New York Withholding Registration Form – There are many reasons an individual might want to complete a form for withholding form. This includes documentation requirements as well as exemptions from withholding, as well as the quantity of requested withholding allowances. It doesn’t matter what reasons someone is deciding to file an Application there are some things to remember.

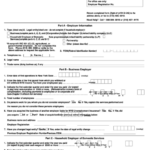

Exemptions from withholding

Non-resident aliens are required to submit Form 1040NR once per year. However, if you satisfy the criteria, you may be eligible to submit an exemption from the withholding form. The exclusions you can find on this page are yours.

When submitting Form1040-NR, Attach Form 1042S. The form lists the amount withheld by the tax authorities for federal tax reporting purposes. When filling out the form, ensure that you have provided the exact details. There is a possibility for one individual to be treated in a manner that is not correct if the correct information is not provided.

Non-resident aliens are subject to a 30% withholding tax. You could be eligible to receive an exemption from withholding if the tax burden exceeds 30%. There are numerous exemptions. Certain of them apply to spouses or dependents like children.

In general, chapter 4 withholding allows you to receive a refund. Refunds may be granted in accordance with Sections 1400 through 1474. These refunds are made by the withholding agent (the person who collects tax at source).

Relational status

The proper marital status and withholding form will simplify the work of you and your spouse. In addition, the amount of money you may deposit at the bank can be awestruck. Knowing which of the many options you’re likely to choose is the challenge. Certain issues should be avoided. False decisions can lead to expensive negative consequences. However, if the instructions are followed and you pay attention you shouldn’t face any issues. If you’re lucky enough, you could be able to make new friends as you travel. Today is the anniversary day of your wedding. I’m hoping you’ll utilize it in order to get that elusive diamond. It’s a difficult task that requires the expertise of a tax professional. A modest amount of money could create a lifetime’s worth of wealth. It is a good thing that you can access many sources of information online. TaxSlayer is a reputable tax preparation company.

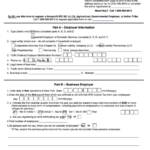

Number of withholding allowances requested

On the W-4 form you file, you should declare the amount of withholding allowances you requesting. This is important as it will impact how much tax you receive from your pay checks.

You may be able to request an exemption for your head of household if you are married. The amount of allowances you can claim will depend on your income. If you have a high income, you can request an increase in your allowance.

It could save you a lot of money by choosing the correct amount of tax deductions. You could actually receive the amount you owe if you submit your annual tax return. But, you should be cautious about your approach.

Do your research, just like you would for any financial option. Calculators are useful to figure out how many allowances for withholding must be made. Alternative options include speaking with a specialist.

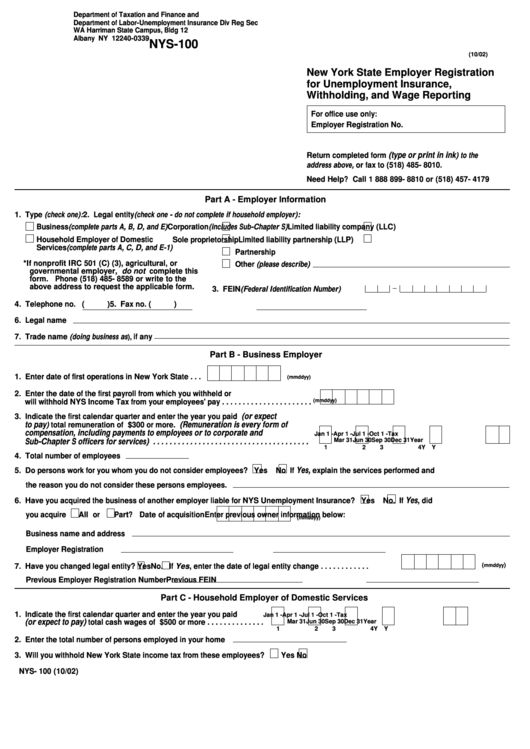

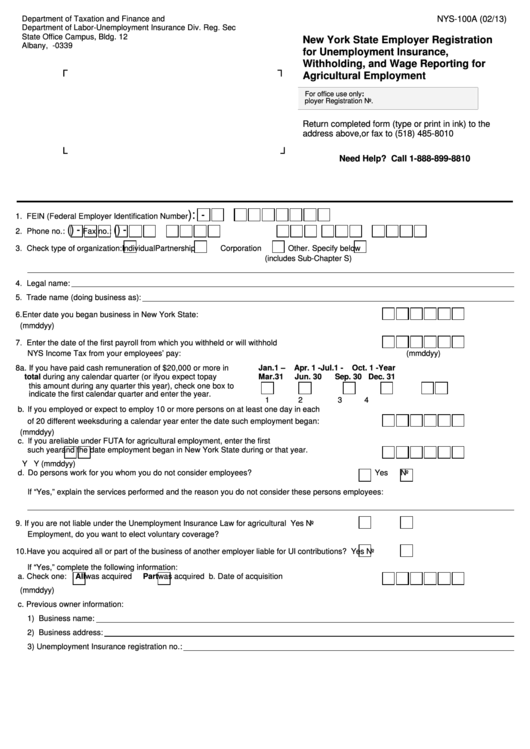

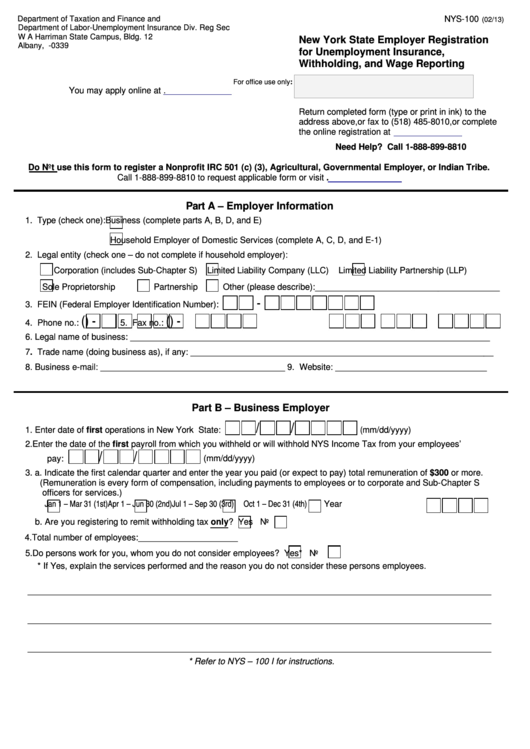

Filing requirements

Employers must collect withholding taxes from their employees and then report the tax. For a limited number of the taxes, you are able to provide documentation to the IRS. There are other forms you may require, such as the quarterly tax return or withholding reconciliation. Here are some information regarding the various forms of tax forms for withholding along with the filing deadlines.

The compensation, bonuses commissions, bonuses, and other income you get from your employees could require you to submit tax returns withholding. You could also be eligible to be reimbursed for taxes withheld if your employees were paid promptly. It is crucial to remember that there are a variety of taxes that are local taxes. In addition, there are specific withholding practices that can be implemented in specific conditions.

The IRS regulations require you to electronically file withholding documents. The Federal Employer Identification Number must be listed on your national revenue tax return. If you don’t, you risk facing consequences.