Ok State Withholding Form – There are many reasons an individual might want to complete a form for withholding form. These factors include the requirements for documentation, exemptions from withholding and also the amount of withholding allowances. There are certain important things to keep in mind, regardless of the reason the person fills out the form.

Withholding exemptions

Non-resident aliens are required to submit Form 1040 NR once per year. However, if your requirements are met, you could be eligible to request an exemption from withholding. This page will provide all exemptions.

The first step to filling out Form 1040-NR is attaching Form 1042 S. This form lists the amount that is withheld by the tax authorities for federal tax reporting for tax reporting purposes. It is important to enter exact information when you fill out the form. If this information is not provided, one individual could be treated.

The tax withholding rate for non-resident aliens is 30%. Nonresident aliens could be qualified for exemption. This happens if your tax burden is lower than 30%. There are numerous exemptions. Some are for spouses or dependents, for example, children.

In general, refunds are accessible for Chapter 4 withholding. Refunds can be made under Sections 1400 to 1474. The agent who withholds the tax or the person who collects the tax at source, is the one responsible for distributing these refunds.

Relational status

An official marriage status withholding form will help your spouse and you both get the most out of your time. It will also surprise you how much money you could put in the bank. Knowing which of the several possibilities you’re most likely to pick is the tough part. You should be careful what you do. It’s expensive to make the wrong decision. However, if the instructions are followed and you pay attention, you should not have any problems. You might make some new friends if you are fortunate. Today marks the anniversary. I’m sure you’ll be able to leverage it to find that perfect engagement ring. To complete the task correctly, you will need to seek the assistance of a certified tax expert. The tiny amount is enough for a life-long wealth. You can get a lot of information on the internet. Reputable tax preparation firms like TaxSlayer are among the most helpful.

The number of withholding allowances claimed

On the W-4 form you file, you should specify the amount of withholding allowances you asking for. This is crucial since the withholdings will impact on how much tax is taken out of your pay checks.

Many factors affect the allowances requested.If you’re married, as an example, you might be eligible to claim an exemption for the head of household. The amount of allowances you can claim will depend on your income. You can apply for an increase in allowances if you earn a significant amount of money.

The proper amount of tax deductions will help you avoid a significant tax charge. In addition, you could even receive a tax refund if the annual tax return is completed. However, it is crucial to choose the right approach.

Like every financial decision, it is important to be aware of the facts. Calculators can assist you in determining the number of withholdings that need to be requested. An alternative is to speak with a specialist.

Specifications that must be filed

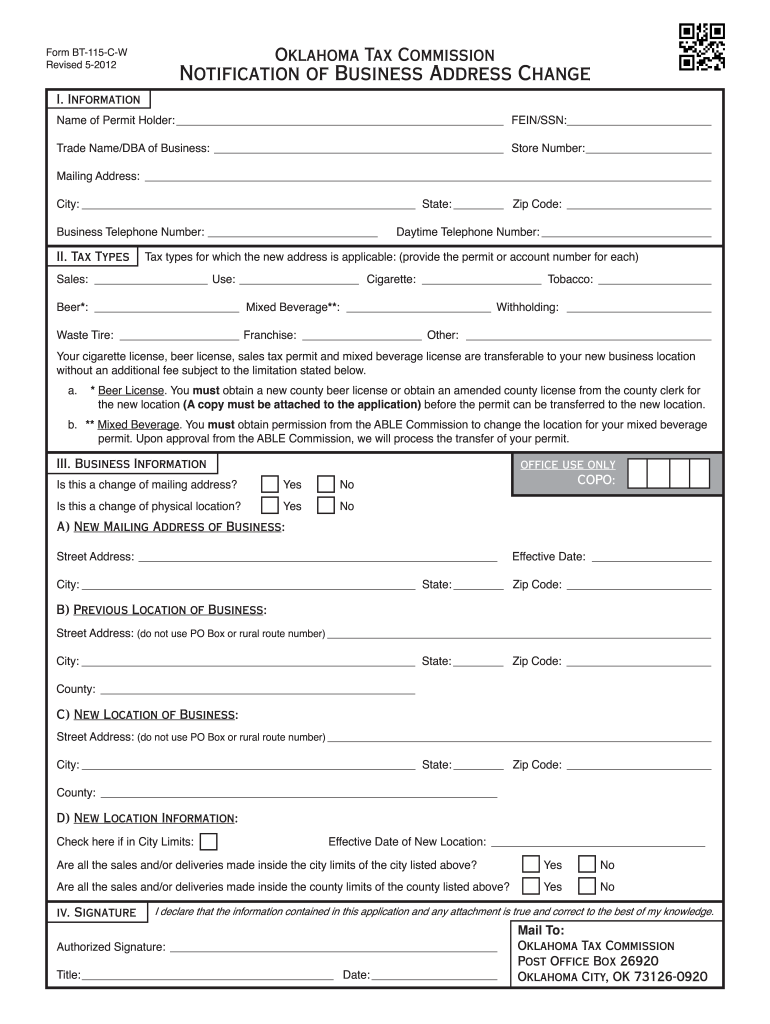

Employers must take withholding tax from their employees and then report the tax. If you are unable to collect the taxes, you are able to send paperwork to IRS. A tax return for the year, quarterly tax returns or the reconciliation of withholding tax are all kinds of documentation you may need. Here are some information on the different types of withholding tax forms along with the filing deadlines.

Tax returns withholding may be required for income such as salary, bonuses, commissions and other income. If your employees receive their wages in time, you could be eligible for the tax deductions you withheld. It is crucial to remember that some of these taxes are local taxes. There are also unique withholding rules that can be utilized in certain situations.

You must electronically submit withholding forms according to IRS regulations. If you are filing your tax returns for the national income tax, be sure to provide your Federal Employee Identification Number. If you don’t, you risk facing consequences.