2024 Employer’s City Of Muskegon Withholding Form – There are many reasons why someone might choose to fill out a form for withholding form. These include document requirements, exclusions from withholding and withholding allowances. You must be aware of these things regardless of the reason you decide to fill out a form.

Exemptions from withholding

Non-resident aliens have to submit Form 1040-NR at a minimum every year. If the requirements are met, you may be eligible to apply for an exemption from withholding. This page you will see the exemptions that are that you can avail.

If you are submitting Form1040-NR to the IRS, include Form 1042S. The form outlines the withholdings made by the agency. Please ensure you are entering the correct information when filling in this form. This information may not be given and result in one person being treated differently.

The tax withholding rate for non-resident aliens is 30 percent. You could be eligible to be exempted from withholding if the tax burden is greater than 30%. There are many different exemptions. Some of them apply to spouses or dependents like children.

In general, the withholding section of chapter 4 allows you to receive an amount of money. Refunds are permitted under Sections 1471-1474. Refunds are given by the tax agent. The withholding agent is the person accountable for tax withholding at the point of origin.

Status of relationships

A marital withholding form is an excellent way to make your life easier and help your spouse. The bank might be shocked by the amount you’ve deposited. The challenge is selecting the best option from the multitude of options. Certain issues should be avoided. It can be costly to make a wrong choice. If you stick to the instructions and keep your eyes open for any pitfalls and pitfalls, you’ll be fine. If you’re lucky, you may even meet new friends while traveling. Today marks the anniversary of your wedding. I’m sure you’ll be able to leverage it to find that perfect wedding ring. It will be a complicated job that requires the knowledge of an expert in taxation. The small amount of money you pay is worth the time and money. Online information is easy to find. TaxSlayer is a trusted tax preparation firm.

