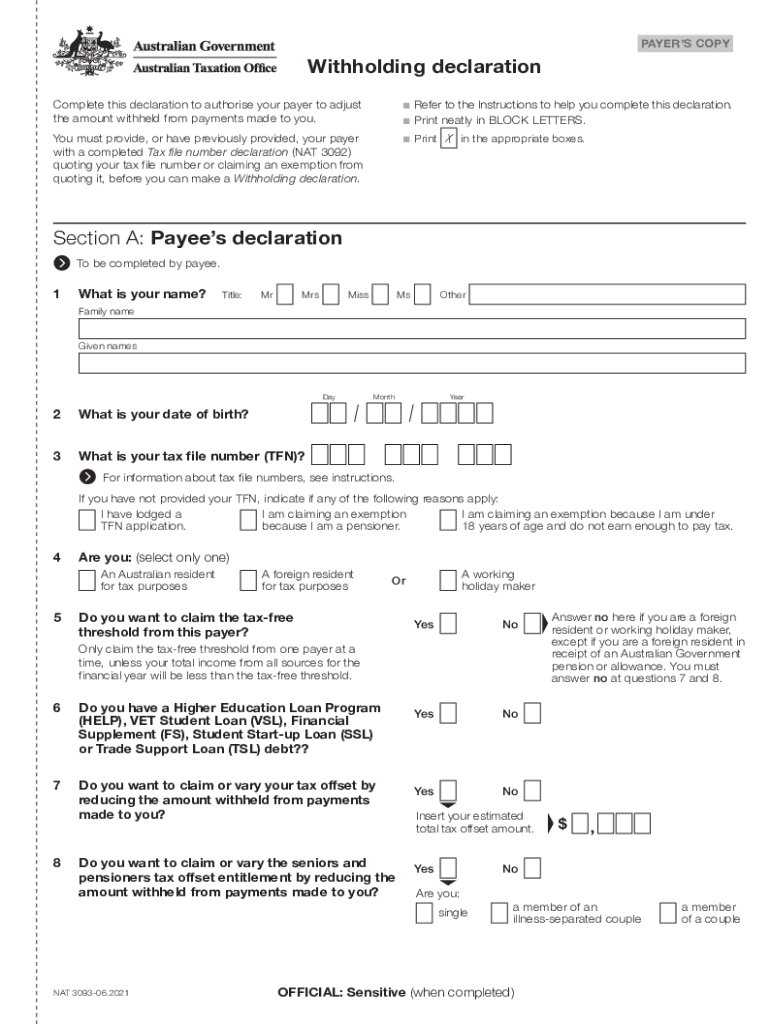

Withholding Tax Declaration Form Luxembourg – There are many reasons one might decide to fill out a withholding form. These include the need for documentation and withholding exemptions. Whatever the reasons someone is deciding to file a Form There are a few points to be aware of.

Exemptions from withholding

Non-resident aliens have to file Form 1040NR once per year. If your requirements are met, you could be eligible for an exemption from withholding. This page you’ll see the exemptions that are available to you.

The first step to filling out Form 1040-NR is to attach Form 1042 S. The form contains information on the withholding process carried out by the tax agency that handles withholding for federal tax reporting for tax reporting purposes. Make sure you enter the right information when filling out this form. There is a possibility for a person to be treated if the correct information is not provided.

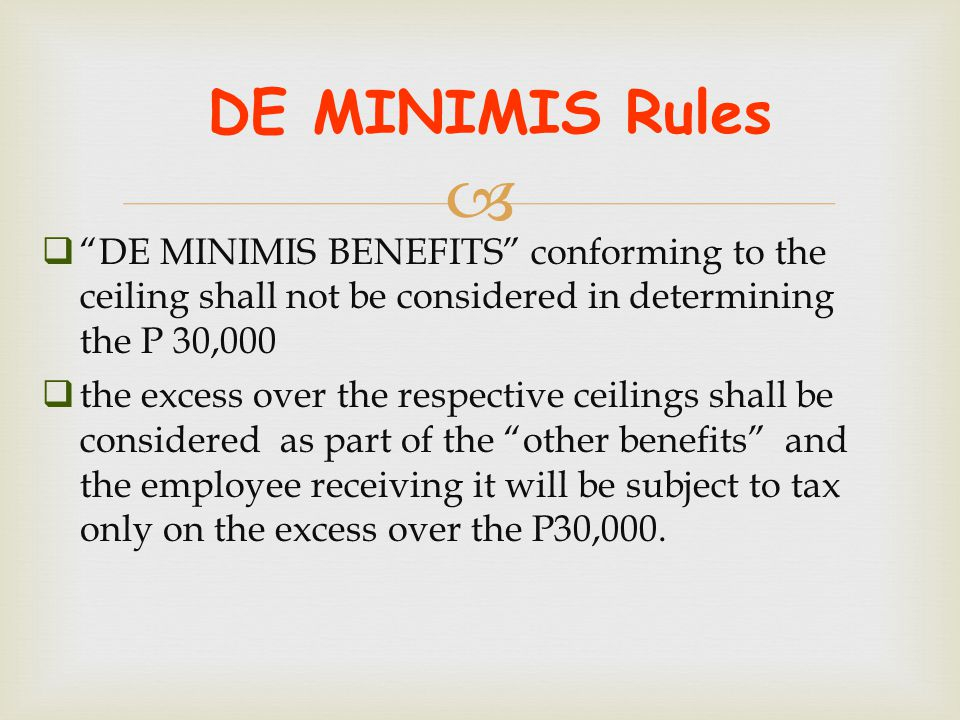

Non-resident aliens are subject to the 30% tax withholding rate. If the tax you pay is lower than 30 percent of your withholding, you may be eligible to receive an exemption from withholding. There are a variety of exemptions that are available. Certain of them apply to spouses and dependents such as children.

