Forms For Changing Md Withholding – There are many reasons why an individual might want to complete a withholding form. These factors include documentation requirements and exemptions from withholding. It doesn’t matter what motive someone has to fill out the Form there are some points to be aware of.

Exemptions from withholding

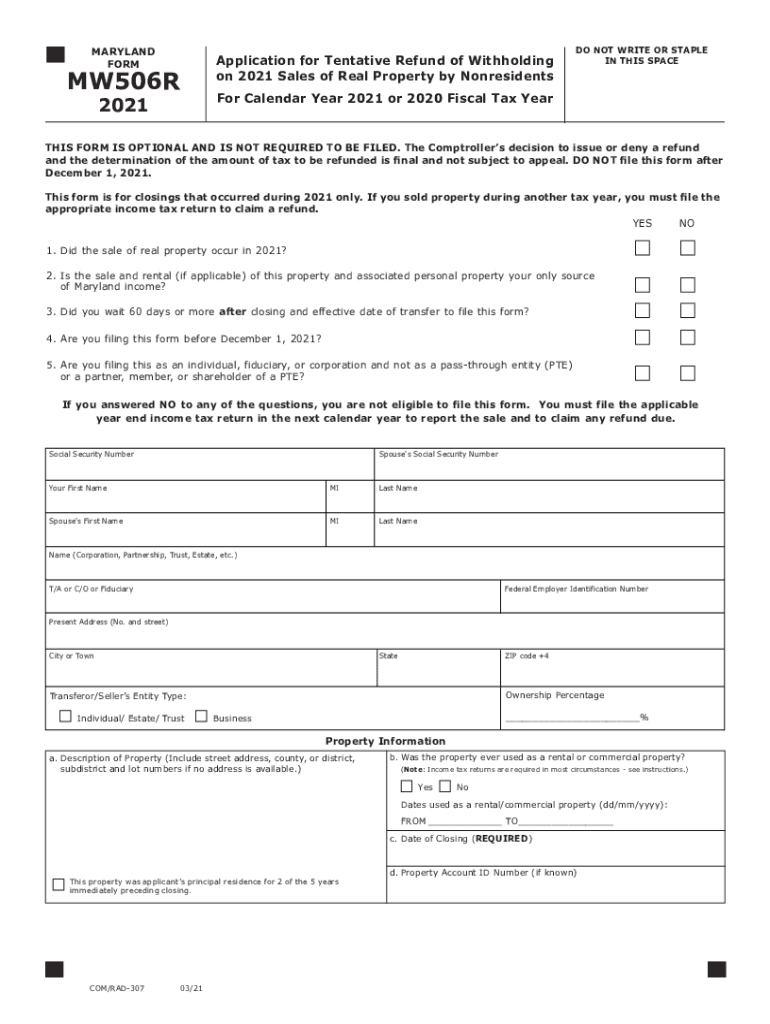

Non-resident aliens must submit Form 1040–NR every calendar year. However, if your requirements are met, you may be eligible to apply for an exemption from withholding. This page will provide the exclusions.

Attaching Form 1042-S is the first step to submit Form 1040-NR. The document is required to declare federal income tax. It details the withholding of the withholding agent. When filling out the form, ensure that you have provided the accurate information. You may have to treat a single person if you don’t provide the correct information.

The non-resident alien tax withholding tax rate is 30. If your tax burden is lower than 30 percent of your withholding, you may qualify to be exempt from withholding. There are many exemptions. Some of them are for spouses, dependents, or children.

You are entitled to refunds if you have violated the provisions of chapter 4. Refunds can be made under Sections 1400 to 1474. Refunds are provided by the agent who withholds tax. This is the person responsible for withholding the tax at the point of origin.

relational status

An official marital status form withholding forms will assist your spouse and you both make the most of your time. Furthermore, the amount of money you may deposit at the bank could delight you. Choosing which of the possibilities you’re most likely to pick is the tough part. There are certain things you should avoid doing. False decisions can lead to costly results. There’s no problem when you follow the directions and pay attention. If you’re lucky, you may meet some new friends on your trip. Today is the anniversary. I’m hoping that you can make use of it to get that elusive wedding ring. It will be a complicated job that requires the experience of an expert in taxation. The little amount is enough for a lifetime of wealth. Online information is easily accessible. TaxSlayer is a reputable tax preparation firm.

