Wisconsin Business State Tax Withholding Form – There are a variety of reasons one might decide to complete a withholding form. This includes the documentation requirements, withholding exclusions as well as the withholding allowances. It is important to be aware of these aspects regardless of why you choose to file a request form.

Withholding exemptions

Nonresident aliens need to submit Form 1040–NR at least once per calendar year. If you meet the criteria, you might be eligible for an exemption to withholding. This page will list all exclusions.

For submitting Form 1040-NR add Form 1042-S. This form details the withholdings that the agency makes. Please ensure you are entering the right information when filling out this form. This information might not be disclosed and result in one individual being treated differently.

The 30% non-resident alien tax withholding tax rate is 30 percent. Exemption from withholding could be available if you have the tax burden lower than 30 percent. There are a variety of exclusions. Some are specifically designed for spouses, while others are designed to be used by dependents like children.

Generally, you are eligible for a reimbursement in accordance with chapter 4. Refunds are permitted under Sections 1471-1474. Refunds are provided by the tax agent. The withholding agent is the person who is responsible for withholding tax at the point of origin.

Status of the relationship

An official marital status form withholding forms will assist your spouse and you both get the most out of your time. You will be pleasantly surprised at how much money you can deposit to the bank. Knowing which of the many possibilities you’re most likely to decide is the biggest challenge. There are some things you should avoid doing. It’s expensive to make the wrong decision. If you stick to it and pay attention to the instructions, you won’t encounter any issues. If you’re lucky, you might even make some new friends when you travel. Today marks the anniversary of your wedding. I’m sure you’ll be able to use this against them to obtain that wedding ring you’ve been looking for. For a successful approach you’ll need the aid of a qualified accountant. The tiny amount is worth it for a life-long wealth. It is a good thing that you can access plenty of information on the internet. TaxSlayer is a reputable tax preparation company.

number of claimed withholding allowances

On the Form W-4 that you submit, you must indicate the amount of withholding allowances you asking for. This is important because the withholdings can have an impact on how much tax is taken from your pay checks.

You could be eligible to apply for an exemption on behalf of the head of your household in the event that you are married. Additionally, you can claim additional allowances based on the amount you earn. If you earn a high amount you may be eligible to receive higher amounts.

You could save thousands of dollars by selecting the appropriate amount of tax deductions. If you file your annual income tax return, you could even get a refund. However, you must choose the right method.

Like any financial decision it is crucial to research the subject thoroughly. Calculators are available to aid you in determining the amount of withholding allowances must be claimed. A better option is to consult with a specialist.

