Ga Withholding On Real Estate Transactions Form – There are many reasons why someone might choose to fill out a form for withholding form. This includes documentation requirements and exemptions for withholding. You must be aware of these aspects regardless of why you choose to fill out a form.

Withholding exemptions

Non-resident aliens are required to submit Form 1040 NR at least once per year. If you meet the criteria, you may be qualified for exemption from withholding. The exclusions you can find on this page are yours.

When submitting Form1040-NR, Attach Form 1042S. To report federal income tax reasons, this form details the withholding made by the tax agency that handles withholding. Make sure that you fill in the correct information when you fill in the form. It is possible for one person to be treated if the information isn’t provided.

The non-resident alien tax withholding tax rate is 30 percent. If the tax you pay is less than 30 percent of your withholding you may qualify to receive an exemption from withholding. There are many exemptions. Some of them are only for spouses or dependents like children.

Generally, withholding under Chapter 4 allows you to claim a return. Refunds are granted in accordance with Sections 1400 through 1474. The withholding agent or the individual who withholds the tax at source, is responsible for making these refunds.

Relational status

An official marital status form withholding forms will assist both of you to make the most of your time. Additionally, the quantity of money you may deposit in the bank will pleasantly be awestruck. Knowing which of the several possibilities you’re likely decide is the biggest challenge. There are certain things you must be aware of. You will pay a lot if you make a wrong choice. If you stick to the guidelines and watch out for any potential pitfalls and pitfalls, you’ll be fine. If you’re fortunate, you might even make some new friends when you travel. Today is your birthday. I’m hoping you can use it against them to get that elusive engagement ring. If you want to do this properly, you’ll require the advice of a qualified Tax Expert. The tiny amount is enough for a life-long wealth. You can get plenty of information on the internet. TaxSlayer, a reputable tax preparation company is among the most effective.

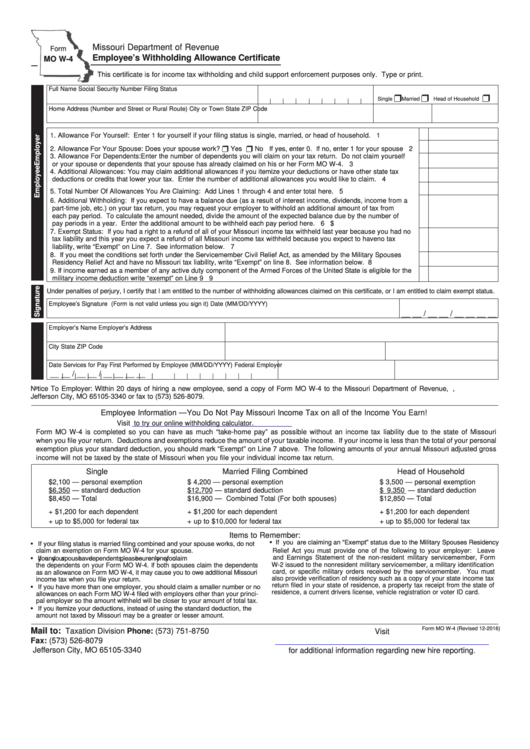

The amount of withholding allowances requested

On the W-4 form you file, you should declare the amount of withholding allowances you seeking. This is essential since the withholdings will effect on the amount of tax that is taken out of your paychecks.

Many factors influence the amount you qualify for allowances. The amount of allowances you can claim will depend on your income. You may be eligible for more allowances if make a lot of money.

Choosing the proper amount of tax deductions might allow you to avoid a significant tax payment. Even better, you might even receive a tax refund if your annual income tax return is completed. It is essential to pick the right method.

Conduct your own research, just as you would in any financial decision. Calculators can assist you in determining how many withholding amounts should be claimed. An expert could be a good alternative.

