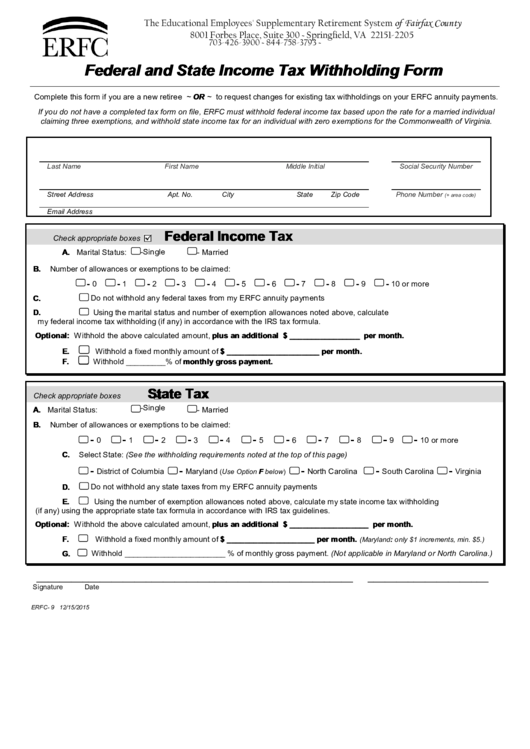

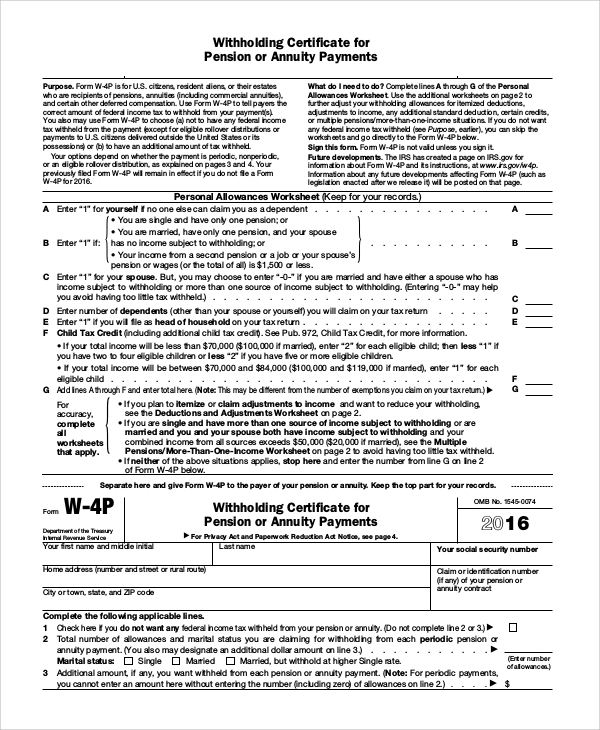

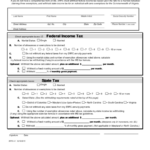

Federal State Withholding Form – There are many reasons someone could choose to submit an application for withholding. These include documents required, the exclusion of withholding, and the requested withholding allowances. No matter the reason for the filing of an application it is important to remember certain points to keep in mind.

Withholding exemptions

Non-resident aliens must submit Form 1040 NR at least once per year. If you satisfy these requirements, you may be able to claim exemptions from the form for withholding. This page you’ll discover the exemptions available to you.

To submit Form 1040-NR The first step is to attach Form 1042S. For federal income tax reporting reasons, this form details the withholding made by the tax agency that handles withholding. Fill out the form correctly. If the information you provide is not provided, one individual could be diagnosed with a medical condition.

The non-resident alien withholding rate is 30%. Tax burdens should not exceed 30% to be exempt from withholding. There are many exemptions. Some are only for spouses and dependents such as children.

Generally, you are eligible to receive a refund under chapter 4. As per Sections 1471 to 1474, refunds can be made. The agent who withholds the tax or the individual who withholds the tax at source is the one responsible for distributing these refunds.

Status of relationships

The marital withholding form is a good way to make your life easier and aid your spouse. The bank could be shocked by the amount that you have to deposit. It can be difficult to choose which one of the options you’ll choose. Undoubtedly, there are some that you shouldn’t do. It can be costly to make the wrong choice. You won’t have any issues If you simply adhere to the instructions and be attentive. If you’re lucky, you may even make new acquaintances while traveling. In the end, today is the date of your wedding anniversary. I hope you will take advantage of it to find that elusive wedding ring. In order to complete the job correctly it is necessary to seek the assistance from a qualified tax professional. The tiny amount is worth it for a life-long wealth. Online information is easily accessible. TaxSlayer is a reputable tax preparation firm.

