Pennsylvania Withholding Tax Form Rev – There are numerous reasons that a person may decide to submit an application for withholding. These include documents required, the exclusion of withholding and withholding allowances. Whatever the reason one chooses to submit an application there are some points to be aware of.

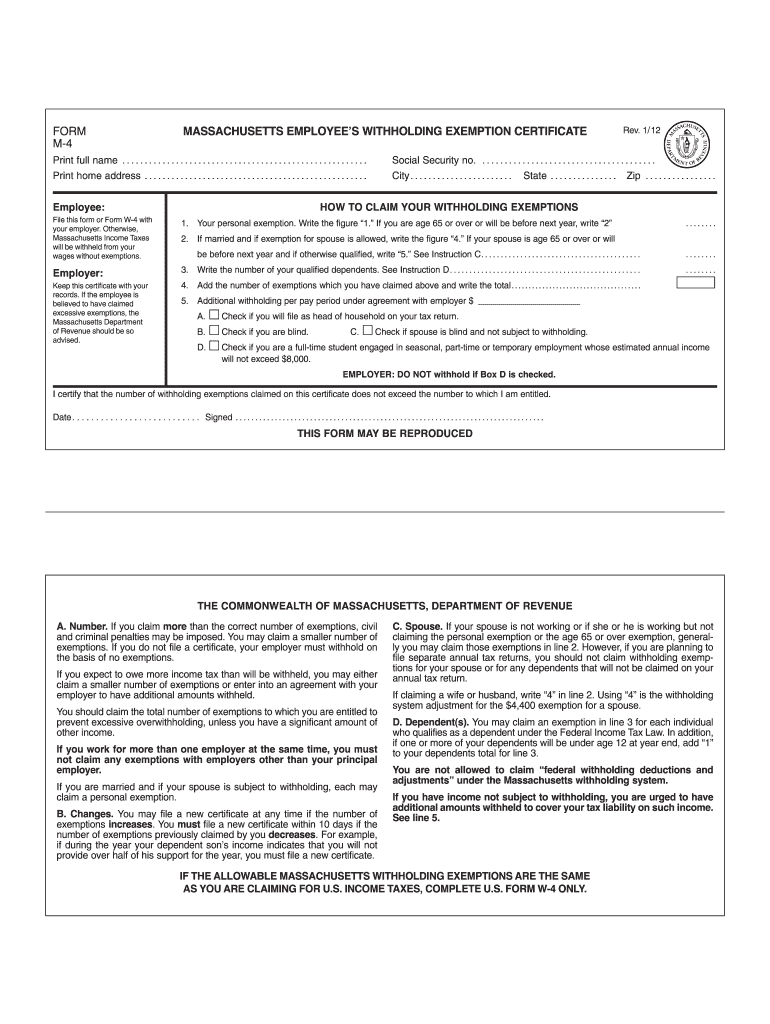

Withholding exemptions

Nonresident aliens are required at least once a year to submit Form1040-NR. You may be eligible to submit an exemption form for withholding, if you meet all the requirements. This page will provide the exclusions.

The application of Form 1042-S to Form 1042-S is a first step to submit Form 1040-NR. The form is used to record the federal income tax. It details the amount of withholding that is imposed by the tax withholding agent. It is important to enter correct information when you complete the form. If the correct information isn’t given, a person could be taken into custody.

The non-resident alien withholding rate is 30 percent. A nonresident alien may be qualified for an exemption. This is if your tax burden is less than 30 percent. There are many different exemptions. Certain of them are applicable to spouses or dependents, like children.

You may be entitled to a refund if you violate the rules of chapter 4. Refunds are allowed according to Sections 1471-1474. Refunds are given to the withholding agent the person who withholds taxes from the source.

