Edd Withholding Form How To Fill Out – There stand a digit of reasons for a person to decide to fill out a form for withholding. These factors include the requirements for documentation, exemptions from withholding and also the amount of required withholding allowances. There are some things you should remember regardless of why the person fills out the form.

Exemptions from withholding

Nonresident aliens are required once a year to submit Form1040-NR. If the requirements are met, you may be eligible for an exemption from withholding. You will discover the exclusions that you can access on this page.

To submit Form 1040-NR, add Form 1042-S. For federal income tax reporting reasons, this form provides the withholding made by the agency responsible for withholding. Please ensure you are entering the right information when filling in this form. If the information you provide is not provided, one individual could be treated.

Non-resident aliens have to pay 30 percent withholding. Exemption from withholding could be granted if you have a a tax burden that is less than 30 percent. There are numerous exemptions. Some of these exclusions are only available to spouses or dependents, such as children.

In general, refunds are offered for the chapter 4 withholding. Refunds can be claimed according to Sections 1401, 1474, and 1475. Refunds are given to the agent who withholds tax that is the person who collects taxes from the source.

Relational status

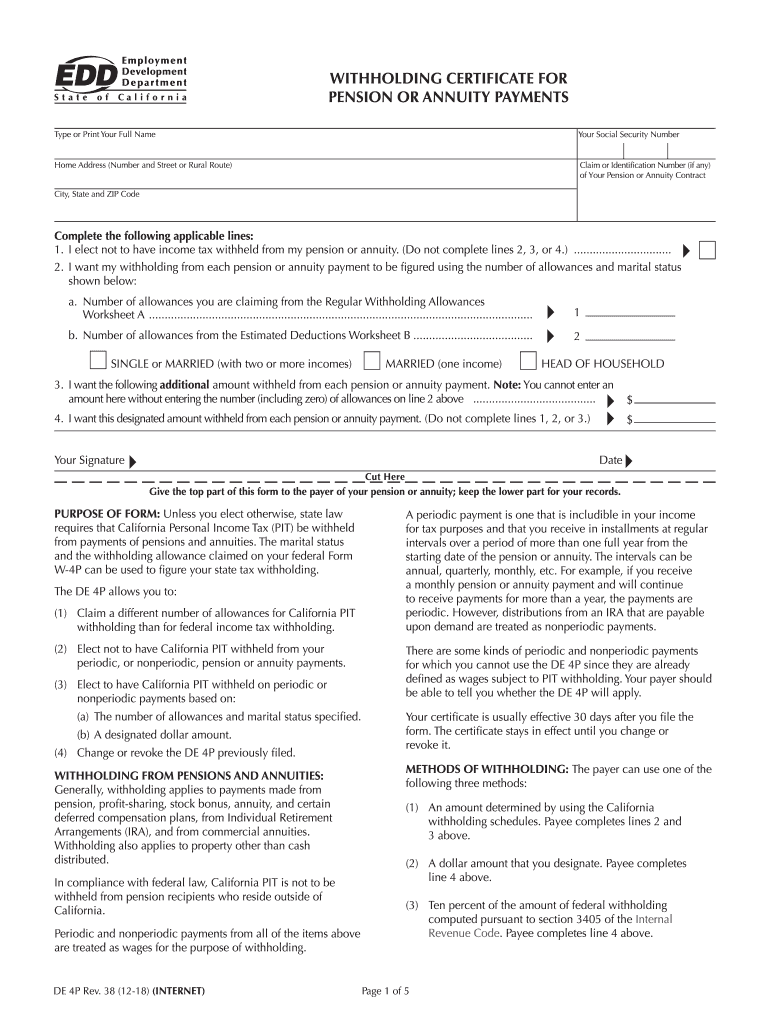

A valid marital status and withholding form will simplify your work and that of your spouse. The bank could be shocked by the amount that you have to deposit. The challenge is selecting the best option out of the many choices. Certain issues should be avoided. There are a lot of costs in the event of a poor decision. If you stick to the instructions and adhere to them, there won’t be any problems. If you’re lucky enough, you could be able to make new friends as traveling. Today is your anniversary. I’m sure you’ll utilize it against them to search for that one-of-a-kind wedding ring. To do this properly, you’ll require the advice of a tax expert who is certified. A modest amount of money could create a lifetime’s worth of wealth. There is a wealth of information on the internet. TaxSlayer is a reputable tax preparation company.

