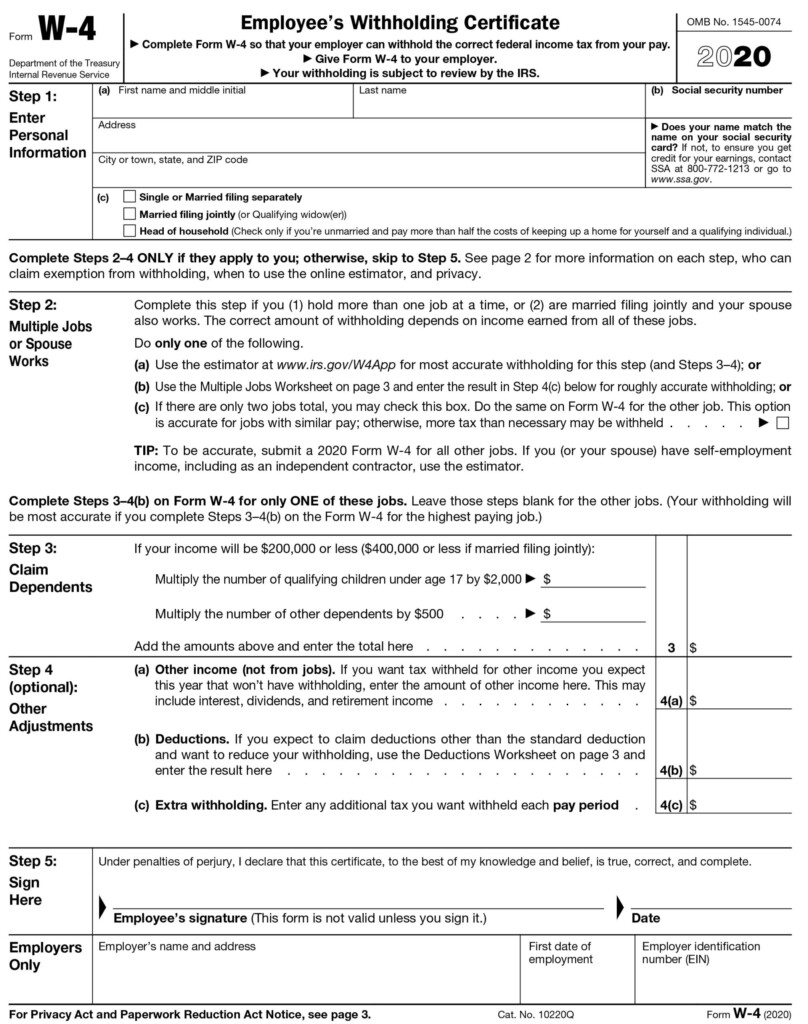

Form Tax Withholding – There are many reasons for a person to decide to fill out a form for withholding. These factors include the requirements for documentation, withholding exemptions and the amount of withholding allowances. Whatever the reason someone chooses to file a Form There are a few aspects to keep in mind.

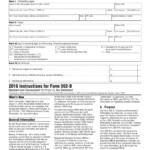

Exemptions from withholding

Non-resident aliens must submit Form 1040-NR at least once per year. If the requirements are met, you could be eligible for an exemption from withholding. You will discover the exclusions available on this page.

When you submit Form1040-NR, attach Form 1042S. For federal income tax reporting purposes, this form details the withholding process of the withholding agency. When filling out the form make sure you fill in the accurate information. If the correct information isn’t given, a person could be taken into custody.

Nonresident aliens have a 30% withholding tax. Non-resident aliens may be qualified for exemption. This is when your tax burden is less than 30%. There are many exclusions. Some are specifically for spouses, and dependents, like children.

You are entitled to an amount of money if you do not follow the terms of chapter 4. Refunds are granted according to Sections 1471-1474. These refunds are provided by the tax agent (the person who collects tax at source).