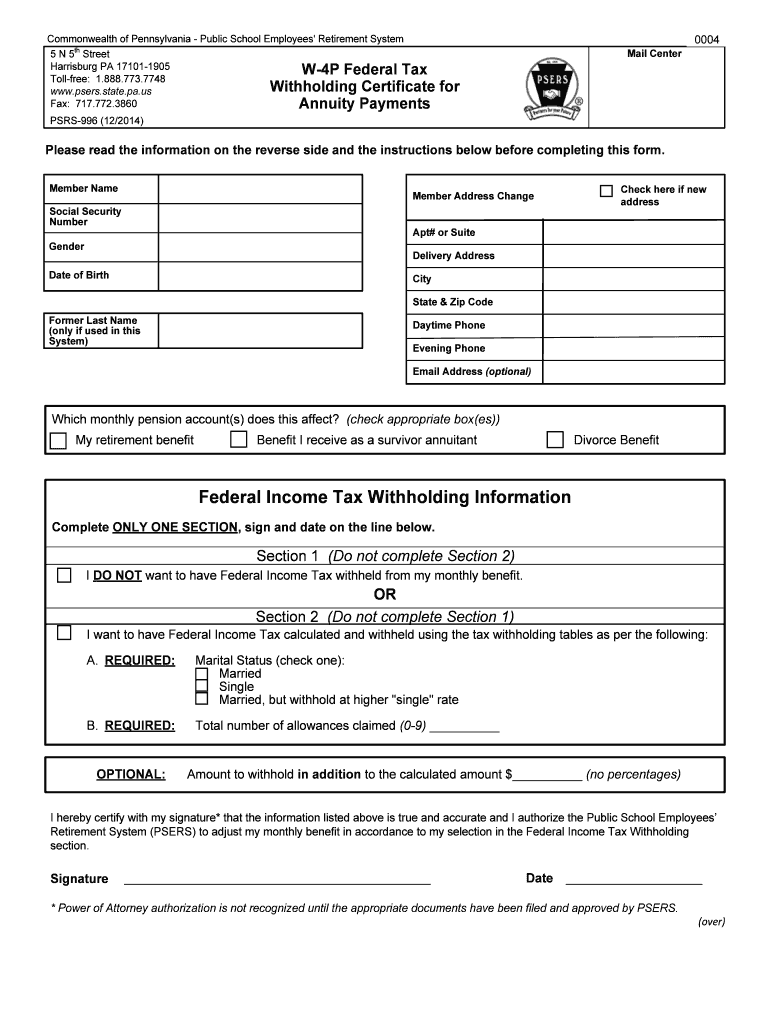

Status of the relationship

You and your spouse’s work is made simpler by a proper marriage-related status withholding document. Furthermore, the amount of money you can put at the bank can be awestruck. The challenge is picking the right bank among the numerous possibilities. There are certain things that you shouldn’t do. Unwise decisions could lead to costly consequences. It’s not a problem when you follow the directions and be attentive. If you’re lucky, you may make new acquaintances on your trip. Since today is the date of your wedding anniversary. I’m hoping you’ll be able to take advantage of it to locate that perfect engagement ring. It will be a complicated task that requires the expertise of a tax professional. A small amount of money can create a lifetime of wealth. You can find plenty of information on the internet. TaxSlayer is a reputable tax preparation firm.

The amount of withholding allowances claimed

The form W-4 should be completed with the amount of withholding allowances you want to claim. This is important because the withholdings will effect on the amount of tax is taken from your pay checks.

There are a variety of factors that affect the amount of allowances requested.If you’re married as an example, you may be eligible to claim an exemption for head of household. The amount of allowances you can claim will depend on the income you earn. If you earn a substantial income, you can request a higher allowance.

A proper amount of tax deductions could help you avoid a significant tax cost. In addition, you could be eligible for a refund when your annual income tax return is completed. Be sure to select your method carefully.

Like any financial decision, you should conduct your own research. Calculators are a great tool to determine how many withholding allowances are required to be claimed. In addition contact an expert.

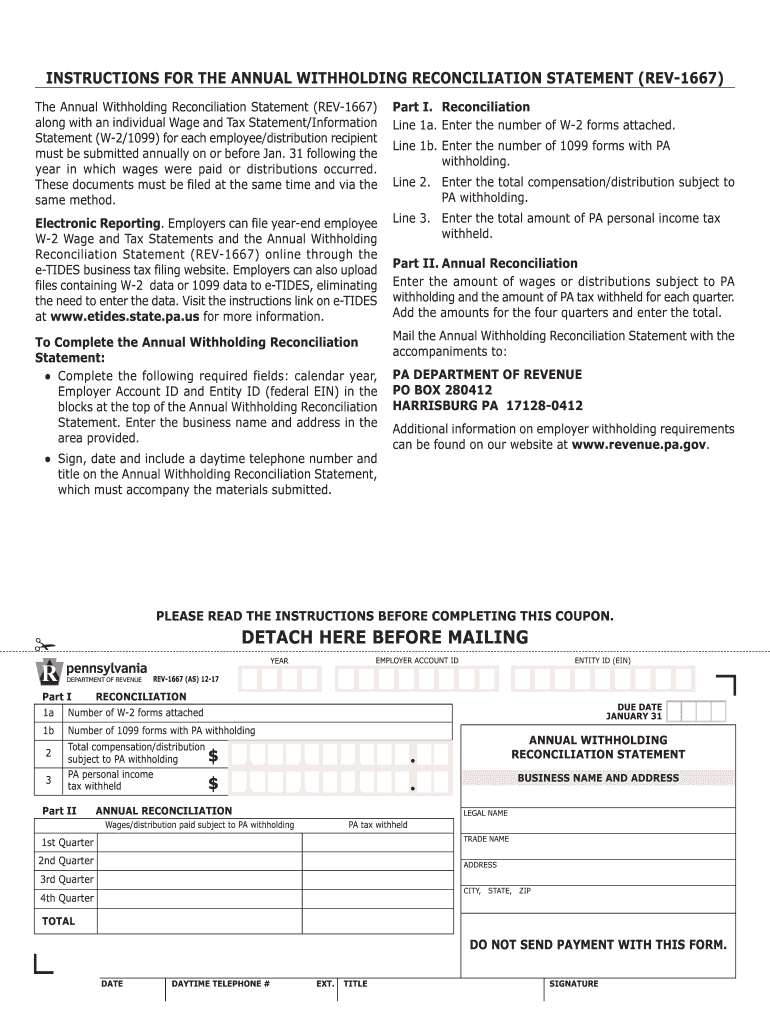

Specifications to be filed

Employers should report the employer who withholds tax from their employees. For a limited number of these taxes, you may provide documentation to the IRS. A reconciliation of withholding tax or an annual tax return for quarterly filing, as well as the annual tax return are all examples of additional documents you could need to submit. Here’s some information about the different tax forms and when they must be filed.

In order to be eligible for reimbursement of tax withholding on salary, bonus, commissions or other revenue that your employees receive You may be required to submit a tax return withholding. Additionally, if your employees are paid punctually, you might be eligible for reimbursement of withheld taxes. It is important to remember that certain taxes could be considered to be local taxes. Additionally, there are unique withholding practices that can be implemented in specific conditions.

You are required to electronically submit withholding forms in accordance with IRS regulations. Your Federal Employer Identification number must be listed when you point your national tax return. If you don’t, you risk facing consequences.