Federal Tax Withholding Form 2024 – There are many reasons someone could choose to submit an application for withholding. These factors include documentation requirements and exemptions from withholding. There are a few points to be aware of, regardless of the reason that a person has to fill out the form.

Withholding exemptions

Non-resident aliens must submit Form 1040-NR at least once per year. If you satisfy these requirements, you may be able to claim exemptions from the form for withholding. There are exemptions accessible to you on this page.

For submitting Form 1040-NR attach Form 1042-S. This document lists the amount withheld by the tax withholding authorities for federal tax reporting to be used for reporting purposes. Complete the form in a timely manner. If this information is not given, a person could be taken into custody.

The non-resident alien tax withholding tax rate is 30. It is possible to be exempted from withholding if your tax burden is greater than 30%. There are a variety of exemptions. Some of them are intended for spouses, while others are designed to be used by dependents such as children.

Generally, a refund is available for chapter 4 withholding. Refunds are available in accordance with sections 1401, 1474, and 1475. These refunds must be made by the withholding agents who is the person who withholds taxes at the source.

Relationship status

A marriage certificate and withholding forms will assist you and your spouse make the most of your time. It will also surprise you how much you can put in the bank. It can be difficult to choose which one of the options you will choose. There are certain items you must avoid. Making the wrong decision will cost you a lot. It’s not a problem If you simply follow the directions and pay attention. If you’re lucky, you might even make new acquaintances while traveling. Today is your birthday. I’m hoping you can use it against them to get that elusive wedding ring. To do it right you’ll require the aid of a qualified accountant. This tiny amount is enough to last the life of your wealth. It is a good thing that you can access a ton of information online. TaxSlayer, a reputable tax preparation business is one of the most helpful.