Generally, you are entitled to a reimbursement under chapter 4. Refunds can be made according to Sections 471 through 474. Refunds are given to the agent who withholds tax the person who withholds the tax at the source.

Status of relationships

A marriage certificate and withholding form will help both of you to make the most of your time. You will be pleasantly surprised by how much you can put in the bank. Knowing which of the many possibilities you’re likely choose is the challenge. There are certain things you should avoid. A bad decision could cause you to pay a steep price. But if you adhere to the directions and be alert for any pitfalls You won’t face any issues. If you’re lucky enough to meet some new acquaintances driving. Today is your birthday. I’m hoping they can reverse the tide in order to assist you in getting the perfect engagement ring. It will be a complicated job that requires the experience of an expert in taxation. The small amount of money you pay is worth the lifetime of wealth. You can find plenty of information on the internet. TaxSlayer is a trusted tax preparation firm is one of the most helpful.

There are many withholding allowances that are being claimed

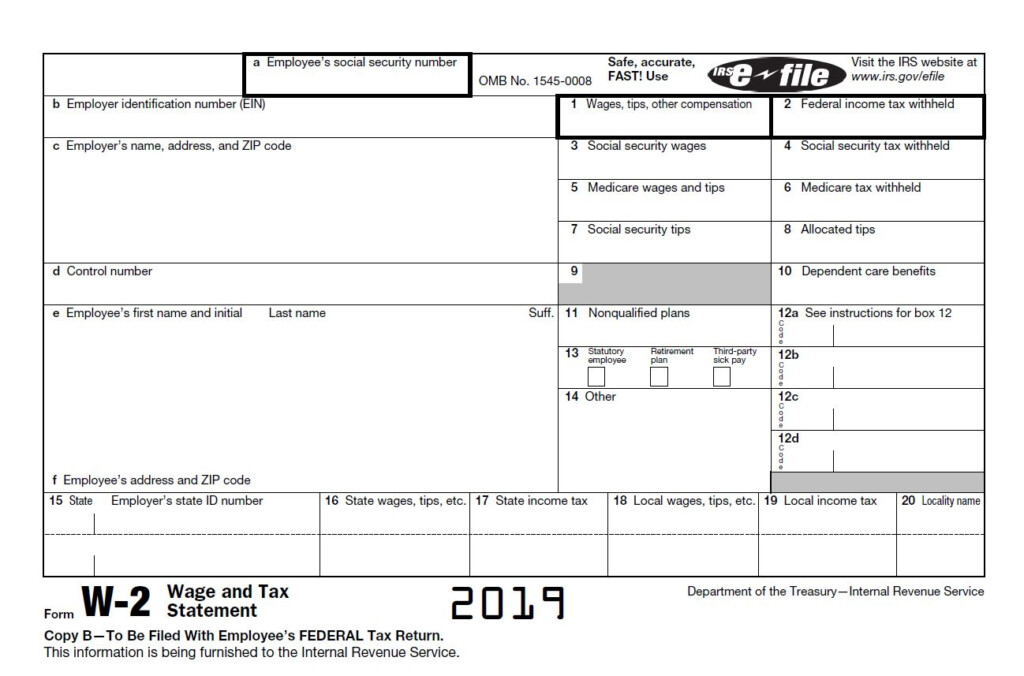

On the W-4 form you fill out, you need to specify how many withholding allowances are you asking for. This is crucial since the tax withheld can affect how much is taken from your pay check.

The amount of allowances you receive will depend on the various aspects. For example If you’re married, you could be eligible for an exemption for the head of household or for the household. The amount you can claim will depend on your income. If you have a high income, you may be eligible for an increased allowance.

A tax deduction that is suitable for you can allow you to avoid tax bills. In addition, you could even get a refund if your annual income tax return is completed. It is important to be cautious about how you approach this.

As with any financial decision you make it is crucial to research the subject thoroughly. To determine the amount of withholding allowances that need to be claimed, utilize calculators. Another option is to talk to a professional.

Formulating specifications

Employers must collect withholding taxes from their employees and then report it. For a limited number of the taxes, you are able to provide documentation to the IRS. A reconciliation of withholding tax or an annual tax return for quarterly filing, or the annual tax return are examples of additional paperwork you might have to file. Here is more information on the different types of withholding taxes as well as the deadlines for filing them.

In order to be qualified for reimbursement of withholding tax on the compensation, bonuses, salary or other income earned by your employees, you may need to submit withholding tax return. Also, if employees are paid on time, you may be eligible to get reimbursement of withheld taxes. Remember that these taxes could be considered as county taxes. Furthermore, there are special tax withholding procedures that can be applied under particular situations.

In accordance with IRS regulations Electronic submissions of withholding forms are required. When you submit your national tax return be sure to include your Federal Employer Identification number. If you don’t, you risk facing consequences.