Ny Employee Withholding Form 2024 Live In Another State – There stand a digit of reasons for a person to decide to complete a withholding form. This is due to the requirement for documentation, exemptions from withholding, as well as the amount of withholding allowances. Whatever the reason the person decides to fill out the form, there are a few aspects to consider.

Exemptions from withholding

Non-resident aliens are required to complete Form 1040-NR once a year. If you meet the conditions, you could be eligible for exemptions from the withholding form. This page lists all exemptions.

The first step in submit Form 1040 – NR is attaching the Form 1042 S. This form lists the amount withheld by the tax authorities for federal income tax reporting purposes. Make sure you enter the correct information when filling in this form. It is possible for one person to be treated if the information is not given.

Non-resident aliens are subjected to the 30% tax withholding rate. Tax burdens is not to exceed 30% to be exempt from withholding. There are numerous exemptions. Some of them are only applicable to spouses and dependents like children.

You are entitled to an amount of money if you do not follow the provisions of chapter 4. Refunds are granted according to Sections 1401, 1474 and 1475. Refunds are to be given by the tax withholding agents that is, the person who withholds taxes at the source.

Relational status

A proper marital status withholding will make it easier for both of you to do your work. It will also surprise you how much you can make a deposit to the bank. The problem is choosing the right option from the multitude of options. There are certain items you must avoid. Unwise decisions could lead to costly negative consequences. If you follow the guidelines and follow them, there shouldn’t be any issues. If you’re lucky you might make new acquaintances on your trip. Today marks the day you celebrate your wedding. I hope you are in a position to leverage this against them in order to acquire that wedding ring you’ve been looking for. If you want to get it right you’ll need the assistance of a certified accountant. It’s worthwhile to accumulate wealth over a lifetime. Information on the internet is easy to find. TaxSlayer and other trusted tax preparation companies are some of the most reliable.

