Maryland Withholding Form Mw506 – There are many reasons someone could choose to submit a withholding application. The reasons include the need for documentation including withholding exemptions and the quantity of requested withholding allowances. It is important to be aware of these things regardless of why you choose to file a request form.

Exemptions from withholding

Non-resident aliens are required to file Form 1040-NR at least every year. However, if your requirements are met, you could be eligible to apply for an exemption from withholding. On this page, you will see the exemptions that are available to you.

To submit Form 1040-NR, attach Form 1042-S. To report federal income tax purposes, this form provides the withholding process of the tax agency that handles withholding. Make sure you fill out the form correctly. This information may not be provided and could result in one individual being treated.

The 30% non-resident alien tax withholding tax rate is 30 percent. If the tax you pay is less than 30% of your withholding, you could be eligible for an exemption from withholding. There are several different exclusions that are available. Certain of them are designed for spouses, while others are intended for use by dependents like children.

In general, you’re eligible for a reimbursement in accordance with chapter 4. Refunds are allowed according to Sections 1471-1474. The refunds are given by the withholding agent (the person who is responsible for withholding tax at the source).

Relational status

The correct marital status as well as withholding form will simplify the job of both you and your spouse. Furthermore, the amount of money that you can deposit at the bank could surprise you. The problem is deciding which one of the many options to choose. There are certain things you should avoid. A bad decision could cause you to pay a steep price. If you stick to the directions and keep your eyes open for any potential pitfalls and pitfalls, you’ll be fine. If you’re lucky enough to meet some new acquaintances while on the road. Since today is the date of your wedding anniversary. I hope you are capable of using this against them to obtain the elusive wedding ring. If you want to get it right, you will need the help of a certified accountant. The tiny amount is enough for a lifetime of wealth. You can find plenty of details online. TaxSlayer and other trusted tax preparation firms are some of the top.

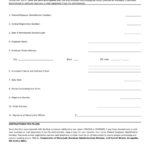

Number of withholding allowances that are claimed

In submitting Form W-4 you should specify the number of withholding allowances you wish to claim. This is crucial since the withholdings will have an effect on the amount of tax is taken out of your pay checks.

There are a variety of factors that can determine the amount that you can claim for allowances. You may also be eligible for higher allowances depending on how much you earn. You can apply for a greater allowance if you make a lot of money.

You may be able to save money on a tax bill by deciding on the right amount of tax deductions. You could actually receive an income tax refund when you file your annual income tax return. It is important to be cautious when it comes to preparing this.

It is essential to do your homework, just like you would with any other financial decision. Calculators are a great tool to figure out how many withholding allowances should be claimed. Alternative options include speaking with a specialist.