Specifications that must be filed

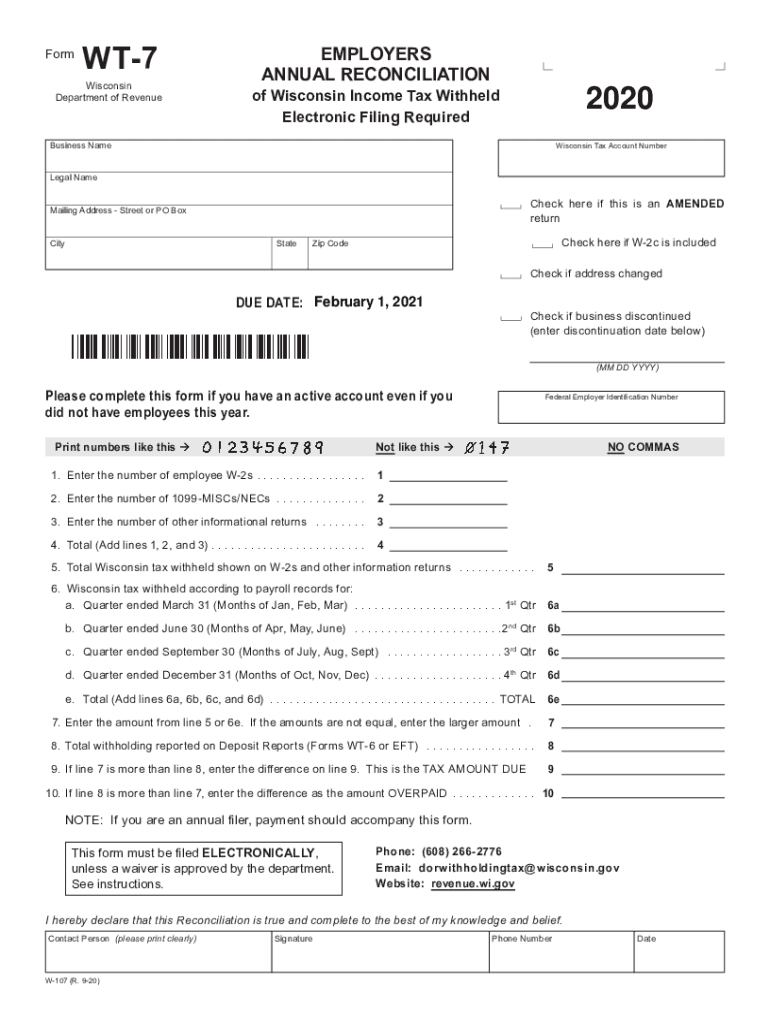

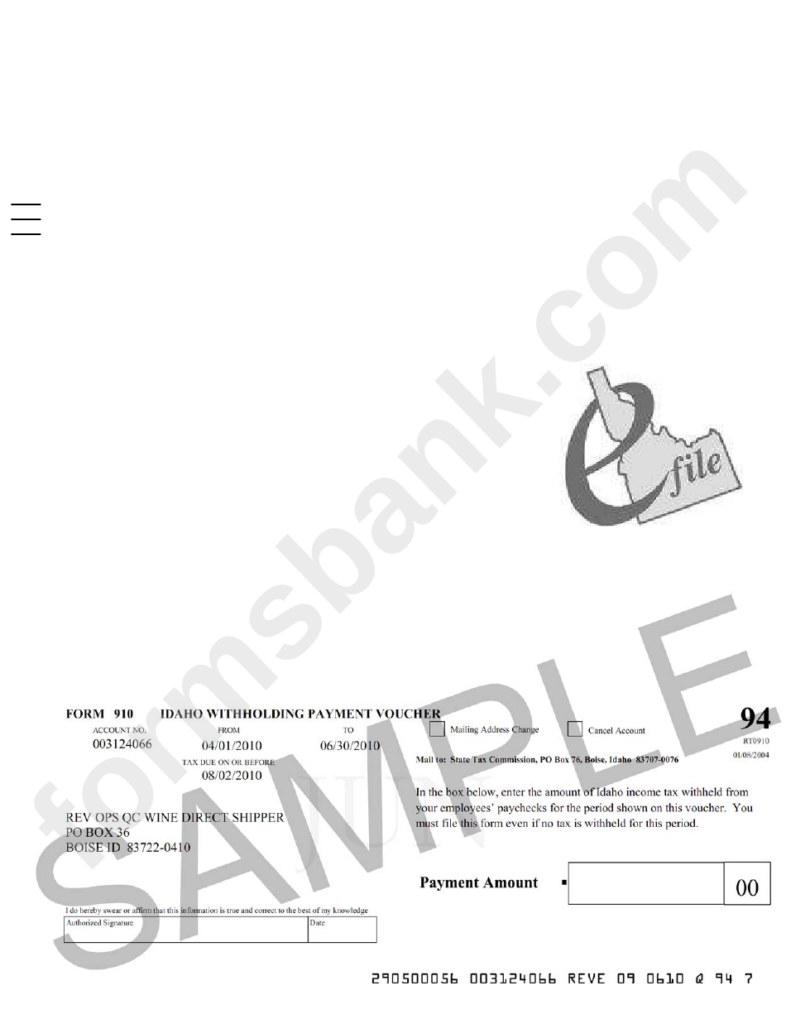

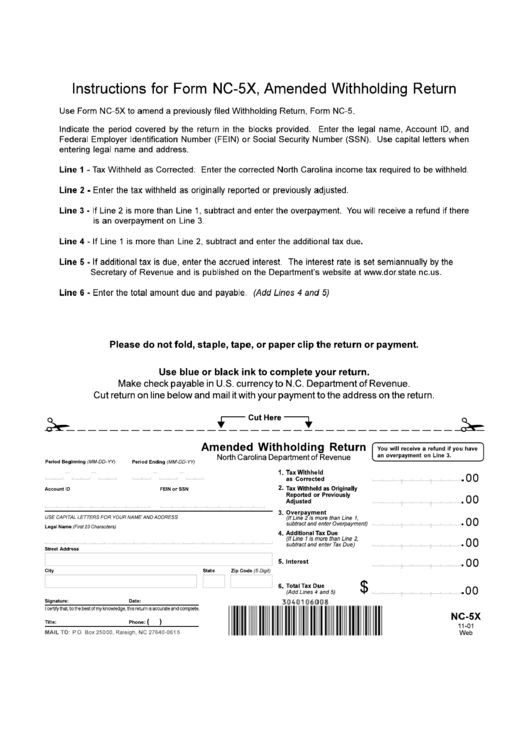

If you’re an employer, you are required to pay and report withholding tax from your employees. The IRS will accept documents to pay certain taxes. You might also need additional documentation such as an withholding tax reconciliation or a quarterly tax return. Here’s some details on the different tax forms for withholding categories and the deadlines for filing them.

Withholding tax returns may be required for certain incomes like bonuses, salary and commissions, as well as other income. Additionally, if you pay your employees on time, you could be eligible to receive reimbursement for taxes withheld. Be aware that certain taxes could be considered to be local taxes. Additionally, you can find specific withholding procedures that can be utilized in certain situations.

Electronic submission of forms for withholding is required according to IRS regulations. It is mandatory to provide your Federal Employer Identification Number when you submit at your income tax return from the national tax system. If you don’t, you risk facing consequences.