Georgia Employee Withholding Form – There are many reasons why an individual might decide to fill out forms for withholding. Withholding exemptions, documentation requirements as well as the quantity of withholding allowances required are just a few of the factors. No matter the motive someone has to fill out an Application there are some things to remember.

Exemptions from withholding

Non-resident aliens are required to submit Form 1040-NR once a year. However, if your requirements are met, you could be eligible to request an exemption from withholding. On this page, you will see the exemptions that are for you to choose from.

The attachment of Form 1042-S is the first step in submitting Form 1040-NR. The document is required to declare the federal income tax. It details the withholding by the withholding agent. Make sure you fill out the form correctly. This information might not be disclosed and result in one person being treated.

The withholding rate for nonresident aliens is 30 percent. Non-resident aliens may be qualified for an exemption. This is the case if your tax burden less than 30%. There are many different exemptions. Certain of them are applicable to spouses or dependents, like children.

You may be entitled to refunds if you have violated the terms of chapter 4. Refunds may be granted in accordance with Sections 1400 through 1474. Refunds are to be given by the tax withholding agents that is, the person who withholds taxes at source.

Status of relationships

A valid marital status and withholding forms will ease the job of both you and your spouse. You’ll be amazed at how much money you can deposit to the bank. Knowing which of the many possibilities you’re likely decide is the biggest challenge. There are certain items you must avoid. False decisions can lead to costly results. But if you adhere to the guidelines and watch out for any potential pitfalls and pitfalls, you’ll be fine. You may make new acquaintances if fortunate. Since today is the date of your wedding anniversary. I’m hoping you’ll be able to utilize it against them to locate that perfect wedding ring. It’s a complex job that requires the knowledge of an accountant. It’s worthwhile to create wealth over the course of a lifetime. You can get a lot of information on the internet. TaxSlayer is a trusted tax preparation company.