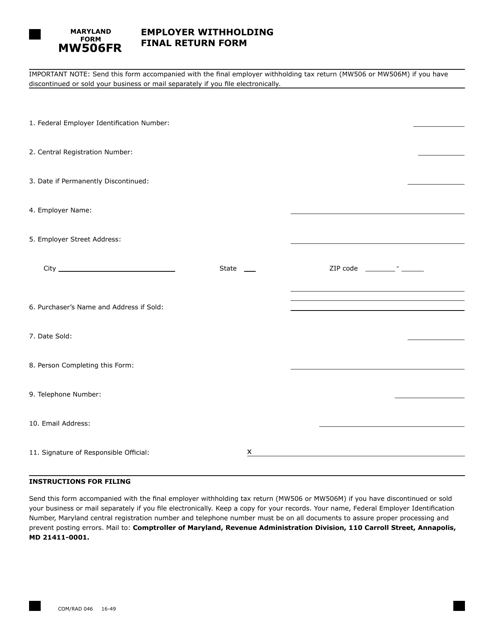

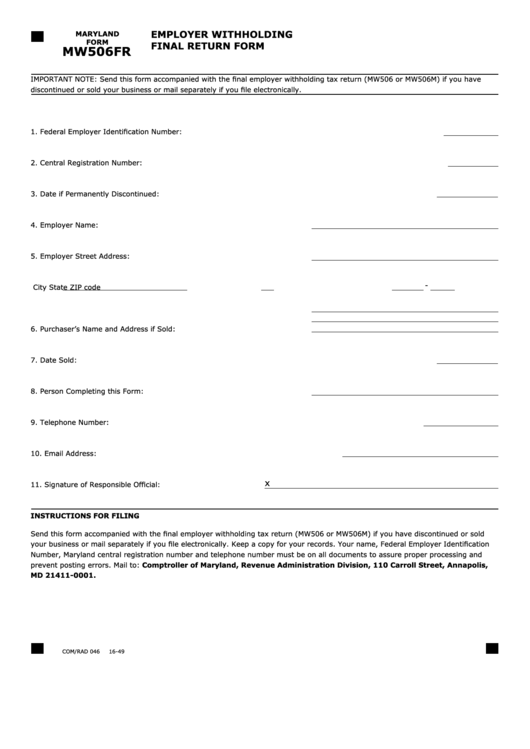

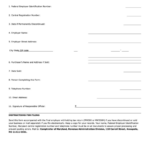

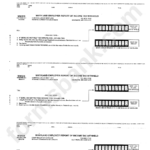

Submitting specifications

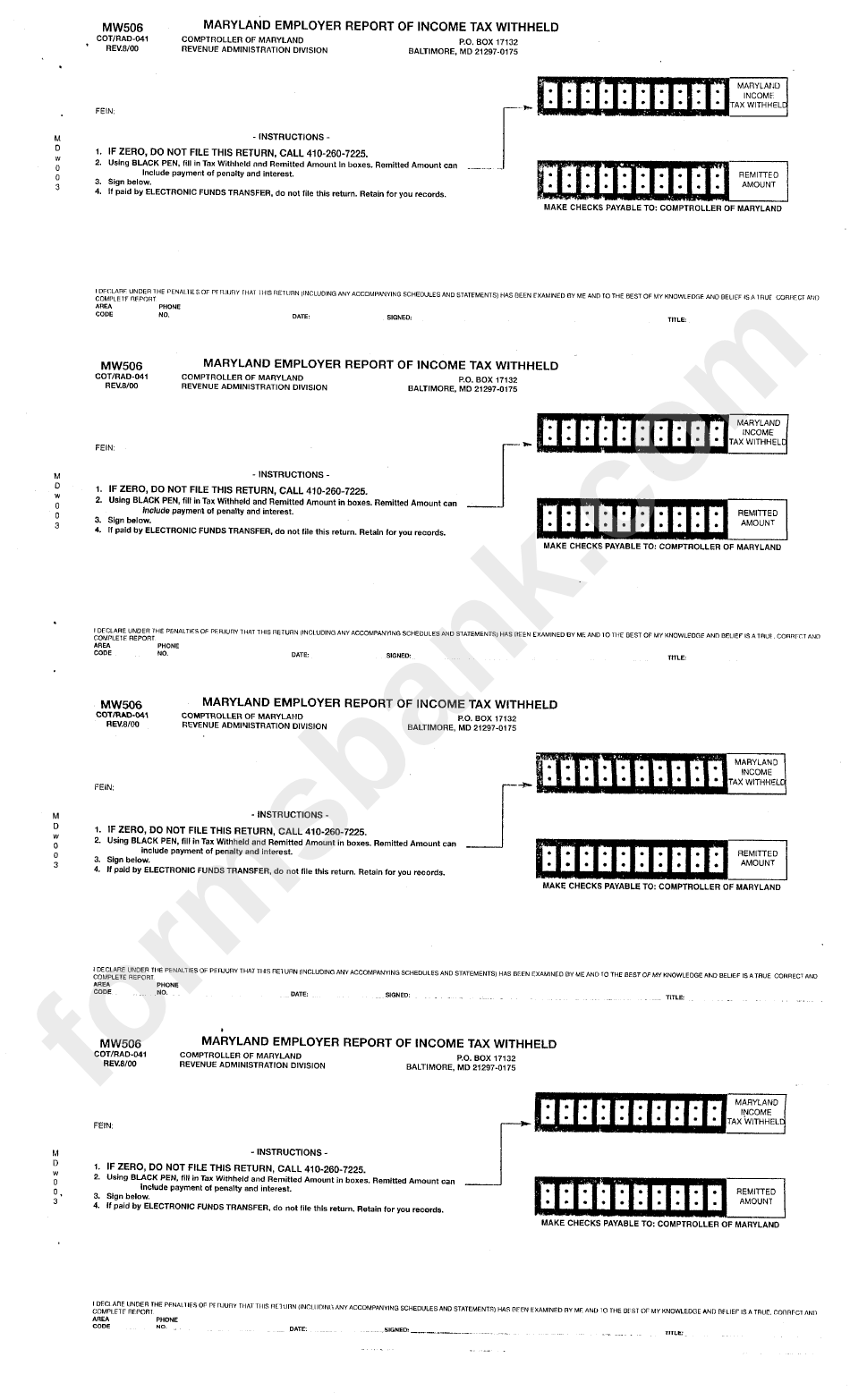

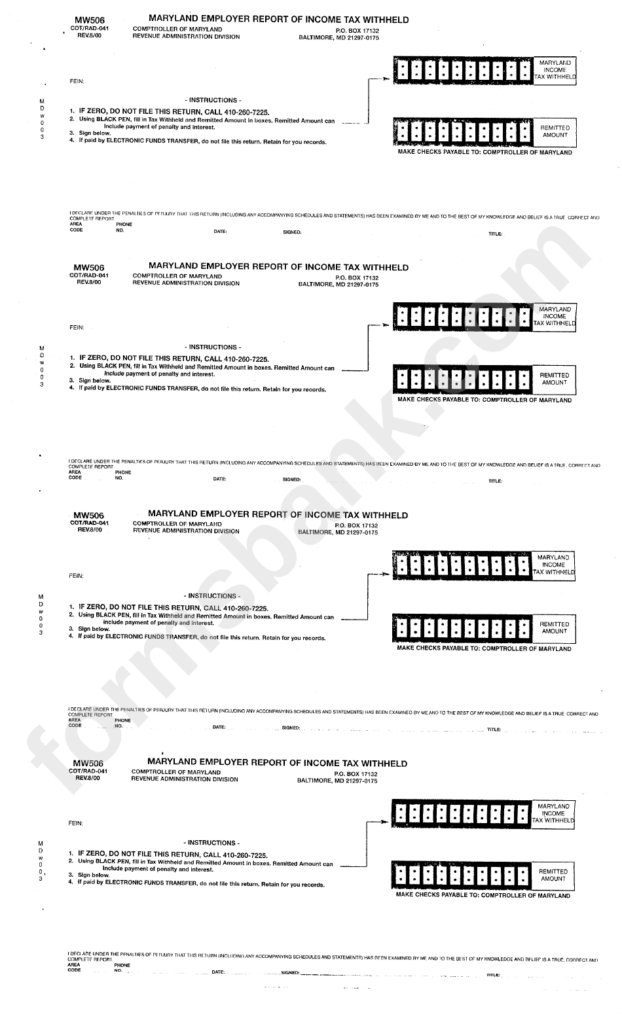

Employers must inform the IRS of any withholding taxes being paid by employees. For certain taxes you can submit paperwork to the IRS. An annual tax return and quarterly tax returns as well as the reconciliation of withholding tax are all types of documents you could need. Here’s some information about the different tax forms, and the time when they should be submitted.

It is possible that you will need to file tax returns for withholding for the income you receive from your employees, like bonuses and commissions or salaries. Also, if your employees receive their wages punctually, you might be eligible for the tax deductions you withheld. It is important to note that some of these taxes are county taxes, is also important. In addition, there are specific methods of withholding that are applied under particular situations.

In accordance with IRS regulations Electronic filings of tax withholding forms are required. Your Federal Employer Identification number must be listed when you point your national tax return. If you don’t, you risk facing consequences.