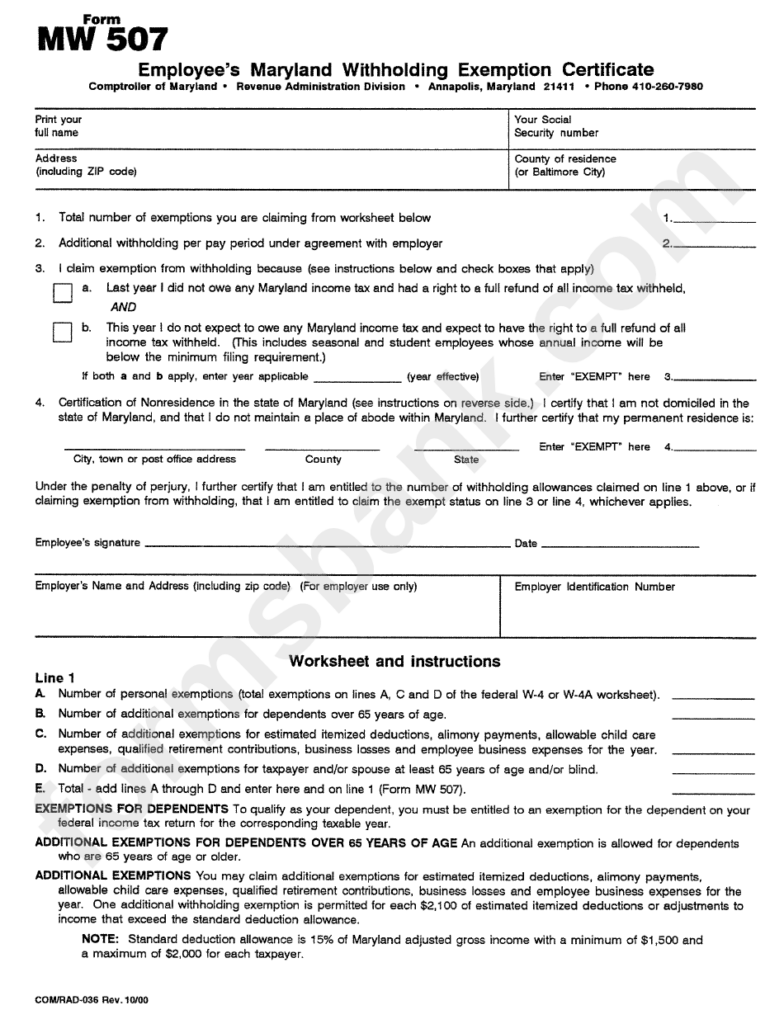

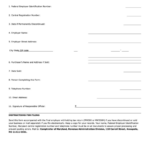

In the amount of withholding allowances claimed

It is important to specify the amount of withholding allowances you want to claim in the W-4 form. This is essential as the tax withheld can affect the amount taken out of your paycheck.

The amount of allowances that you are entitled to will be determined by the various aspects. For instance, if you are married, you may be entitled to an exemption for your household or head. Your income can determine the amount of allowances available to you. If you earn a significant amount of money, you could get a bigger allowance.

It can save you lots of money by determining the right amount of tax deductions. If you submit your annual income tax return, you could even receive a refund. However, it is crucial to select the correct method.

As with any financial decision, it is important to be aware of the facts. To figure out the amount of tax withholding allowances that need to be claimed, make use of calculators. An expert may be an alternative.

Formulating specifications

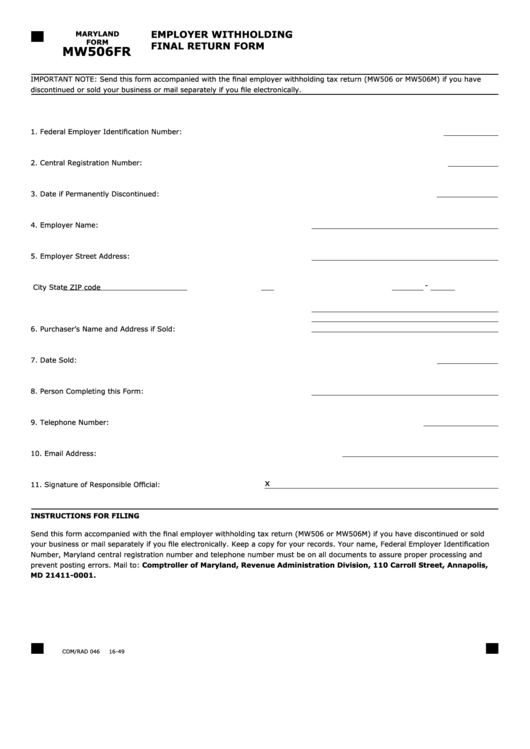

Employers are required to report the company who withholds taxes from their employees. It is possible to submit documents to the IRS for some of these taxation. Additional documents that you could need to submit include the reconciliation of your withholding tax, quarterly tax returns, and the annual tax return. Here is more information on the various forms of withholding taxes and the deadlines to file them.

Employees may need you to submit withholding taxes returns to be eligible for their salary, bonuses and commissions. In addition, if you paid your employees in time, you may be eligible for reimbursement of taxes that you withheld. It is important to note that some of these taxes may be taxes imposed by the county, is important. There are specific withholding strategies that may be suitable in certain situations.

According to IRS rules, you must electronically submit withholding forms. When you file your national tax return make sure you provide your Federal Employer Identification number. If you don’t, you risk facing consequences.