Number of withholding allowances claimed

When filling out the form W-4 you fill out, you need to indicate the amount of withholding allowances you asking for. This is important because the tax amount withdrawn from your paychecks will be affected by how you withhold.

There are a variety of factors that can affect the amount you are eligible for allowances. You can also claim more allowances depending on how much you earn. If you earn a higher income, you may be eligible for a higher allowance.

A tax deduction appropriate for you could help you avoid large tax bills. In fact, if you file your annual income tax return, you may even receive a refund. However, you must be careful about how you approach the tax return.

As with any financial decision, you should conduct your homework. Calculators are a great tool to determine the amount of withholding allowances you should claim. If you prefer, you may speak with an expert.

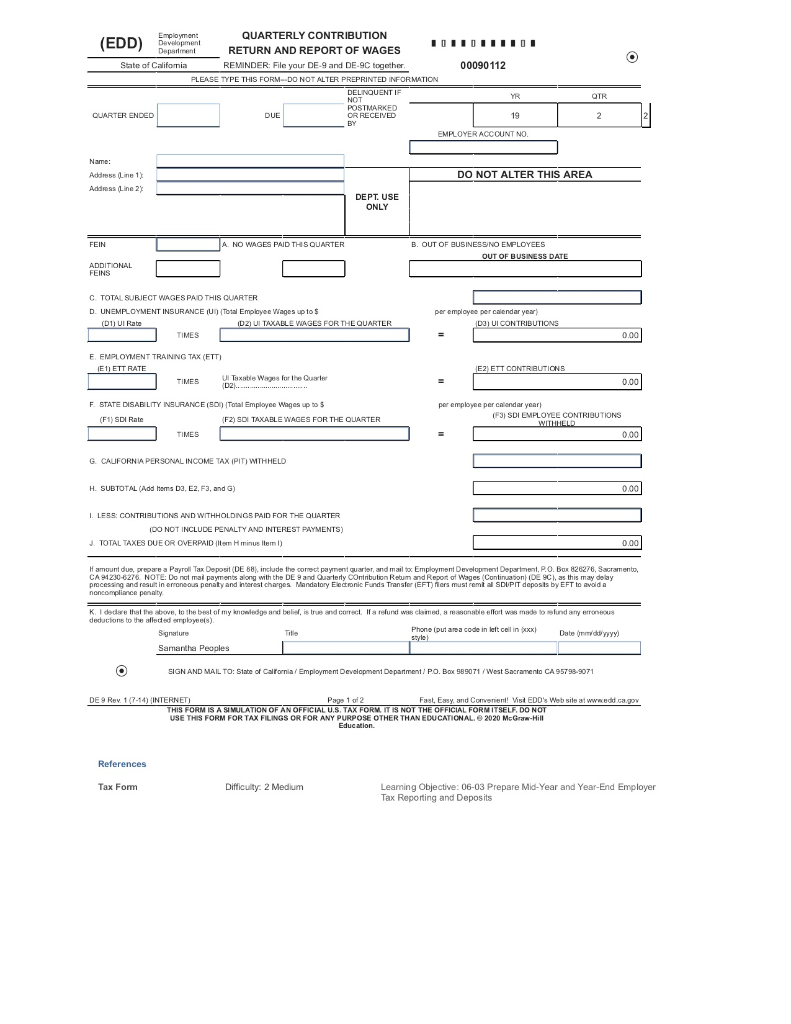

Submission of specifications

Employers are required to collect withholding taxes from their employees and then report the tax. In the case of a small amount of the taxes, you are able to send paperwork to IRS. There may be additional documents, such as the reconciliation of your withholding tax or a quarterly return. Here’s some details on the different tax forms for withholding categories and the deadlines for the submission of these forms.

You may have to file tax returns for withholding to claim the earnings you earn from your employees, including bonuses or commissions. You may also have to file for salary. Additionally, if you pay your employees on-time it could be possible to qualify to be reimbursed for any taxes taken out of your paycheck. The fact that certain taxes are county taxes must be considered. There are special methods of withholding that are suitable in certain situations.

In accordance with IRS regulations, you are required to electronically submit forms for withholding. If you are submitting your national revenue tax return be sure to include the Federal Employer Identification number. If you don’t, you risk facing consequences.