Employee 2024 Federal Withholding Form – There are a variety of reasons one might decide to complete a withholding form. These factors include documentation requirements and withholding exemptions. There are a few things you should remember regardless of the reason a person files the form.

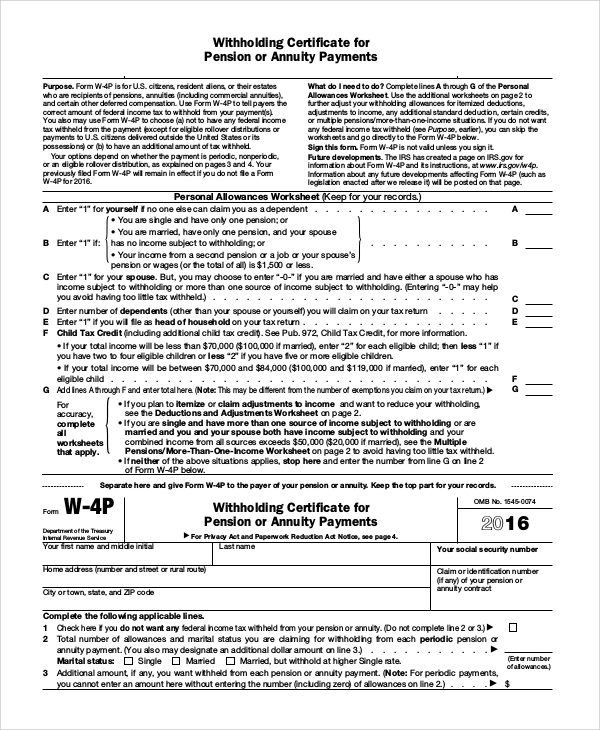

Exemptions from withholding

Nonresident aliens need to submit Form 1040–NR at least once per calendar year. If the requirements meet, you may be eligible to apply for an exemption from withholding. The exclusions you can find on this page are yours.

For submitting Form 1040-NR attach Form 1042-S. The form lists the amount withheld by the tax authorities to report federal income tax purposes. Be sure to enter the correct information when filling in this form. This information may not be provided and could result in one person being treated.

Non-resident aliens are subject to 30 percent withholding. The tax burden of your business is not to exceed 30% in order to be exempt from withholding. There are several different exclusions offered. Some are for spouses and dependents, such as children.

In general, the chapter 4 withholding gives you the right to the possibility of a refund. Refunds can be claimed according to sections 1401, 1474, and 1475. Refunds will be made to the agent who withholds tax, the person who withholds the tax from the source.

Status of the relationship

The work of your spouse and you will be made easy with a valid marriage-related status withholding document. Additionally, the quantity of money you may deposit in the bank will pleasantly surprise you. It isn’t always easy to determine which one of the many options is most attractive. There are some things you should not do. A bad decision could cause you to pay a steep price. It’s not a problem when you follow the directions and be attentive. If you’re lucky to meet some new friends while driving. Today marks the anniversary of your wedding. I hope you will use it against them to find that elusive ring. It’s a complex job that requires the experience of a tax professional. The tiny amount is enough for a life-long wealth. There are numerous online resources that provide details. TaxSlayer, a reputable tax preparation firm is one of the most effective.

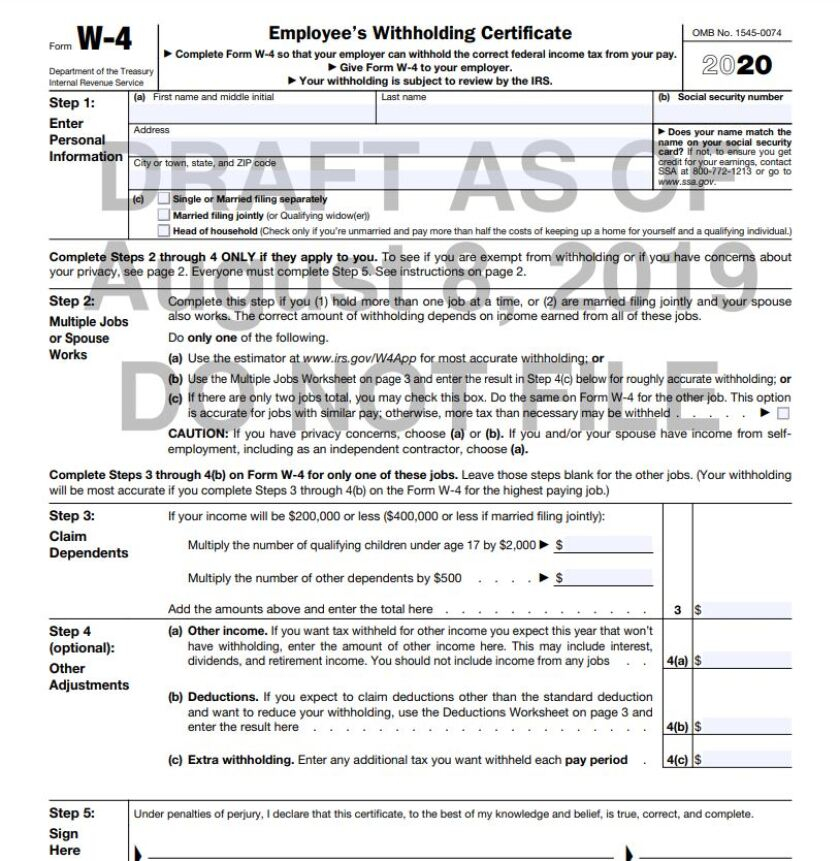

The amount of withholding allowances made

The W-4 form must be filled in with the amount of withholding allowances that you would like to be able to claim. This is crucial since the tax withheld can affect how much is taken from your paychecks.

You may be eligible to request an exemption for the head of your household if you are married. Your income level also affects how much allowances you’re entitled to. If you earn a high amount you may be eligible to receive a higher allowance.

A proper amount of tax deductions will save you from a large tax cost. Even better, you might be eligible for a refund when your annual income tax return has been completed. But be sure to choose your method carefully.

Like any financial decision, it is important to conduct your research. To determine the amount of tax withholding allowances that need to be claimed, you can utilize calculators. An expert may be an option.

Sending specifications

Employers must inform the IRS of any withholding taxes being collected from employees. Certain of these taxes can be reported to the IRS by submitting forms. There may be additional documents, such as an withholding tax reconciliation or a quarterly tax return. Here are the details on different withholding tax forms and their deadlines.

You may have to file withholding tax returns for the income you receive from your employees, like bonuses or commissions. You may also have to file for salary. If you also pay your employees on time, you might be eligible to be reimbursed for any taxes withheld. It is important to note that there are a variety of taxes that are local taxes. There are specific withholding strategies that may be applicable in specific situations.

The IRS regulations require you to electronically submit withholding documents. It is mandatory to include your Federal Employer ID Number when you point your national income tax return. If you don’t, you risk facing consequences.