Withholding Form For Nj – There are many reasons an individual might decide to fill out withholding forms. These factors include the requirements for documentation, exemptions from withholding, as well as the amount of the required withholding allowances. There are some points to be aware of regardless of the reason the person fills out a form.

Withholding exemptions

Non-resident aliens are required to submit Form1040-NR once every year to file Form1040-NR. However, if your requirements are met, you may be eligible to request an exemption from withholding. On this page, you’ll discover the exemptions for you to choose from.

If you are submitting Form1040-NR to the IRS, include Form 1042S. The form lists the amount that is withheld by the tax authorities for federal income tax reporting purposes. Be sure to enter the correct information as you fill in the form. This information may not be disclosed and cause one person to be treated.

The non-resident alien tax withholding rate is 30 percent. Your tax burden should not exceed 30% to be exempt from withholding. There are numerous exemptions. Some of them apply to spouses or dependents, like children.

The majority of the time, a refund is offered for the chapter 4 withholding. Refunds can be granted according to Sections 471 through 474. The person who is the withholding agent or the individual who withholds the tax at source, is responsible for making these refunds.

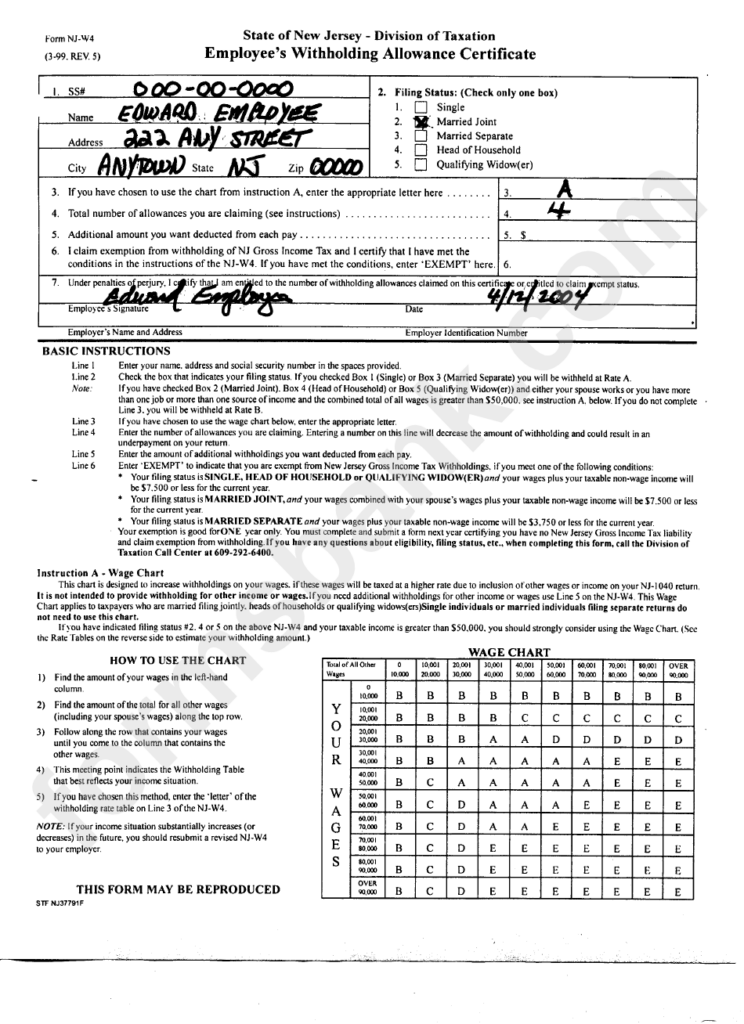

Relational status

Your and your spouse’s job is made simpler by a proper marriage status withholding form. You’ll be amazed at the amount you can deposit at the bank. The trick is to decide what option to choose. There are some things you should avoid. There will be a significant cost in the event of a poor choice. But if you adhere to the directions and watch out for any pitfalls and pitfalls, you’ll be fine. If you’re lucky, you may even make new acquaintances while you travel. Today marks the day you celebrate your wedding. I’m hoping that you can apply it against them to secure the elusive diamond. It’s a difficult job that requires the knowledge of a tax professional. A small amount of money can create a lifetime of wealth. Information on the internet is readily available. TaxSlayer, a reputable tax preparation firm is among the most helpful.

