Vanguard Withholding Form – There stand a digit of reasons for a person to decide to fill out a tax form. These factors include the documents required, the exclusion of withholding as well as the withholding allowances. You must be aware of these aspects regardless of your reason for choosing to fill out a form.

Exemptions from withholding

Non-resident aliens are required to complete Form 1040-NR every year. If your requirements are met, you could be eligible to request an exemption from withholding. This page lists all exclusions.

The first step to submitting Form 1040 – NR is attaching Form 1042 S. For federal income tax reporting reasons, this form provides the withholding process of the tax agency that handles withholding. When you fill out the form, ensure that you provide the exact details. You could be required to treat one person for not providing this information.

Nonresident aliens pay a 30% withholding tax. If the tax you pay is less than 30 percent of your withholding you could be eligible to be exempt from withholding. There are many exemptions that are available. Some of them are intended to be used by spouses, while some are meant to be used by dependents, such as children.

Generally, withholding under Chapter 4 allows you to claim an amount of money back. Refunds may be granted in accordance with Sections 1400 through 1474. The refunds are made by the tax withholding agents who is the person who withholds taxes at source.

Relational status

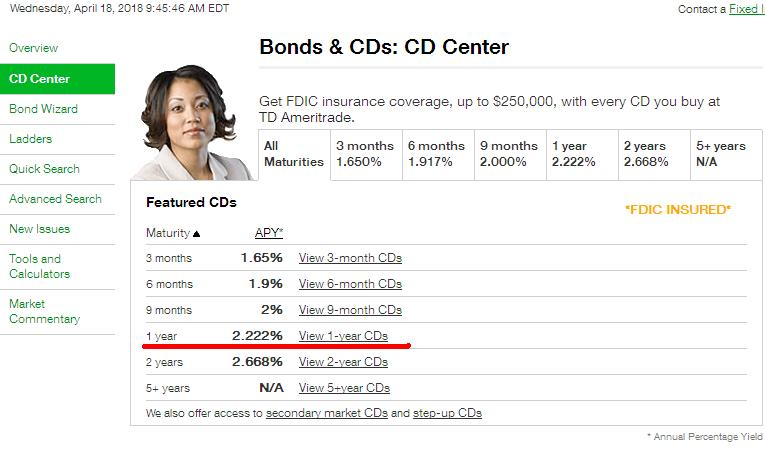

A marriage certificate and withholding forms will assist you and your spouse get the most out of your time. You’ll also be surprised by with the amount of money you can deposit at the bank. The problem is picking the right bank out of the many possibilities. There are some things you must be aware of. It’s costly to make the wrong choice. If you stick to the directions and keep your eyes open for any pitfalls You won’t face any issues. If you’re lucky, you may be able to make new friends as traveling. Today marks the anniversary. I’m hoping you can make use of it to get that elusive engagement ring. It’s a complex job that requires the knowledge of an accountant. A lifetime of wealth is worth that tiny amount. There is a wealth of information online. Trustworthy tax preparation companies like TaxSlayer are among the most efficient.

In the amount of withholding allowances that are claimed

The W-4 form must be completed with the amount of withholding allowances you want to take advantage of. This is important because the tax withheld will affect the amount of tax taken from your paychecks.

You may be able to claim an exemption for your spouse in the event that you are married. The amount you are eligible for will be contingent on the income you earn. If you earn a substantial income, you can request a higher allowance.

The proper amount of tax deductions can help you avoid a significant tax cost. If you submit the annual tax return for income You could be eligible for a refund. You need to be careful when it comes to preparing this.

