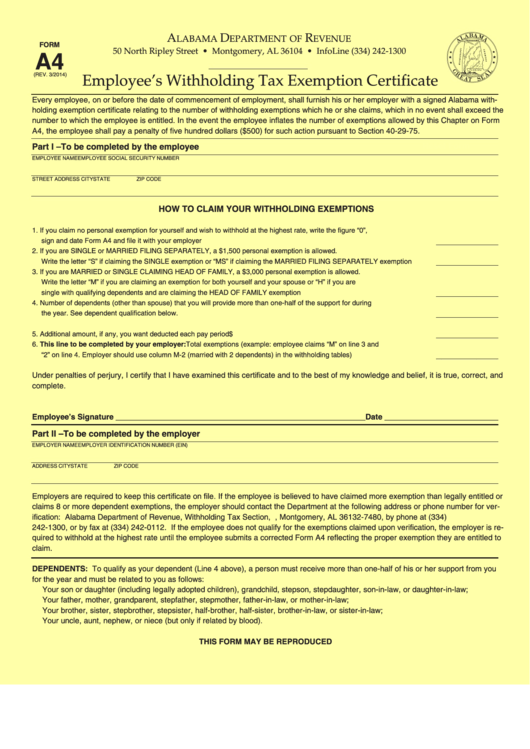

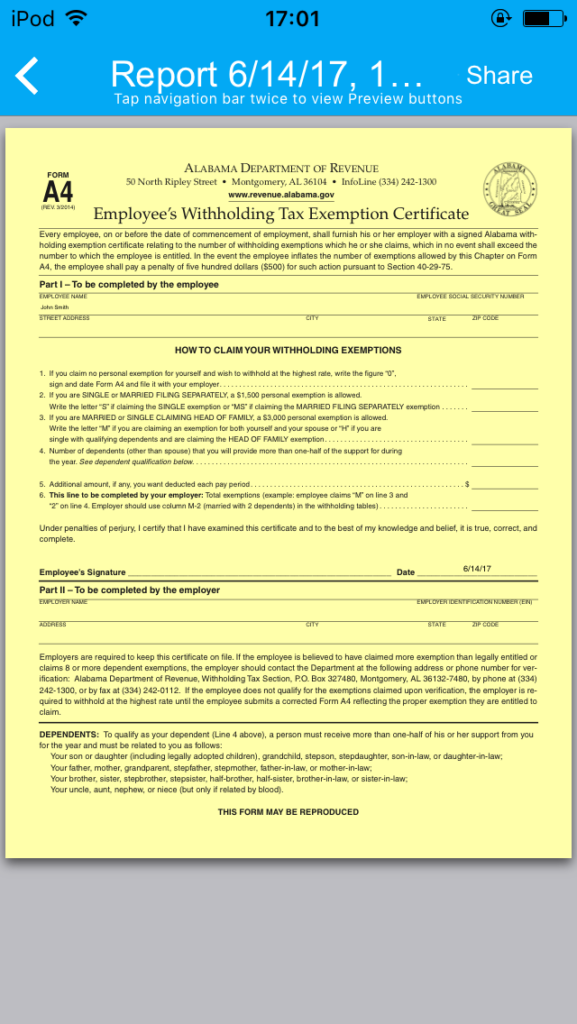

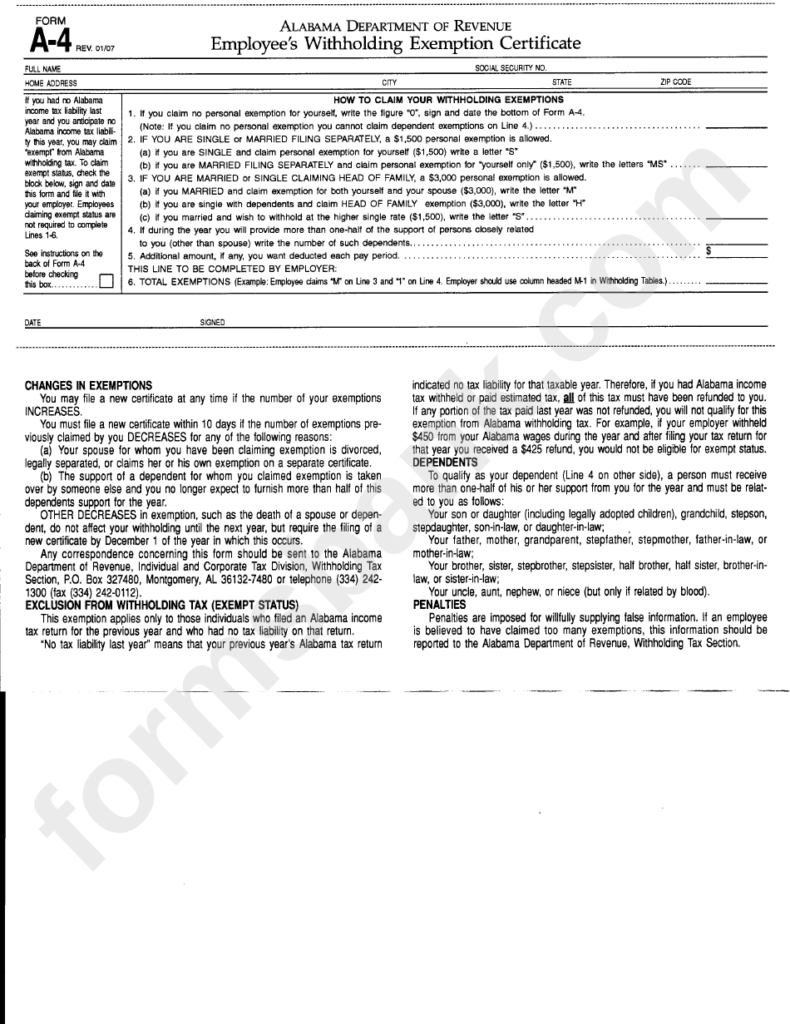

Alabama State Withholding Form A 4 2024 – There are many reasons why one might choose to fill out forms withholding. This includes the documentation requirements, withholding exclusions, and the requested withholding allowances. You must be aware of these aspects regardless of the reason you decide to submit a request form.

Exemptions from withholding

Nonresident aliens are required to complete Form 1040-NR every year. If you meet the requirements you may be eligible for an exemption to withholding. The exclusions you can find on this page are yours.

The first step to submitting Form 1040 – NR is attaching the Form 1042 S. The form is used to record the federal income tax. It outlines the withholding by the withholding agent. Make sure you enter the right information when filling out this form. This information may not be disclosed and cause one person to be treated.

The 30% non-resident alien tax withholding rate is 30. The tax burden of your business should not exceed 30% to be eligible for exemption from withholding. There are numerous exemptions. Some are for spouses and dependents, like children.

Generally, a refund is available for chapter 4 withholding. Refunds can be claimed in accordance with Sections 1401, 1474 and 1475. Refunds are to be given by the agents who withhold taxes, which is the person who collects taxes at the source.

Status of relationships

The marital withholding form is a good way to simplify your life and help your spouse. You will be pleasantly surprised at how much money you can put in the bank. The challenge is in deciding which one of the many options to choose. Certain things are best avoided. Making the wrong choice could result in a costly loss. If you follow the instructions and adhere to them, there won’t be any issues. If you’re lucky, you could make new acquaintances on your trip. Today is the anniversary date of your wedding. I’m hoping you’re able to use this against them to obtain that wedding ring you’ve been looking for. For a successful approach, you will need the aid of a qualified accountant. A little amount could create a lifetime’s worth of wealth. Information on the internet is readily available. TaxSlayer is a reputable tax preparation firm.