Specifications for filing

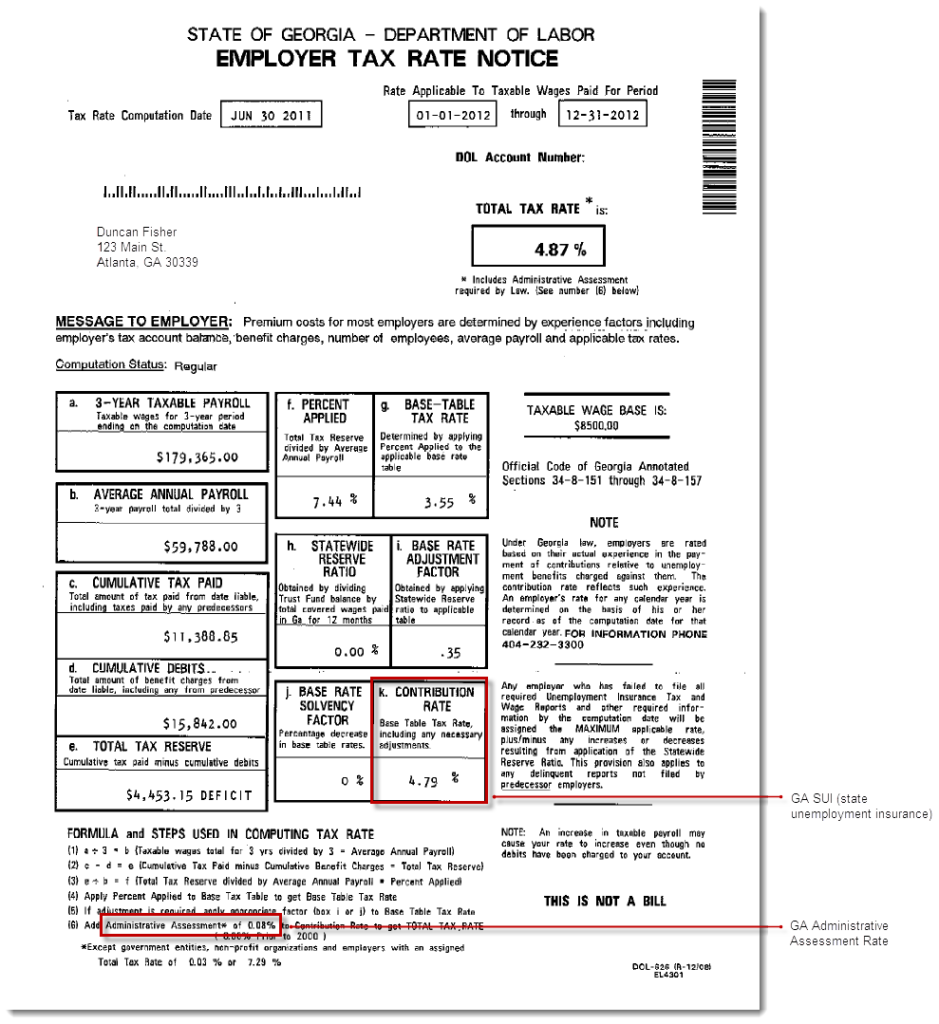

Employers are required to report the company who withholds tax from employees. Certain of these taxes can be reported to the IRS through the submission of paperwork. Additional documents that you could need to submit include a withholding tax reconciliation, quarterly tax returns, as well as an annual tax return. Here are some information about the various types of tax forms for withholding as well as the deadlines for filing.

In order to be eligible for reimbursement of tax withholding on compensation, bonuses, salary or other income earned by your employees You may be required to file a tax return for withholding. You could also be eligible to be reimbursed for tax withholding if your employees received their wages on time. The fact that some of these taxes are also county taxes should be considered. There are specific tax withholding strategies that could be appropriate in particular situations.

You are required to electronically submit withholding forms according to IRS regulations. When you file your tax returns for the national income tax, be sure to include your Federal Employee Identification Number. If you don’t, you risk facing consequences.