Dc Withholding Tax Form 2024 – There are many reasons an individual might want to complete a form for withholding form. Documentation requirements, withholding exemptions and the amount of the allowance demanded are all elements. However, if one chooses to submit an application, there are a few aspects to consider.

Withholding exemptions

Non-resident aliens must file Form 1040-NR at least every year. If you satisfy the requirements, you could be eligible for an exemption to withholding. You will discover the exclusions accessible to you on this page.

When you submit Form1040-NR, attach Form 1042S. The form outlines the withholdings that are made by the agency. It is essential to fill in exact information when you fill out the form. You may have to treat a specific person for not providing this information.

The non-resident alien withholding rate is 30%. You may be eligible to get an exemption from withholding if your tax burden exceeds 30 percent. There are many exemptions. Some are for spouses or dependents, like children.

Generally, a refund is available for chapter 4 withholding. Refunds are allowed according to Sections 1471-1474. Refunds are to be given by the withholding agents who is the person who collects taxes at source.

Status of relationships

An appropriate marital status that is withheld can help both you and your spouse to accomplish your job. You’ll be amazed by the amount you can deposit to the bank. Choosing which of the possibilities you’re most likely to pick is the tough part. There are certain items you must avoid. You will pay a lot when you make a bad choice. If you adhere to the instructions and follow them, there shouldn’t be any problems. If you’re lucky you may even meet acquaintances on your travels. Today is your anniversary. I’m hoping you’ll be able to use it against them in order to get that elusive diamond. To do it right you’ll need the assistance of a certified accountant. This tiny amount is enough to last the life of your wealth. Information on the internet is easy to find. TaxSlayer and other trusted tax preparation companies are some of the most reliable.

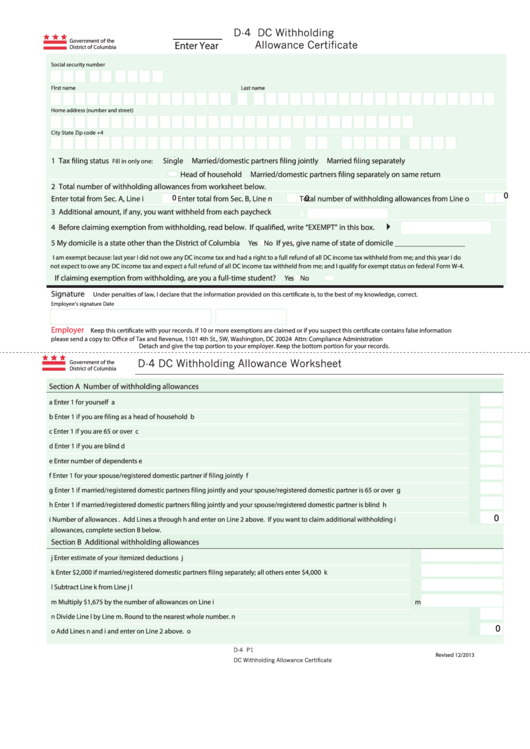

Number of withholding allowances claimed

On the W-4 form you file, you should indicate the amount of withholding allowances you asking for. This is essential since the tax amount taken from your paycheck will be affected by how you withhold.

You could be eligible to request an exemption for the head of your household if you are married. Your income can determine the amount of allowances offered to you. If you earn a high amount, you might be eligible to receive more allowances.

Tax deductions that are appropriate for your situation could aid you in avoiding large tax obligations. It is possible to receive an income tax refund when you file the annual tax return. Be cautious when it comes to preparing this.

Like any financial decision, you should conduct your homework. Calculators can help determine how many withholding amounts should be requested. If you prefer contact a specialist.

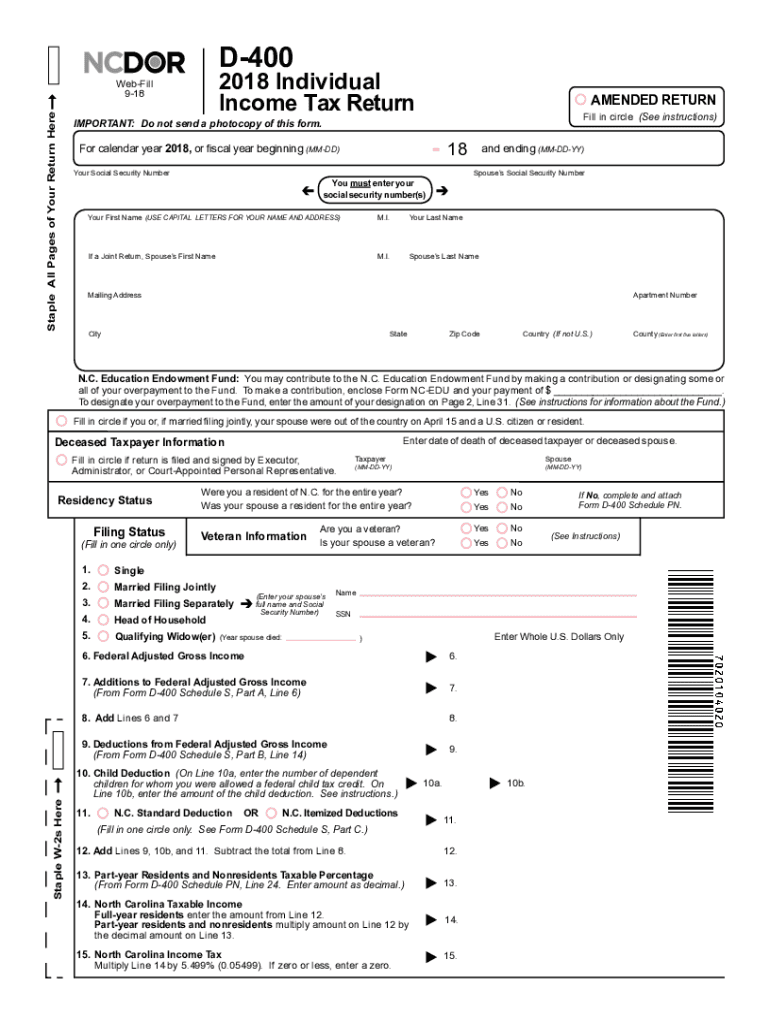

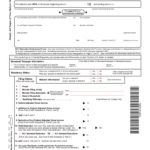

Formulating specifications

Withholding taxes on your employees must be collected and reported if you’re an employer. Certain of these taxes may be reported to the IRS by submitting forms. There are additional forms you may require, such as the quarterly tax return or withholding reconciliation. Below are information on the different tax forms that you can use for withholding as well as their deadlines.

The bonuses, salary, commissions, and other earnings you earn from your employees may necessitate you to file withholding tax returns. You could also be eligible to get reimbursements of taxes withheld if you’re employees were paid promptly. It is important to note that some of these taxes could be considered to be county taxes, is also important. Additionally, there are unique tax withholding procedures that can be applied under particular situations.

According to IRS regulations, you are required to electronically submit forms for withholding. The Federal Employer Identification Number needs to be listed on to your national tax return. If you don’t, you risk facing consequences.