Pa Local Income Tax Withholding Form – There are many explanations why somebody could decide to complete a withholding form. Withholding exemptions, documentation requirements and the amount of the allowance demanded are all elements. No matter the reason someone chooses to file the Form There are a few aspects to keep in mind.

Exemptions from withholding

Non-resident aliens must file Form 1040-NR at least once per year. If you satisfy the requirements, you could be eligible to be exempt from withholding. The following page lists all exclusions.

To submit Form 1040-NR, add Form 1042-S. The form outlines the withholdings that are made by the agency. When filling out the form, ensure that you have provided the exact details. A person could be treated differently if this information is not provided.

The non-resident alien tax withholding tax rate is 30 percent. You may be eligible to be exempted from withholding tax if your tax burden is greater than 30%. There are many exemptions. Some are for spouses or dependents, for example, children.

You can claim a refund if you violate the provisions of chapter 4. Refunds are made in accordance with Sections 471 to 474. Refunds will be made to the withholding agent that is the person who collects the tax at the source.

Status of relationships

The marital withholding form is an excellent way to simplify your life and assist your spouse. You’ll be amazed at how much money you can put in the bank. It isn’t easy to decide which of the options most appealing. There are certain actions you should not do. False decisions can lead to expensive results. You won’t have any issues If you simply follow the directions and pay attention. It is possible to make new acquaintances if lucky. Today is your anniversary. I’m hoping that they will turn it against you to get you the perfect engagement ring. In order to complete the job correctly, you will need to get the help of a certified tax expert. A modest amount of money could create a lifetime’s worth of wealth. You can find tons of information online. TaxSlayer as well as other reliable tax preparation firms are some of the top.

The amount of withholding allowances that were made

On the W-4 form you submit, you must declare how many withholding allowances are you seeking. This is crucial because the amount of tax taken from your pay will be affected by how much you withhold.

A number of factors can determine the amount that you can claim for allowances. Your income also determines how much allowances you’re eligible to claim. You may be eligible for more allowances if earn a significant amount of money.

The right amount of tax deductions will help you avoid a significant tax bill. Even better, you might be eligible for a refund when your annual income tax return is filed. But, you should be careful about how you approach the tax return.

You must do your homework the same way you would for any financial option. Calculators are available to aid you in determining the amount of withholding allowances must be claimed. It is also possible to speak with a specialist.

