State Of Wisconsin Tax Withholding Form – There are many reasons that one could fill out the form to request withholding. This includes documentation requirements and withholding exemptions. No matter the reason for a person to file an application it is important to remember certain points you must keep in mind.

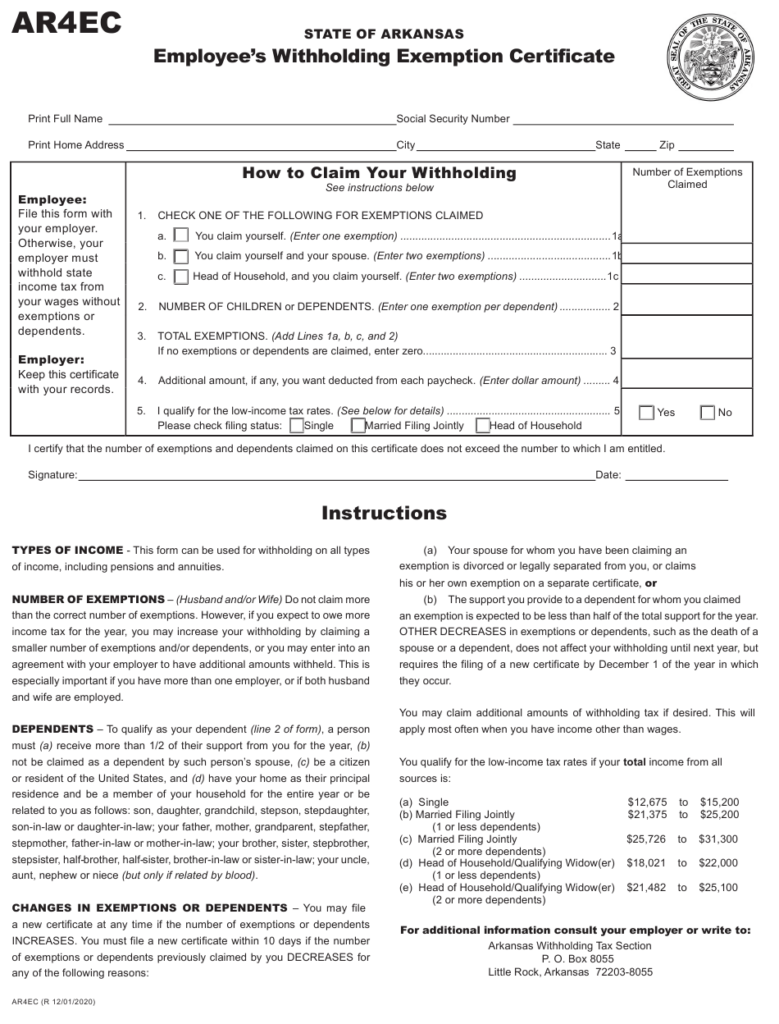

Withholding exemptions

Non-resident aliens are required to complete Form 1040-NR once per year. If you meet the criteria, you could be eligible for an exemption to withholding. This page you will see the exemptions that are that you can avail.

Attaching Form 1042-S is the first step to submit Form 1040-NR. The document is required to declare the federal income tax. It provides the details of the withholding of the withholding agent. Be sure to enter the correct information as you fill in the form. This information might not be disclosed and cause one person to be treated differently.

The non-resident alien withholding tax is 30 percent. A nonresident alien may be qualified for an exemption. This happens if your tax burden is lower than 30%. There are many exclusions. Some are specifically designed for spouses, whereas others are meant for use by dependents, such as children.

Generally, a refund is available for chapter 4 withholding. Refunds can be made according to Sections 471 through 474. The refunds are given by the tax agent (the person who is responsible for withholding tax at source).

Status of relationships

You and your spouse’s work is made simpler by a proper marital status withholding form. The bank might be shocked by the amount of money that you deposit. The challenge is picking the right bank from the multitude of options. You must be cautious in with what you choose to do. It’s costly to make a wrong decision. There’s no problem If you simply follow the directions and pay attention. You may make new friends if you are lucky. In the end, today is the anniversary of your wedding. I’m hoping you’ll be able to utilize it in order to get the elusive diamond. To do it right you’ll need the aid of a qualified accountant. The accumulation of wealth over time is more than that tiny amount. There is a wealth of information on the internet. TaxSlayer is one of the most trusted and reputable tax preparation firms.