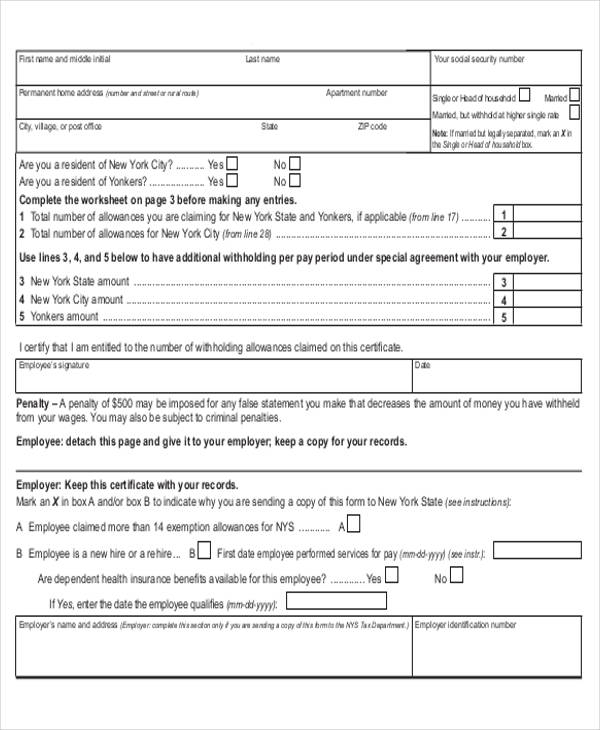

Relational status

The correct marital status as well as withholding forms can simplify your work and that of your spouse. The bank could be shocked by the amount of money that you have to deposit. It isn’t easy to determine which one of the options you’ll choose. Certain things are best avoided. There are a lot of costs in the event of a poor choice. If you stick to the instructions and follow them, there shouldn’t be any problems. If you’re lucky, you might even make new acquaintances while traveling. Today is the day you celebrate your wedding. I’m hoping you’ll utilize it to secure the elusive diamond. It’s a complex task that requires the expertise of a tax professional. It’s worth it to build wealth over the course of your life. You can get many sources of information online. TaxSlayer is one of the most trusted and respected tax preparation companies.