Filing requirements

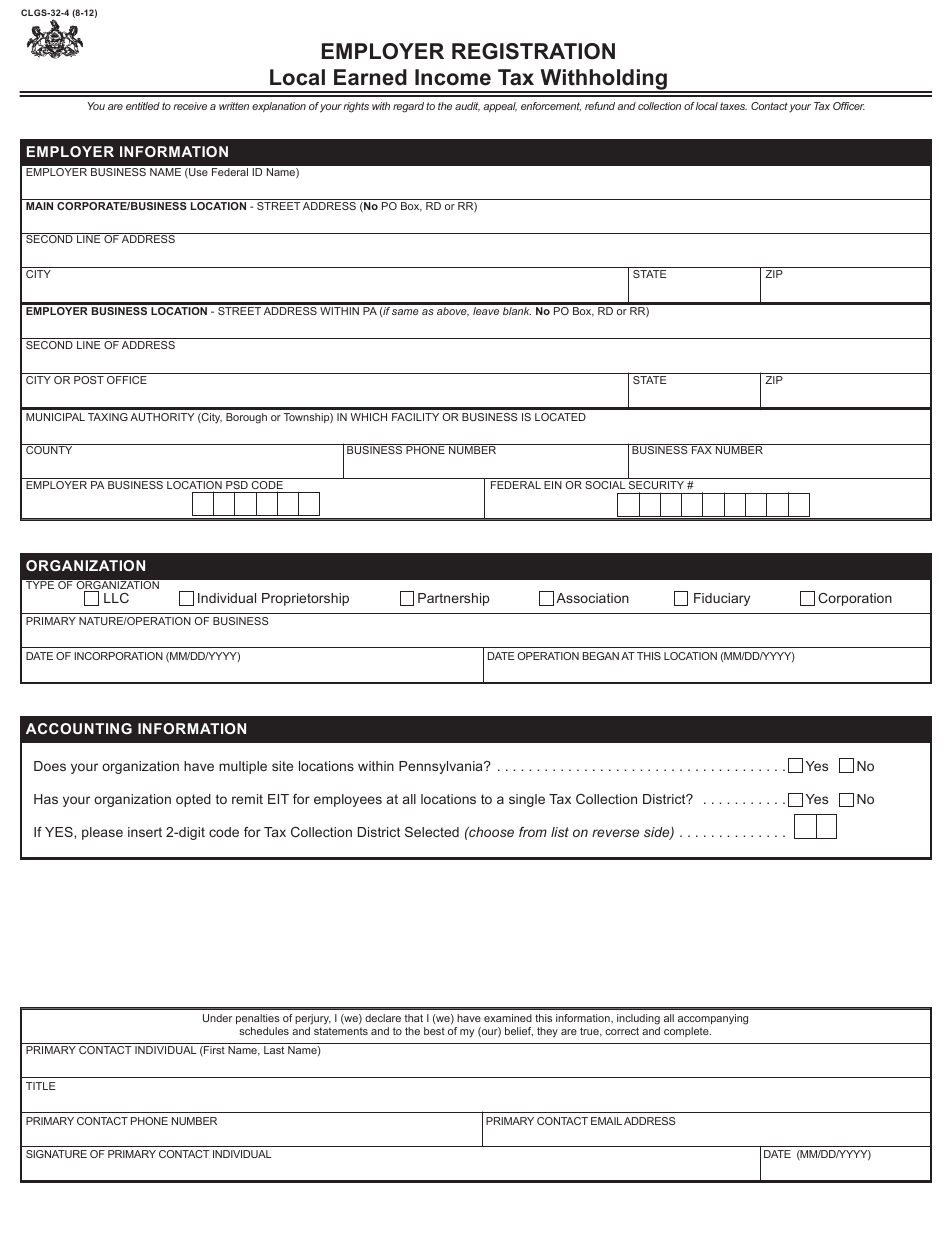

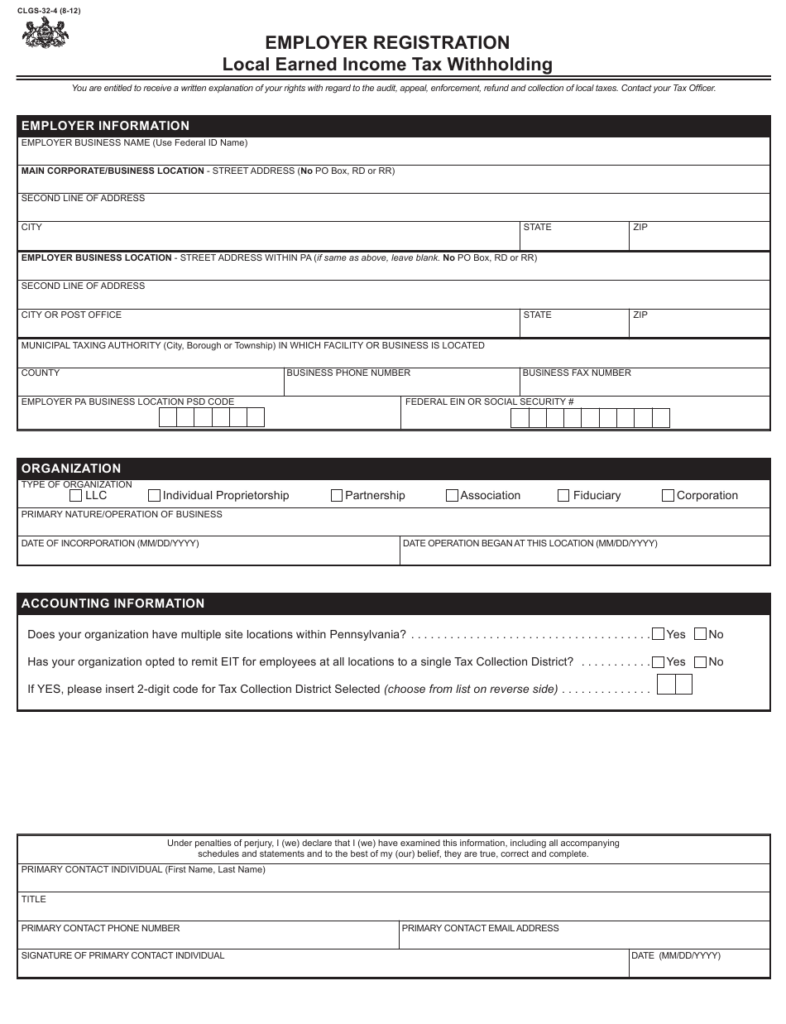

Employers are required to report the company who withholds taxes from their employees. The IRS may accept forms for some of these taxes. A withholding tax reconciliation or a quarterly tax return, as well as an annual tax return are examples of other paperwork you may be required to submit. Here’s a brief overview of the different tax forms and when they need to be submitted.

You might have to file tax returns withholding to claim the earnings you earn from your employees, like bonuses, commissions, or salary. If you pay your employees on time, you could be eligible for the refund of taxes that you withheld. The fact that some of these taxes are county taxes should be taken into consideration. Additionally, there are unique methods of withholding that are implemented in specific circumstances.

Electronic filing of withholding forms is mandatory according to IRS regulations. Your Federal Employer Identification number must be noted when you file to your tax return for the nation. If you don’t, you risk facing consequences.