South Carolina State Withholding Form – There are many reasons someone may choose to fill out forms withholding. This is due to the requirement for documentation, exemptions from withholding, as well as the amount of required withholding allowances. However, if the person decides to fill out an application there are some aspects to consider.

Withholding exemptions

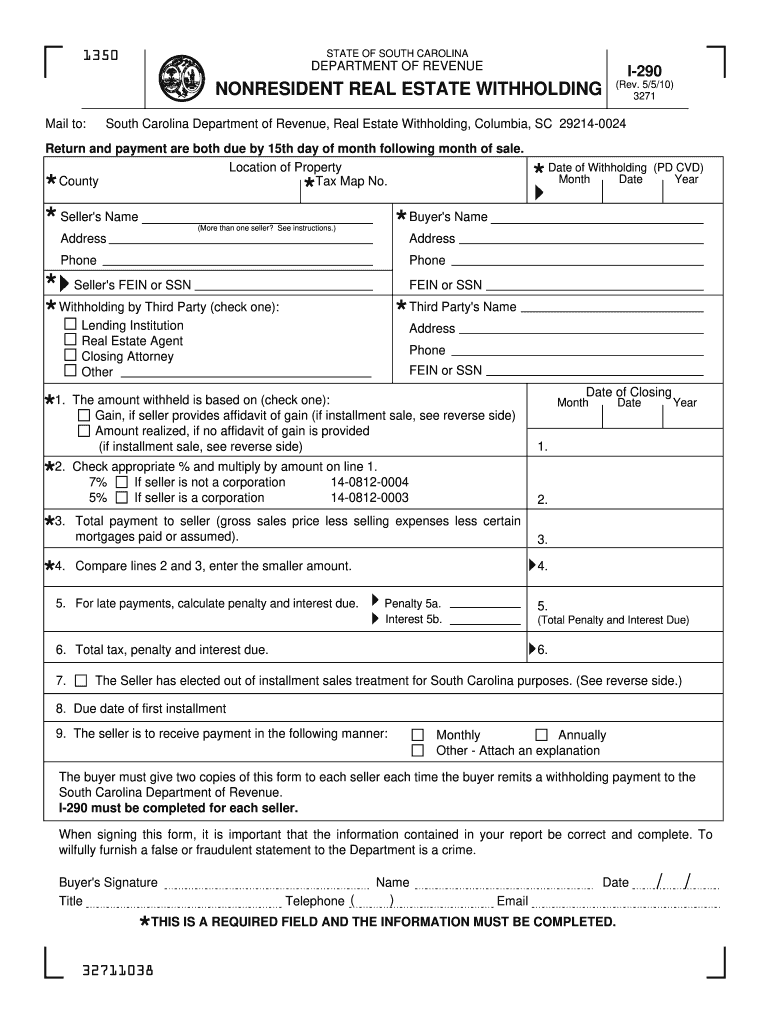

Non-resident aliens must submit Form 1040-NR once a year. It is possible to submit an exemption form for withholding tax when you meet the conditions. This page will list all exemptions.

For submitting Form 1040-NR include Form 1042-S. The form lists the amount that is withheld by the withholding agencies to report federal income tax to be used for reporting purposes. It is crucial to enter correct information when you complete the form. You could be required to treat a specific person for not providing this information.

The rate of withholding for non-resident aliens is 30 percent. It is possible to receive an exemption from withholding if your tax burden is higher than 30%. There are numerous exemptions. Some of them apply to spouses or dependents, like children.

Generally, a refund is offered for the chapter 4 withholding. Refunds are allowed according to Sections 1471-1474. These refunds must be made by the withholding agents, which is the person who withholds taxes at the source.

Status of relationships

The marital withholding form can simplify your life and assist your spouse. The bank may be surprised by the amount you’ve deposited. The problem is deciding what option to pick. Certain, there are that you shouldn’t do. You will pay a lot if you make a wrong decision. If you stick to the guidelines and watch out for any pitfalls You won’t face any issues. If you’re lucky enough, you could even meet new friends while traveling. Today is your anniversary. I’m hoping that you can utilize it in order to find the sought-after diamond. It’s a complex task that requires the expertise of an expert in taxation. It’s worth it to build wealth over the course of a lifetime. There are tons of websites that offer details. TaxSlayer is among the most trusted and respected tax preparation firms.