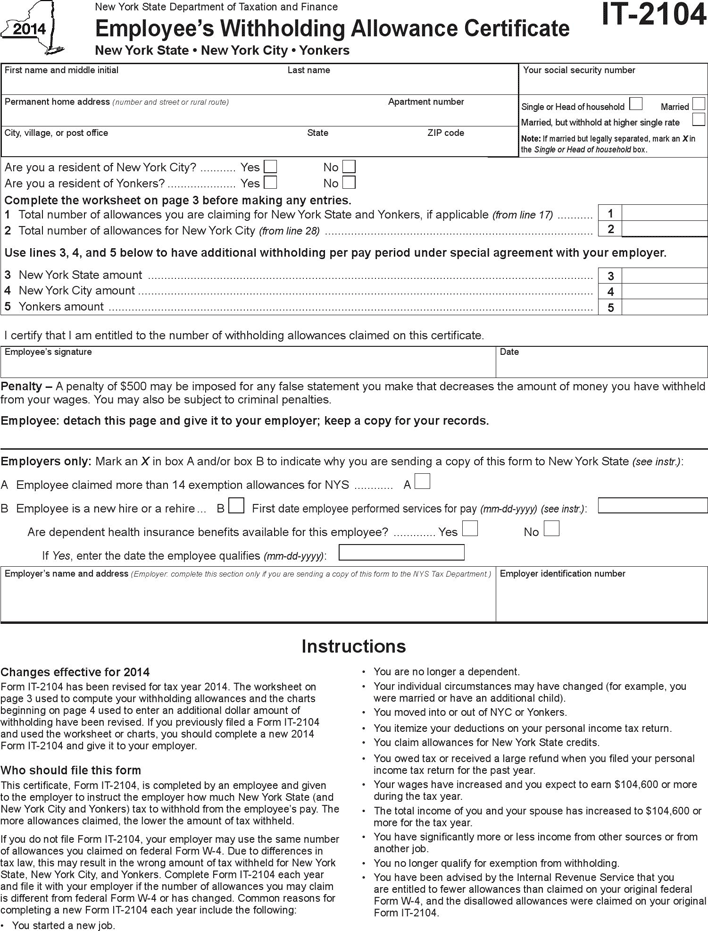

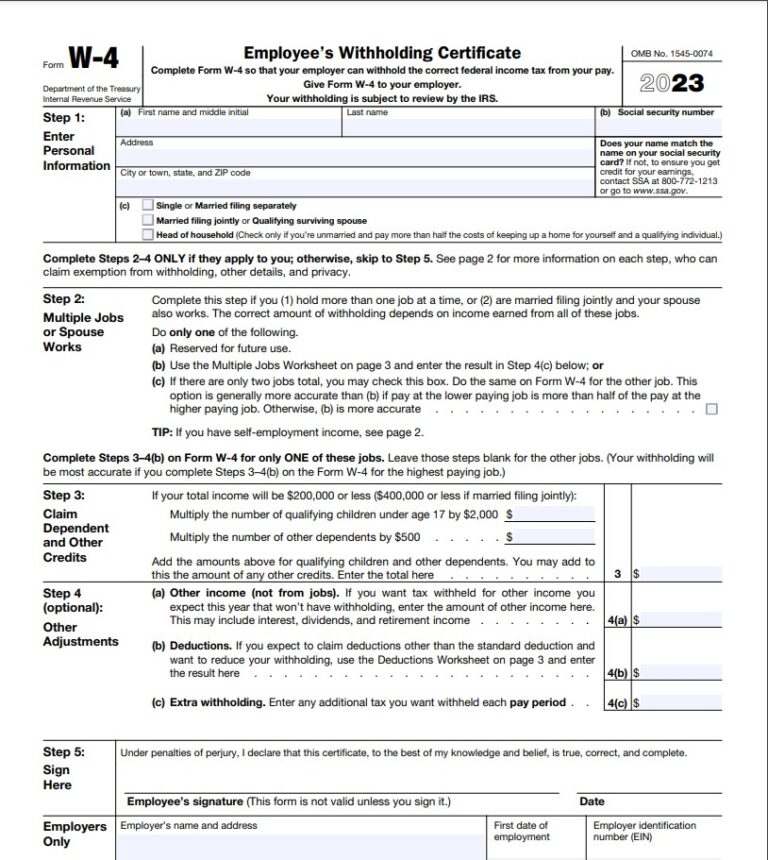

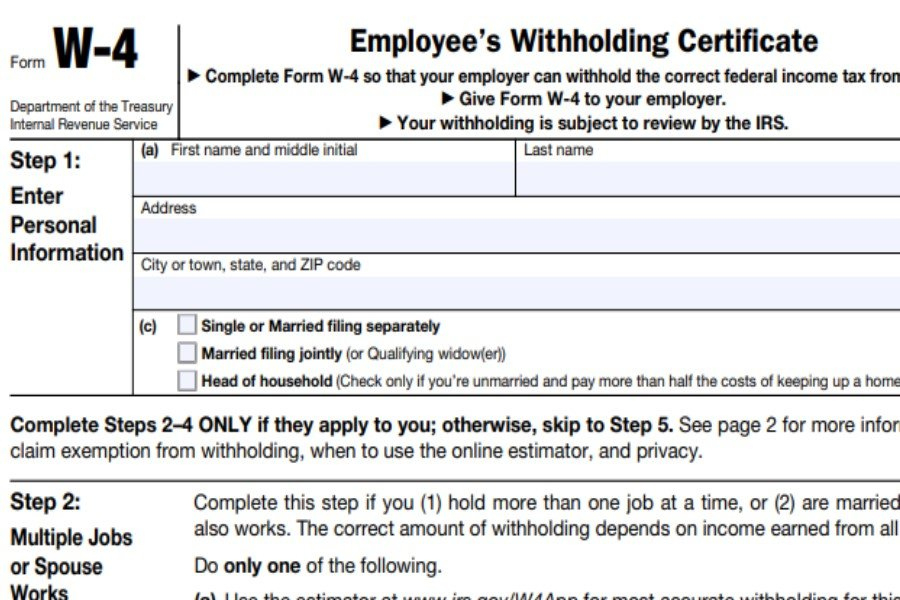

The number of withholding allowances that were made

The W-4 form must be filled in with the amount of withholding allowances you want to claim. This is important because it affects how much tax you receive from your paychecks.

There are a variety of factors that affect the allowances requested.If you’re married, as an example, you might be able to apply for an exemption for the head of household. Your income also determines the amount of allowances you’re eligible to claim. If you make a lot of income, you may be eligible for a larger allowance.

The right amount of tax deductions will aid you in avoiding a substantial tax bill. Refunds could be possible if you submit your income tax return for the previous year. But , you have to choose your strategy carefully.

Like any other financial decision, you must do your research. Calculators can help determine the number of withholdings that need to be demanded. Another option is to talk with a specialist.

Submission of specifications

Withholding taxes on employees need to be reported and collected when you’re an employer. The IRS may accept forms for some of these taxes. A withholding tax reconciliation, the quarterly tax return as well as an annual tax return are all examples of other paperwork you may need to submit. Here is more information on the different types of withholding tax and the deadlines for filing them.

The salary, bonuses, commissions, and other income you get from employees might require you to submit withholding tax returns. You could also be eligible to be reimbursed for tax withholding if your employees were paid in time. Be aware that certain taxes might be county taxes. In some situations, withholding rules can also be different.

According to IRS rules, you must electronically file withholding forms. It is mandatory to provide your Federal Employer Identification Number when you point at your income tax return from the national tax system. If you don’t, you risk facing consequences.