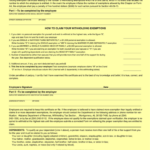

Alabama Child Support Withholding Form – There are a variety of reasons why a person might decide to file a withholding application. Withholding exemptions, documentation requirements and the amount of allowances for withholding required are just a few of the factors. Whatever the reasons someone is deciding to file the Form There are a few things to remember.

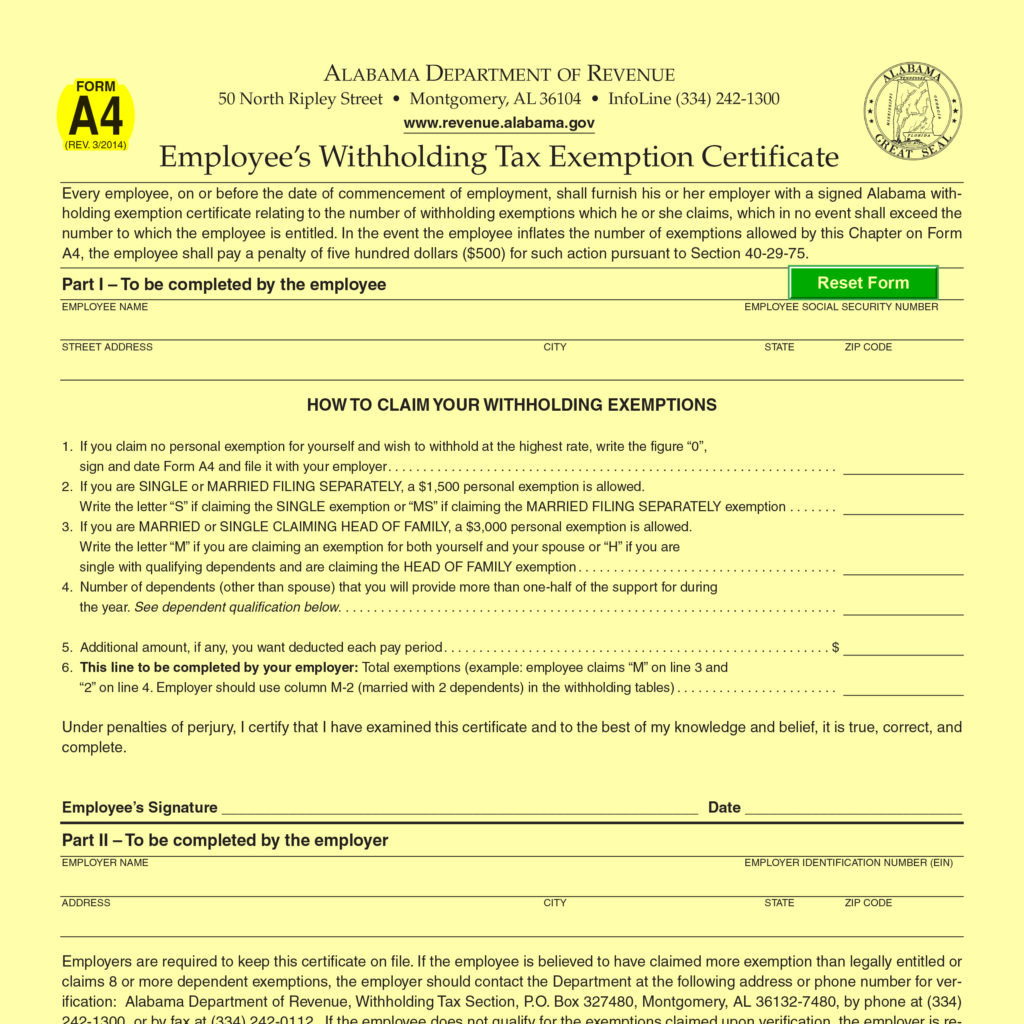

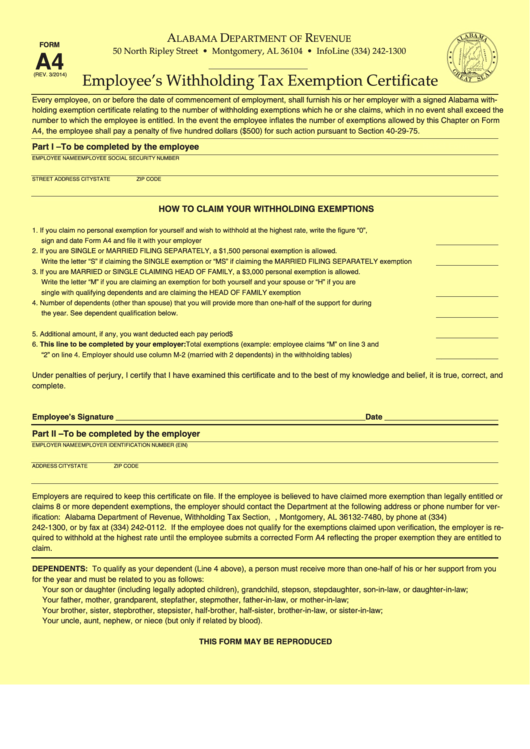

Exemptions from withholding

Non-resident aliens must submit Form 1040 NR once every year. If your requirements meet, you may be eligible to apply for an exemption from withholding. This page lists the exclusions.

When you submit Form1040-NR, attach Form 1042S. The form provides information about the withholding done by the tax agency that handles withholding for federal tax reporting to be used for reporting purposes. It is important to enter exact information when you fill out the form. You may have to treat one person if you don’t provide the correct information.

Nonresident aliens have the option of paying a 30% tax on withholding. Exemption from withholding could be granted if you have a an income tax burden of lower than 30%. There are numerous exemptions. Some are specifically designed to be used by spouses, while some are intended for use by dependents, such as children.

In general, you’re eligible for a reimbursement under chapter 4. Refunds can be claimed under sections 1401, 1474, and 1475. These refunds are provided by the agent who withholds tax (the person who is responsible for withholding tax at source).

Relational status

An official marital status form withholding forms will assist you and your spouse make the most of your time. The bank may be surprised by the amount of money that you deposit. The problem is picking the right bank among the numerous possibilities. There are some things you must be aware of. Unwise decisions could lead to expensive results. However, if the instructions are followed and you pay attention, you should not have any problems. If you’re lucky enough to meet some new acquaintances while driving. Today is the anniversary day of your wedding. I’m hoping that they will turn it against you in order to assist you in getting the elusive engagement ring. For a successful approach you’ll need the aid of a qualified accountant. The little amount is worth it for a lifetime of wealth. You can get a lot of information online. TaxSlayer is a reputable tax preparation company.