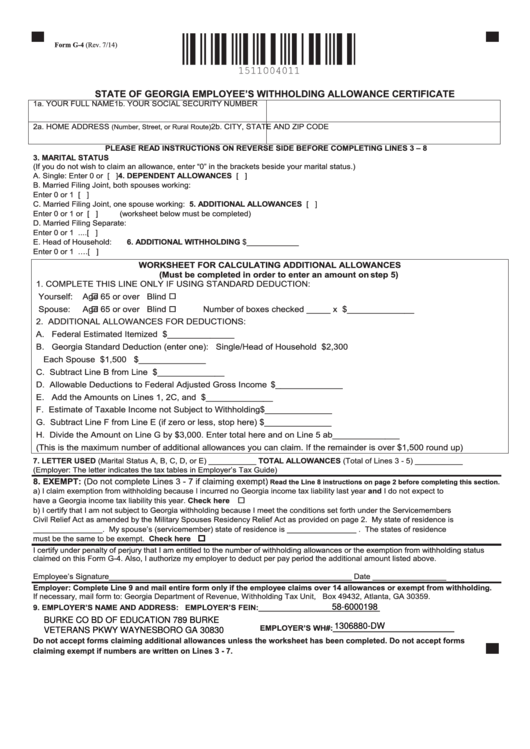

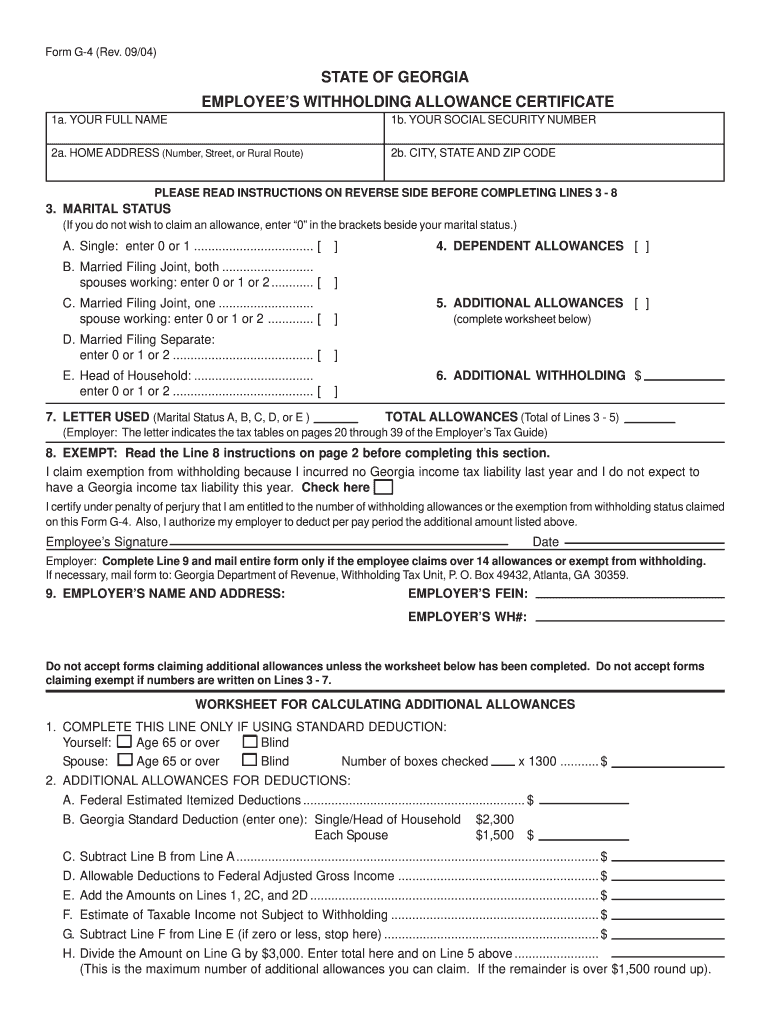

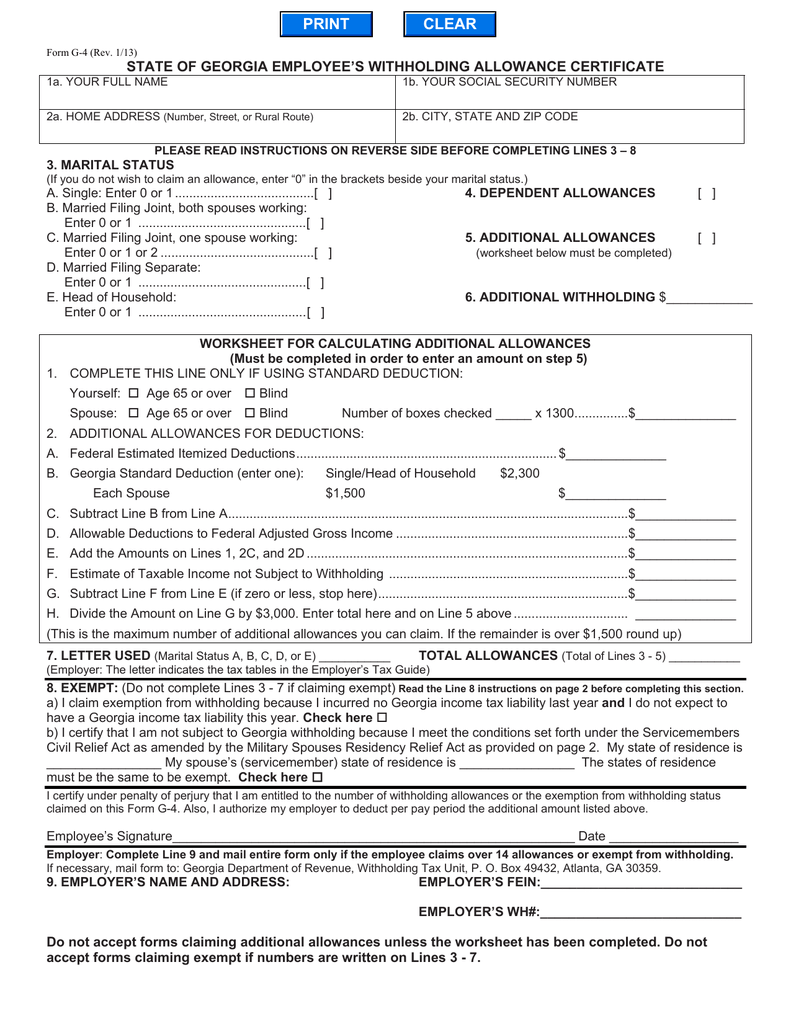

The number of withholding allowances claimed

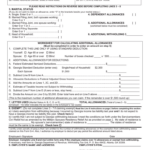

In submitting Form W-4 you should specify the number of withholdings allowances you would like to claim. This is crucial since the withholdings can have an effect on the amount of tax that is taken out of your paycheck.

There are a variety of factors that can determine the amount that you can claim for allowances. You may also be eligible for higher allowances depending on how much you earn. If you make a lot of income, you may be eligible for a larger allowance.

You might be able to reduce the amount of your tax bill by deciding on the right amount of tax deductions. The possibility of a refund is possible if you submit your income tax return for the current year. But it is important to pick the right method.

As with any other financial decision, you must do your research. Calculators are readily available to assist you in determining how much withholding allowances must be claimed. A better option is to consult to a professional.

Specifications to be filed

Employers should report the employer who withholds taxes from employees. The IRS may accept forms for certain taxes. A reconciliation of withholding tax, an annual tax return for quarterly filing, or the annual tax return are all examples of additional documents you could be required to submit. Below are details on the various forms of withholding tax and the deadlines to file them.

In order to be eligible for reimbursement of withholding tax on the pay, bonuses, commissions or any other earnings that your employees receive it is possible to file a tax return for withholding. Additionally, if your employees receive their wages punctually, you might be eligible to get the tax deductions you withheld. You should also remember that certain taxes could be considered to be local taxes. There are also special withholding strategies which can be utilized in certain circumstances.

In accordance with IRS regulations, you are required to electronically submit withholding forms. When filing your national revenue tax returns, be sure to include the Federal Employee Identification Number. If you don’t, you risk facing consequences.