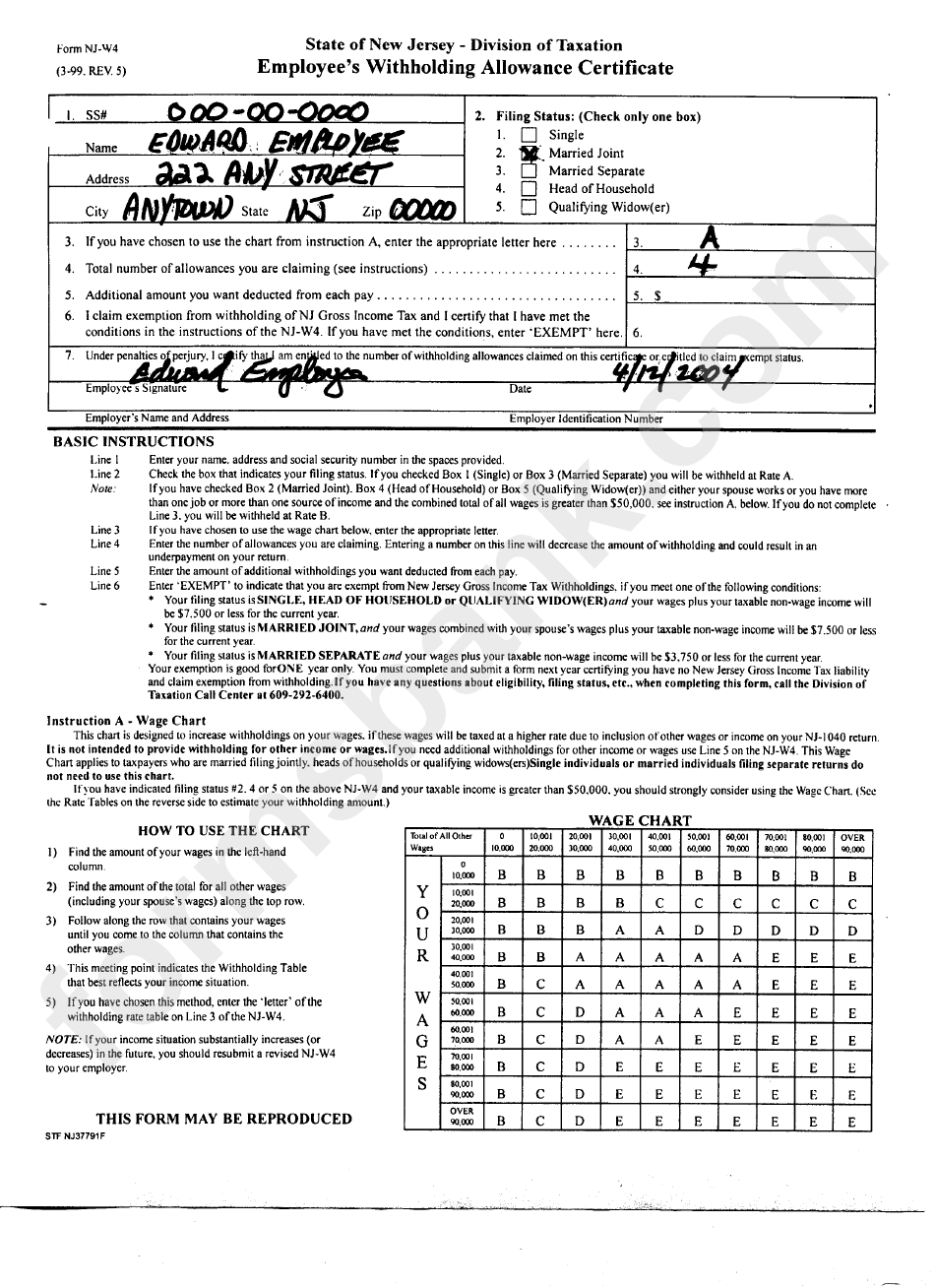

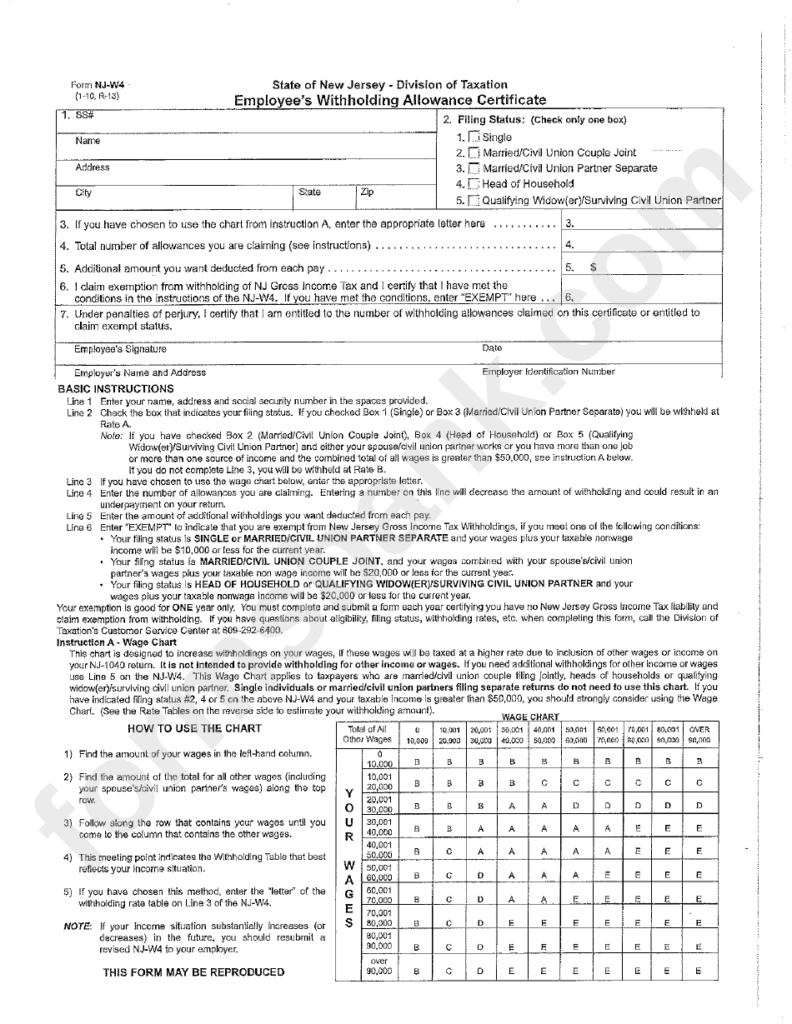

the number of claims for withholding allowances

On the Form W-4 that you fill out, you need to indicate the amount of withholding allowances you asking for. This is important since it will affect how much tax you will receive from your wages.

There are a variety of factors that can affect the amount you are eligible for allowances. You can also claim more allowances depending on how much you earn. If you have a high income, you could be eligible to request an increase in your allowance.

A tax deduction suitable for you can help you avoid large tax bills. In addition, you could even get a refund if the annual tax return is filed. But, you should be aware of your choices.

Like every financial decision, it is important to conduct your own research. To figure out the amount of withholding allowances to be claimed, use calculators. As an alternative to a consultation with a specialist.

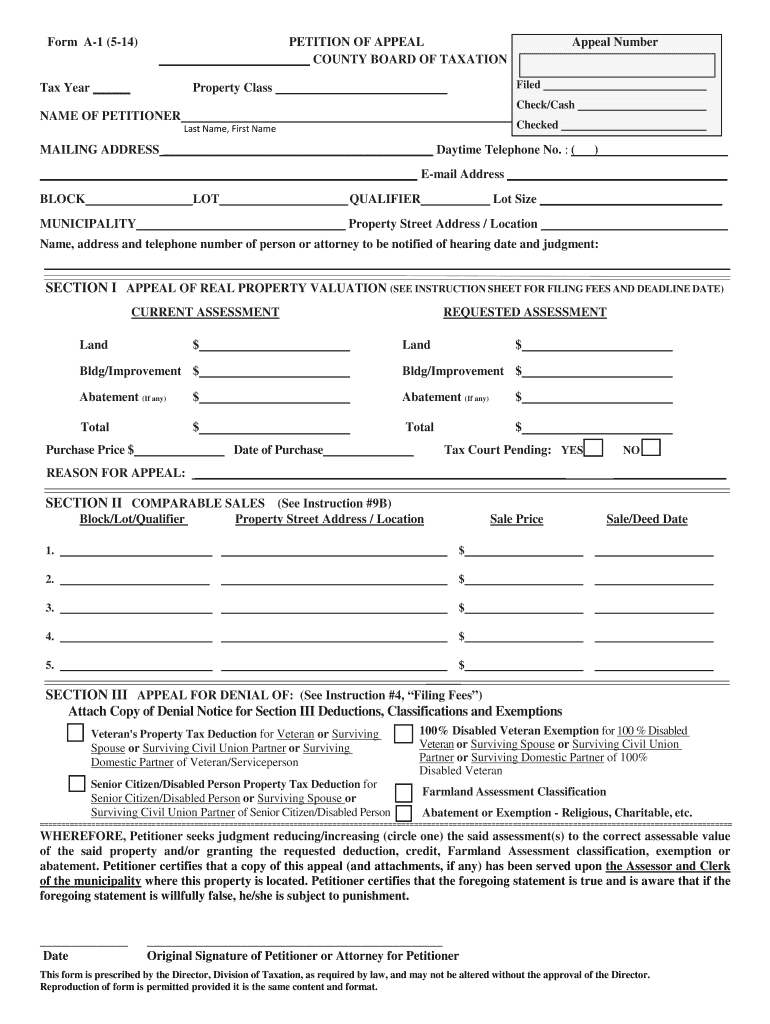

Specifications for filing

Employers should report the employer who withholds tax from employees. In the case of a small amount of the taxes, you are able to provide documentation to the IRS. You might also need additional documentation such as the reconciliation of your withholding tax or a quarterly return. Here’s some information about the various withholding tax form categories and the deadlines for the submission of these forms.

The compensation, bonuses, commissions, and other earnings you earn from your employees could require you to file tax returns withholding. If you make sure that your employees are paid on time, then you may be eligible to receive reimbursement of any withheld taxes. It is important to remember that some of these taxes might be county taxes. Additionally, there are unique tax withholding procedures that can be applied under particular situations.

Electronic submission of forms for withholding is mandatory according to IRS regulations. When you file your tax return for national revenue, please provide the Federal Employer Identification number. If you don’t, you risk facing consequences.