The amount of withholding allowances made

It is important to specify the amount of the withholding allowance you wish to claim on the Form W-4. This is important because the tax amount withdrawn from your paychecks will be affected by how you withhold.

You may be eligible to request an exemption for your head of household in the event that you are married. Your income level will also affect the amount of allowances you can receive. If you have high income, you might be eligible to receive more allowances.

A proper amount of tax deductions can help you avoid a significant tax charge. You could actually receive a refund if you file your annual tax return. It is important to be cautious regarding how you go about this.

As with any financial decision, you must do your research. To determine the amount of withholding allowances that need to be claimed, you can use calculators. A better option is to consult to a professional.

Specifications for filing

Withholding tax from your employees have to be collected and reported when you’re an employer. You may submit documentation to the IRS for some of these taxes. Other documents you might need to submit include an withholding tax reconciliation as well as quarterly tax returns and an annual tax return. Here’s some details about the different tax forms and when they need to be submitted.

To be eligible to receive reimbursement for withholding taxes on the pay, bonuses, commissions or other income earned by your employees it is possible to file a tax return for withholding. If you also pay your employees on time, you might be eligible for reimbursement for any taxes taken out of your paycheck. It is crucial to remember that some of these taxes are local taxes. Additionally, there are unique withholding practices that can be implemented in specific conditions.

You are required to electronically submit tax withholding forms as per IRS regulations. If you are filing your national revenue tax returns, be sure to provide your Federal Employee Identification Number. If you don’t, you risk facing consequences.

Gallery of Alabama Child Support Withholding Form

Alabama State Tax Withholding Form 2022 W4 Form