The number of withholding allowances that were made

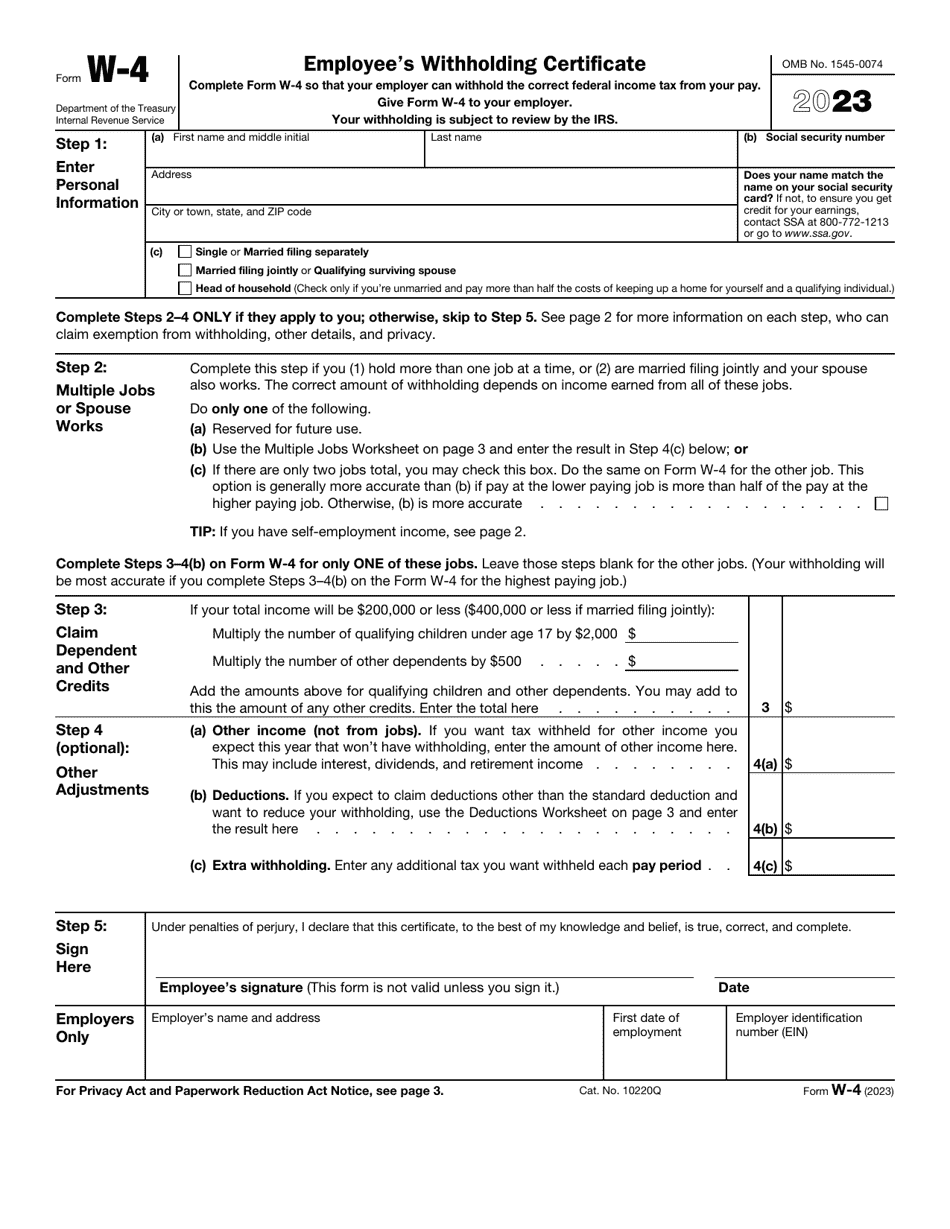

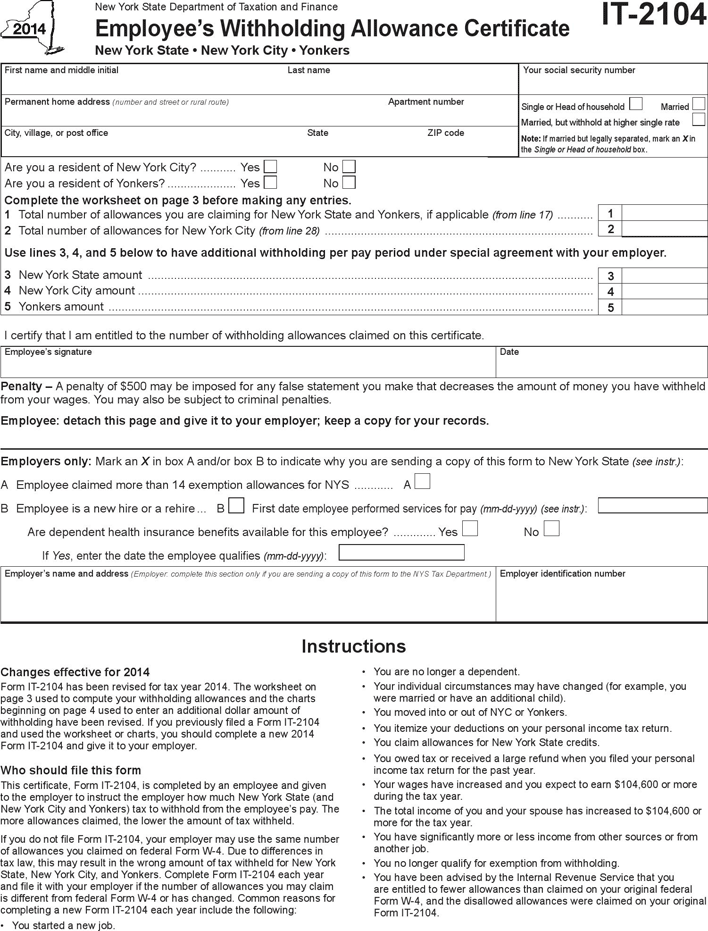

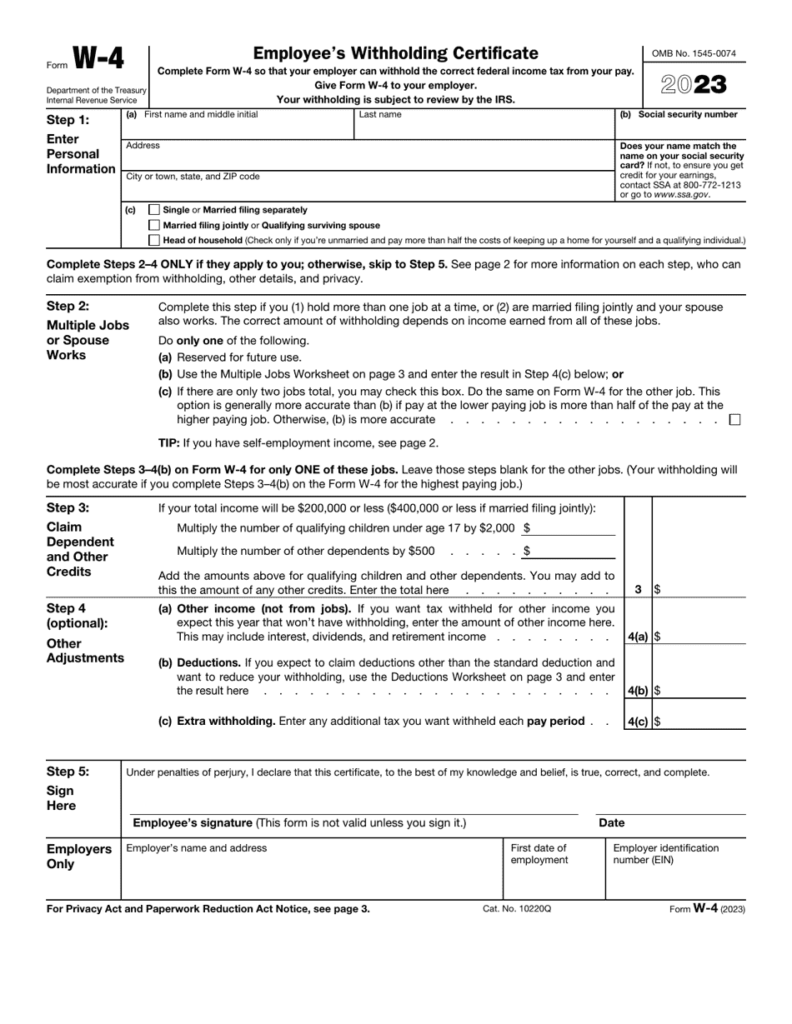

It is essential to state the amount of the withholding allowance you want to claim in the W-4 form. This is important as it will impact the amount of tax you get from your paychecks.

There are a variety of factors that can affect the amount you are eligible for allowances. The amount you earn will determine how many allowances you are eligible for. If you earn a significant amount of income, you may be eligible for a larger allowance.

You could save lots of money by determining the right amount of tax deductions. Additionally, you may be eligible for a refund when your tax return for income is completed. You need to be careful about how you approach this.

Just like with any financial decision, it is important to do your homework. Calculators are readily available to help you determine how much withholding allowances you can claim. A better option is to consult with a professional.

Sending specifications

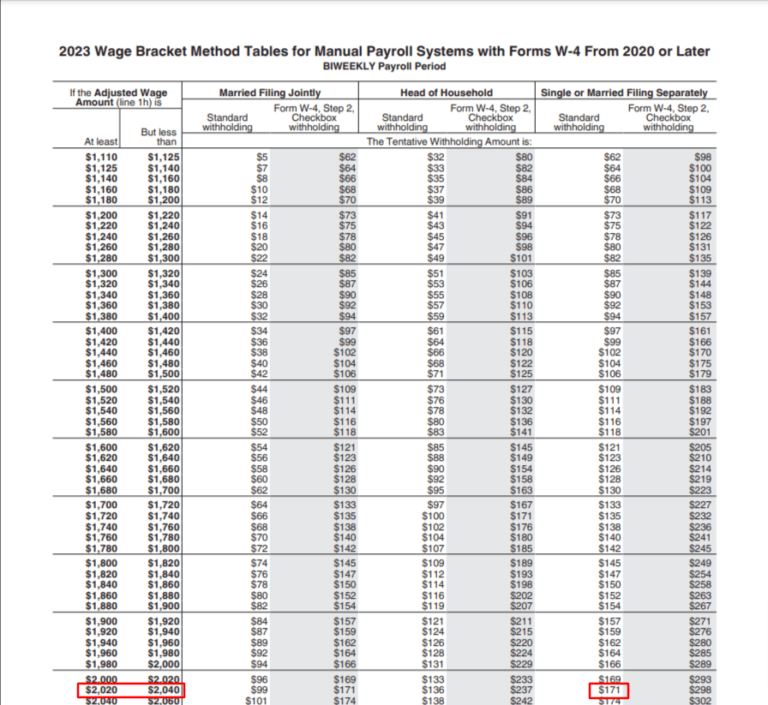

Employers must pay withholding taxes to their employees and then report the amount. The IRS can accept paperwork to pay certain taxes. A tax return for the year and quarterly tax returns, or withholding tax reconciliation are all types of documents you could require. Here are some details about the various types of withholding tax forms and the filing deadlines.

In order to be eligible for reimbursement of tax withholding on salary, bonus, commissions or other income received from your employees You may be required to file a tax return for withholding. In addition, if you pay your employees on-time, you might be eligible to be reimbursed for any taxes that were withheld. It is important to note that some of these taxes could be considered to be county taxes, is also important. Additionally, there are unique tax withholding procedures that can be used in certain situations.

According to IRS regulations Electronic submissions of withholding forms are required. When you submit your national revenue tax return, please provide your Federal Employer Identification number. If you don’t, you risk facing consequences.