Amount of withholding allowances claimed

When filling out the form W-4 you submit, you must specify the amount of withholding allowances you asking for. This is crucial since the tax withheld can affect the amount of tax taken from your paychecks.

A number of factors can determine the amount that you can claim for allowances. The amount you’re eligible to claim will depend on your income. If you earn a substantial amount of money, you could get a bigger allowance.

Tax deductions that are appropriate for your situation could aid you in avoiding large tax payments. Even better, you might even get a refund if your annual income tax return is completed. It is important to be cautious when it comes to preparing this.

As with any financial decision you make it is crucial to do your homework. To figure out the amount of withholding allowances that need to be claimed, utilize calculators. Other options include talking to a specialist.

Submission of specifications

Employers are required to pay withholding taxes to their employees and report the amount. You may submit documentation to the IRS to collect a portion of these taxes. An annual tax return, quarterly tax returns or the reconciliation of withholding tax are all examples of paperwork you might need. Here’s a brief overview of the different tax forms, and when they must be filed.

You may have to file tax returns for withholding for the income you receive from your employees, including bonuses, commissions, or salary. You could also be eligible to get reimbursements for tax withholding if your employees received their wages in time. Remember that these taxes may be considered to be taxation by the county. There are also unique withholding methods that are utilized in certain circumstances.

In accordance with IRS regulations, you have to electronically submit withholding forms. It is mandatory to provide your Federal Employer ID Number when you submit your national income tax return. If you don’t, you risk facing consequences.