The number of withholding allowances claimed

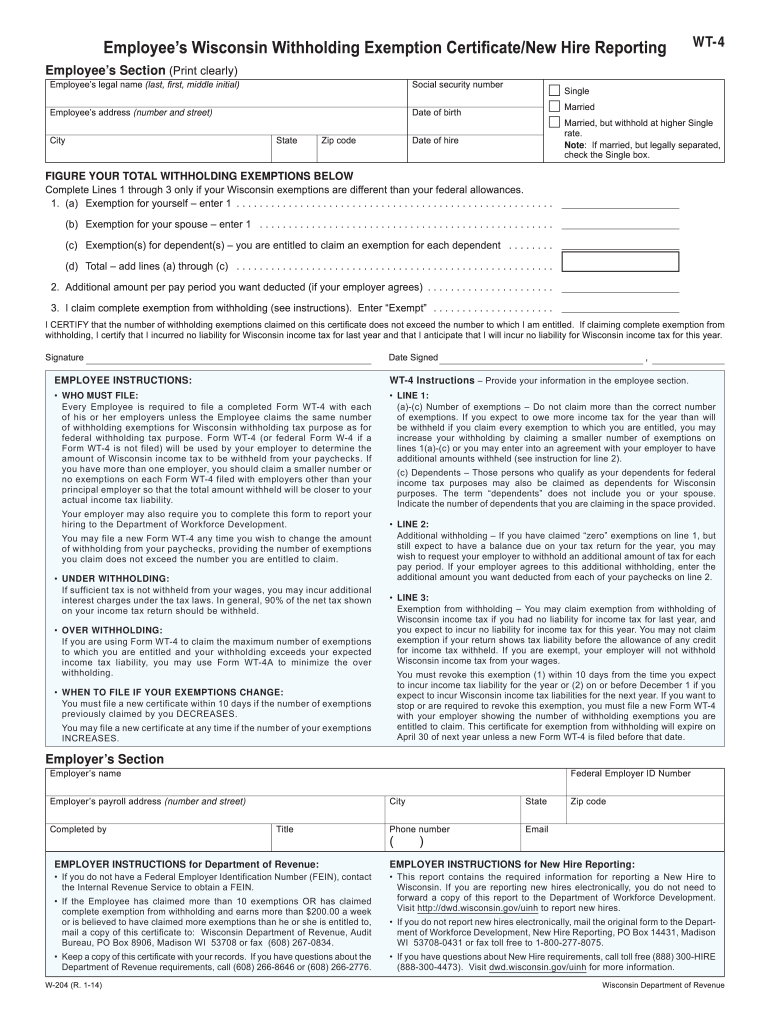

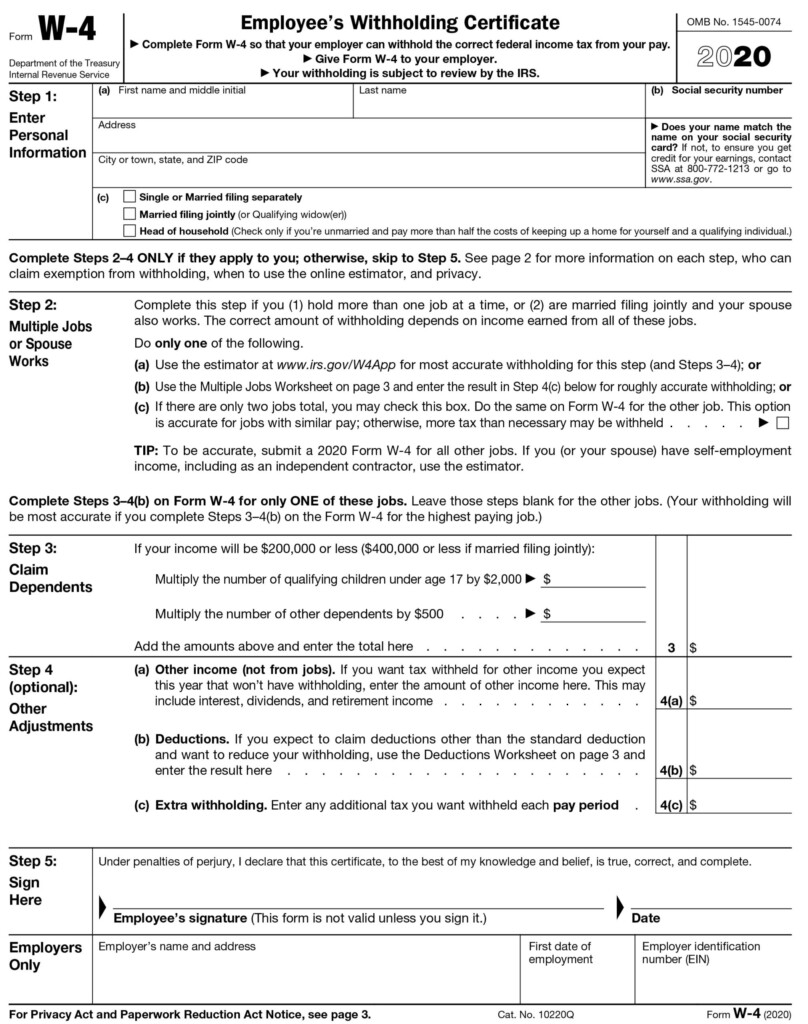

You must specify how many withholding allowances to claim on the Form W-4 that you file. This is essential because the amount of tax withdrawn from your pay will be affected by how much you withhold.

Many factors influence the amount you qualify for allowances. The amount you earn will influence how many allowances your are entitled to. If you earn a substantial income, you may be eligible for a higher allowance.

Selecting the appropriate amount of tax deductions could help you avoid a hefty tax bill. Even better, you might even get a refund if the annual tax return is completed. However, it is crucial to pick the right method.

In any financial decision, you should do your research. Calculators can be utilized to determine the amount of withholding allowances you should claim. Another option is to talk with a professional.

filing specifications

Withholding taxes on your employees must be collected and reported in the event that you’re an employer. The IRS may accept forms for certain taxes. There may be additional documentation , like the reconciliation of your withholding tax or a quarterly tax return. Here’s a brief overview of the different tax forms, and when they must be submitted.

The compensation, bonuses commissions, bonuses, and other earnings you earn from your employees could require you to file withholding tax returns. Additionally, if you pay your employees on-time, you might be eligible for reimbursement for any taxes that were not withheld. Be aware that some of these taxes may be county taxes. Additionally, there are unique withholding practices that can be implemented in specific circumstances.

According to IRS regulations the IRS regulations, electronic filings of tax withholding forms are required. Your Federal Employer identification number should be listed when you point to your tax return for the nation. If you don’t, you risk facing consequences.