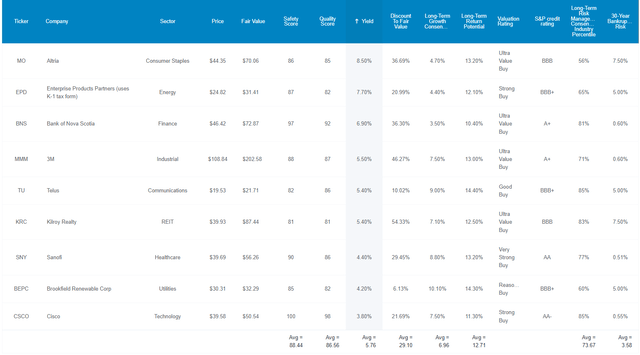

Do your research, just like you would for any financial option. Calculators can aid you in determining the amount of withholding allowances must be claimed. A specialist might be a viable alternative.

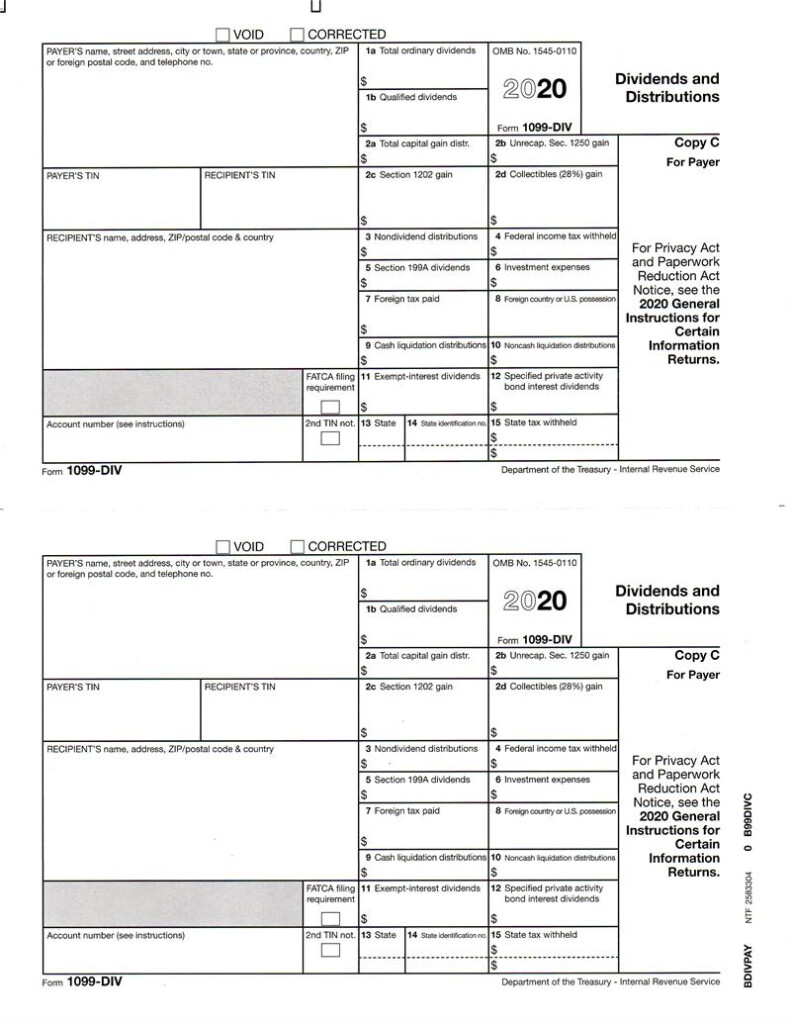

Specifications to be filed

Employers must pay withholding taxes to their employees and report the tax. For a limited number of these taxes, you can provide documentation to the IRS. A tax reconciliation for withholding, an annual tax return for quarterly filing, or an annual tax return are all examples of other paperwork you may be required to submit. Here are some information about the various types of tax withholding forms and the filing deadlines.

The bonuses, salary commissions, bonuses, and other income that you receive from your employees could necessitate you to file tax returns withholding. If you paid your employees in time, you may be eligible for reimbursement of taxes that you withheld. It is important to note that certain taxes are county taxes must also be noted. You may also find unique withholding rules that can be utilized in certain circumstances.

Electronic submission of forms for withholding is required according to IRS regulations. The Federal Employer Identification Number should be listed on your national revenue tax return. If you don’t, you risk facing consequences.