The number of withholding allowances claimed

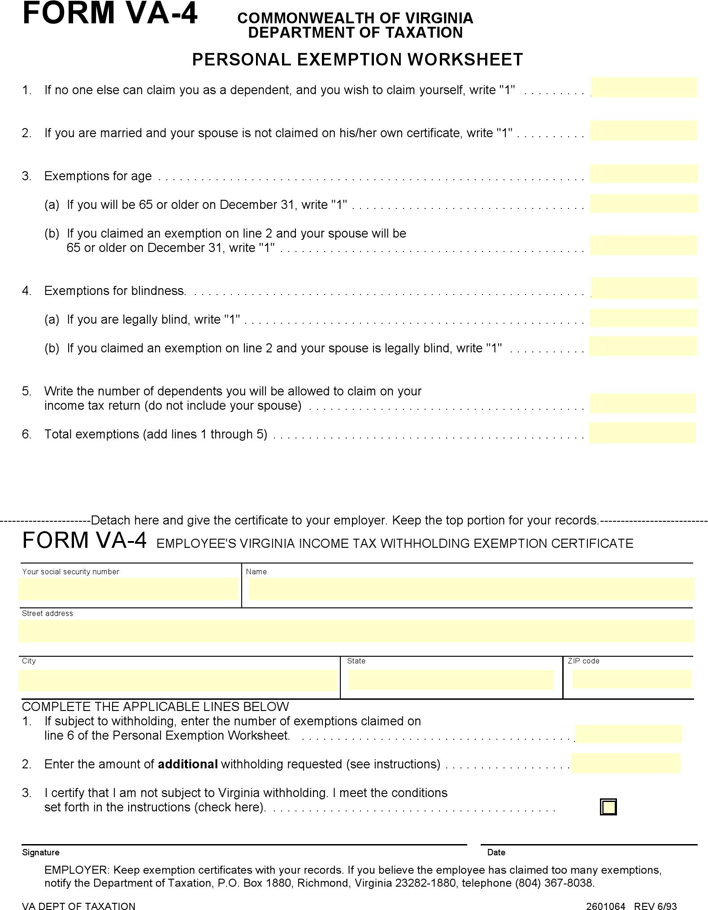

On the W-4 form you submit, you must declare the amount of withholding allowances you seeking. This is important since the tax amount you are able to deduct from your paychecks will depend on how much you withhold.

Many factors affect the amount of allowances requested.If you’re married as an example, you may be eligible for an exemption for the head of household. The amount of allowances you’re eligible to claim will depend on the income you earn. If you make a lot of income, you may get a bigger allowance.

You may be able to save money on a tax bill by deciding on the correct amount of tax deductions. If you file the annual tax return for income You could be entitled to a refund. You need to be careful about how you approach this.

Like any financial decision, it is important to research the subject thoroughly. Calculators can be utilized to figure out the amount of withholding allowances that must be requested. A professional could be a good alternative.

Filing specifications

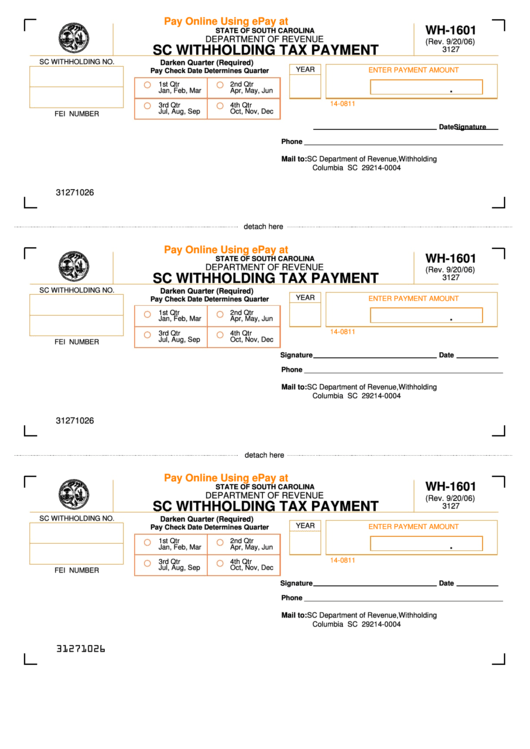

Withholding taxes from employees need to be collected and reported when you are an employer. If you are unable to collect the taxes, you are able to provide documentation to the IRS. It is possible that you will require additional documentation , like a withholding tax reconciliation or a quarterly return. Below are information on the different withholding tax forms and the deadlines for each.

Employees may need you to submit withholding taxes return forms to get their wages, bonuses and commissions. If you make sure that your employees are paid on time, you may be eligible to receive the refund of taxes that you withheld. Remember that these taxes can be considered as taxation by the county. There are special methods of withholding that are suitable in certain situations.

Electronic submission of forms for withholding is mandatory according to IRS regulations. Your Federal Employer Identification number must be noted when you file your national tax return. If you don’t, you risk facing consequences.

Gallery of South Carolina State Withholding Form

State Tax Withholding Forms Template Free Download Speedy Template