the number of claims for withholding allowances

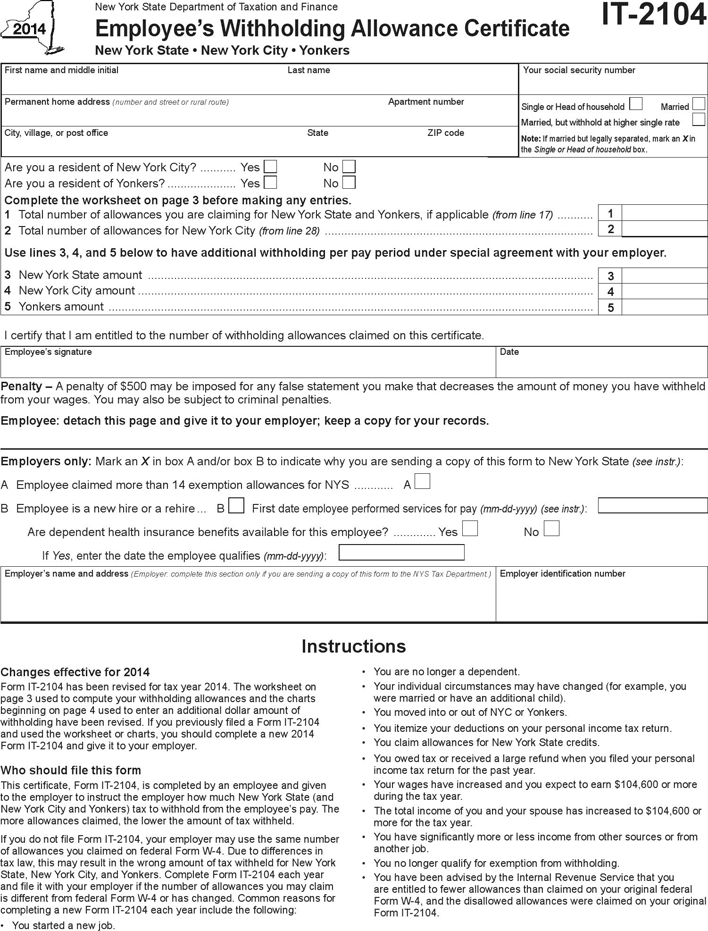

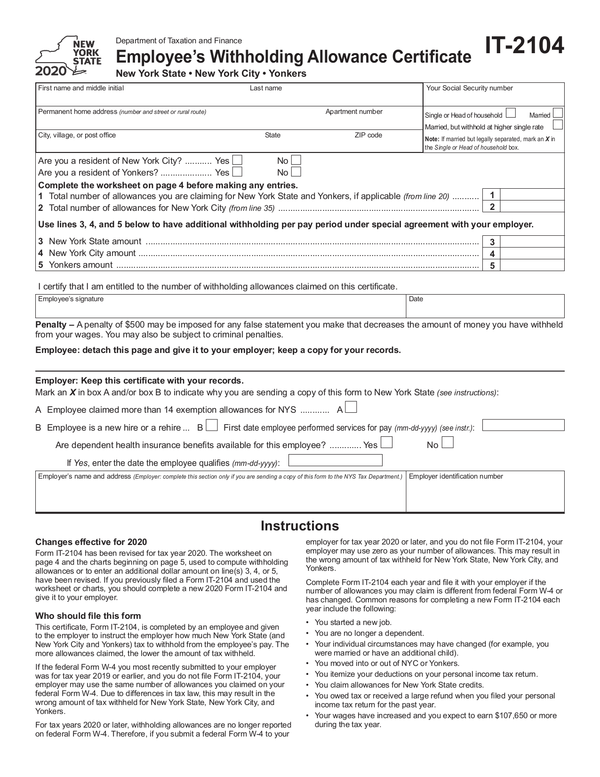

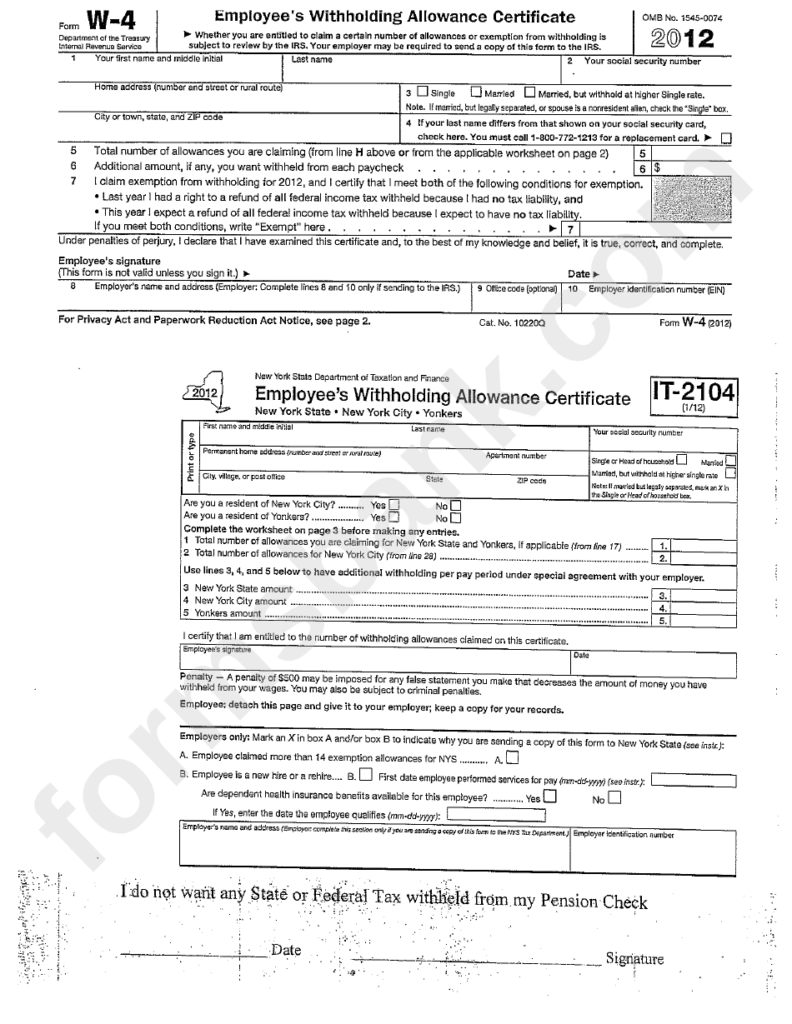

On the Form W-4 that you submit, you must indicate how many withholding allowances are you seeking. This is essential as the tax withheld can affect how much is taken from your paychecks.

A number of factors can influence the amount you qualify for allowances. Your income level also affects how many allowances you are entitled to. You could be eligible to claim a greater allowance if you make a lot of money.

A tax deduction appropriate for you could allow you to avoid tax obligations. If you submit your annual tax returns and you are entitled to a refund. It is essential to pick the right method.

It is essential to do your homework as you would with any other financial choice. Calculators can assist you in determining how much withholding allowances are required to be claimed. It is also possible to speak with an expert.

Filing specifications

Withholding taxes on employees need to be collected and reported when you are an employer. For a limited number of these taxes, you can send paperwork to IRS. An annual tax return and quarterly tax returns as well as tax withholding reconciliations are just a few examples of paperwork you might require. Here’s a brief overview of the different tax forms, and when they must be submitted.

Employees may need you to file withholding tax returns to be eligible for their wages, bonuses and commissions. It is also possible to be reimbursed for taxes withheld if your employees received their wages promptly. Noting that certain of these taxes may be taxes imposed by the county, is crucial. There are also unique withholding strategies that are applicable in specific situations.

In accordance with IRS regulations Electronic submissions of withholding forms are required. If you are filing your national revenue tax returns, be sure to include your Federal Employee Identification Number. If you don’t, you risk facing consequences.