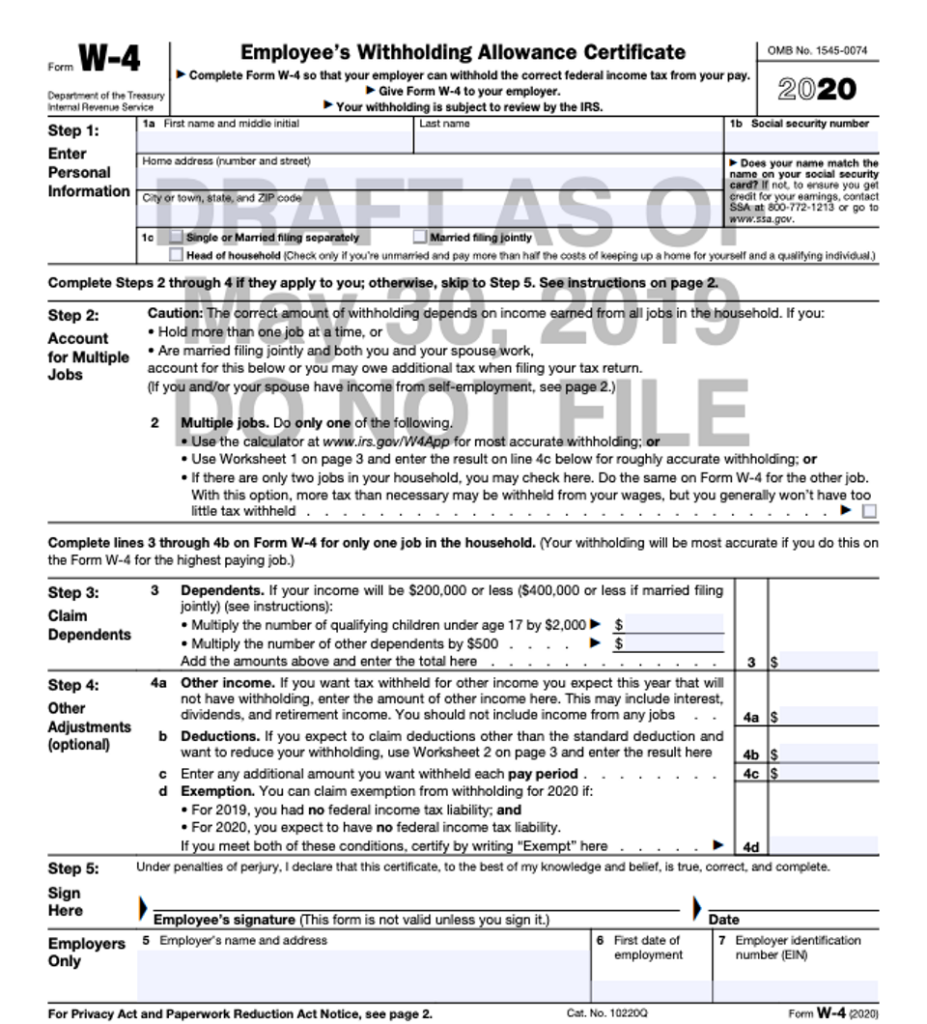

the number of claims for withholding allowances

It is essential to state the amount of withholding allowances which you wish to claim on the W-4 form. This is important because the withholdings can have an effect on the amount of tax that is taken out of your paychecks.

There are a variety of factors that can influence the amount you qualify for allowances. Your income will affect the amount of allowances you are entitled to. You could be eligible to claim more allowances if have a large amount of income.

Selecting the appropriate amount of tax deductions could save you from a large tax payment. If you file your annual income tax return, you might even receive a refund. But , you have to choose the right method.

Conduct your own research, just as you would with any financial decision. Calculators can be utilized to determine how many withholding allowances you should claim. Alternate options include speaking to a specialist.

Specifications that must be filed

Employers are required to report the company who withholds tax from their employees. Some of these taxes can be submitted to the IRS by submitting forms. Other documents you might require to submit includes an withholding tax reconciliation, quarterly tax returns, as well as an annual tax return. Here’s some details on the various withholding tax form categories and the deadlines for filing them.

The compensation, bonuses commissions, bonuses, and other income you get from your employees could require you to file tax returns withholding. In addition, if you paid your employees on time, you could be eligible for reimbursement of taxes withheld. Noting that certain of these taxes may be taxation by county is vital. There are also unique withholding techniques that are applicable under certain conditions.

Electronic submission of forms for withholding is required under IRS regulations. It is mandatory to include your Federal Employer ID Number when you file your national income tax return. If you don’t, you risk facing consequences.