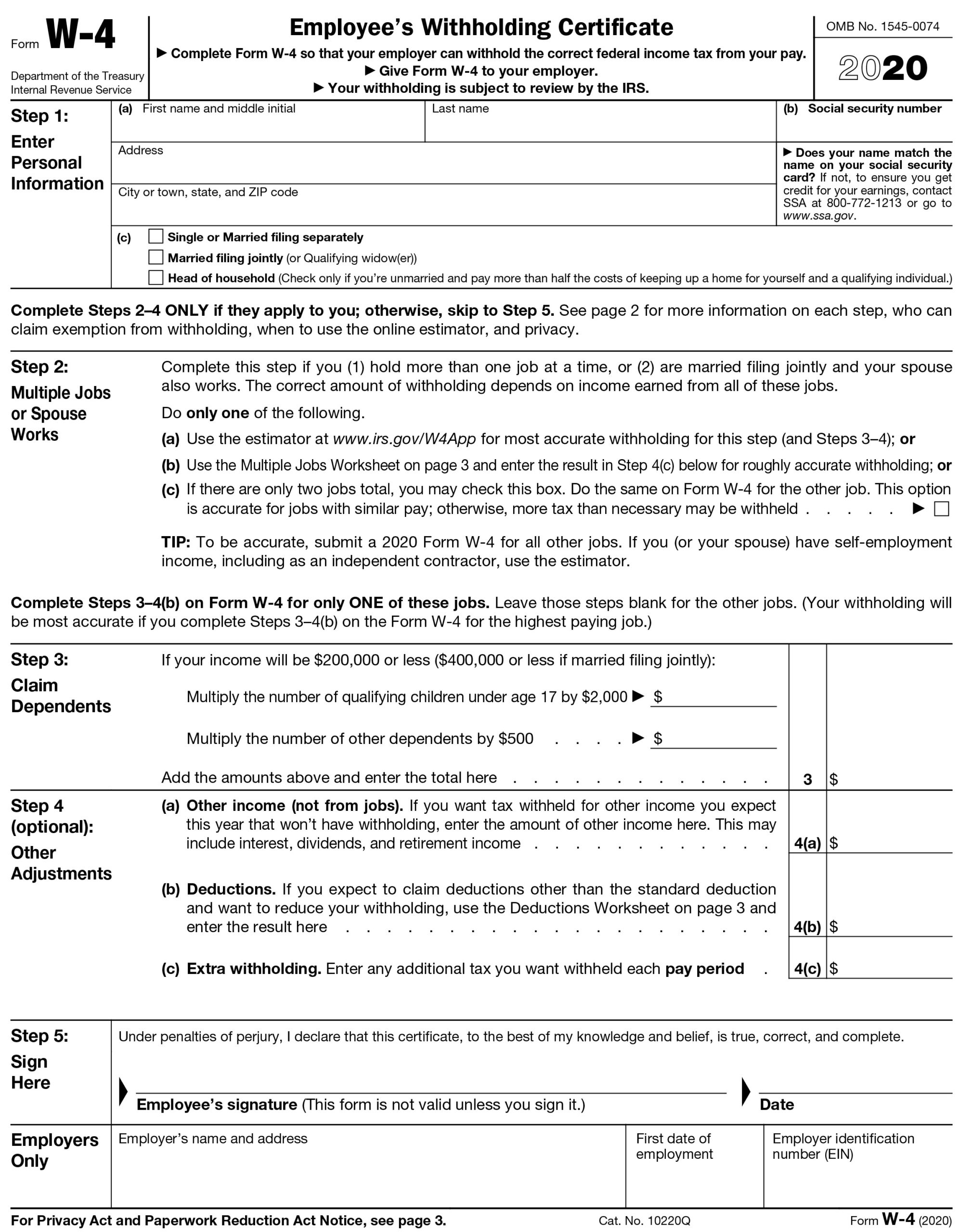

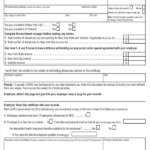

Number of withholding allowances requested

You need to indicate how many withholding allowances you want to be able to claim on the W-4 you fill out. This is crucial since your wages could depend on the tax amount you pay.

You may be eligible to request an exemption for the head of your household in the event that you are married. Your income level can also determine the amount of allowances offered to you. If you make a lot of income, you may be eligible for a higher allowance.

The proper amount of tax deductions could help you avoid a significant tax charge. In fact, if you file your annual income tax return, you may even be eligible for a tax refund. However, you must choose your method carefully.

Just like with any financial decision it is crucial to do your homework. To figure out the amount of tax withholding allowances that need to be claimed, you can use calculators. A better option is to consult with a professional.

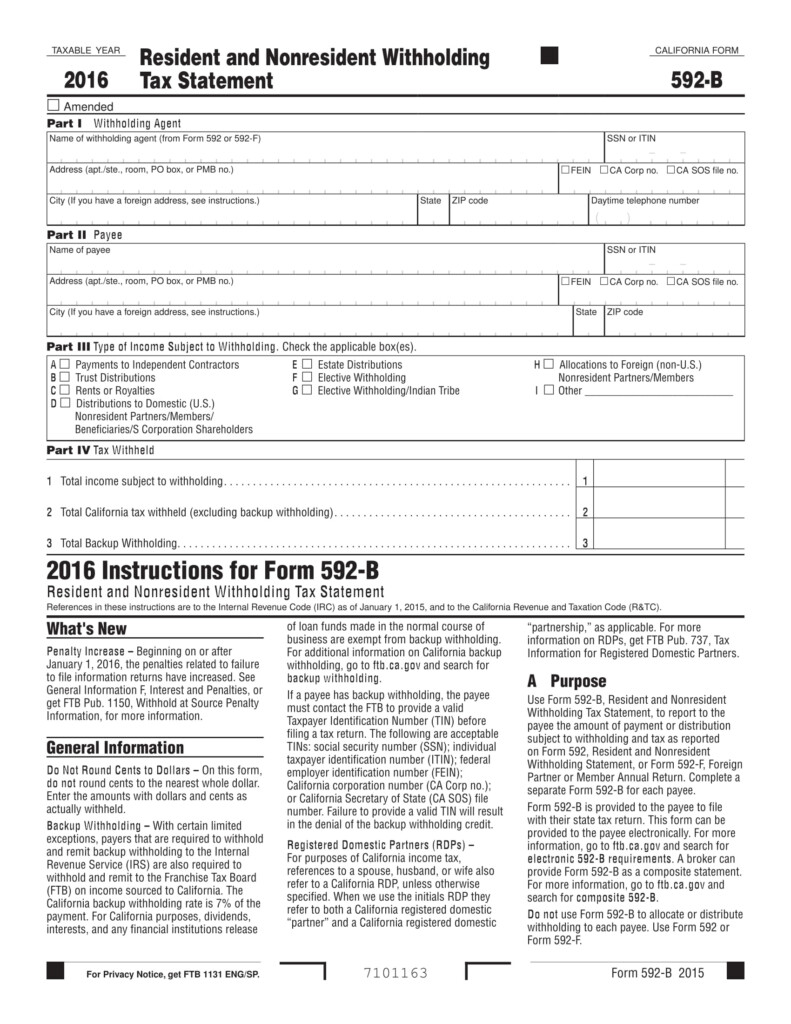

Specifications to be filed

Employers must inform the IRS of any withholding tax that is being collected from employees. The IRS will accept documents for certain taxes. A tax return for the year, quarterly tax returns or withholding tax reconciliation are all kinds of documentation you may need. Below are information on the various tax forms for withholding and the deadlines for each.

Tax returns withholding may be required for income like bonuses, salary, commissions and other income. If you also pay your employees on-time you may be eligible for reimbursement for any taxes that were taken out of your paycheck. It is important to note that not all of these taxes are local taxes. In certain situations there are rules regarding withholding that can be different.

The IRS regulations require that you electronically file withholding documents. The Federal Employer Identification number must be noted when you file to your tax return for the nation. If you don’t, you risk facing consequences.