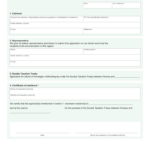

District Of Columbia State Tax Withholding Form – There are many reasons that an individual could submit an application for withholding. These factors include the requirements for documentation, exemptions from withholding, as well as the amount of required withholding allowances. There are certain points to be aware of regardless of why that a person has to fill out a form.

Withholding exemptions

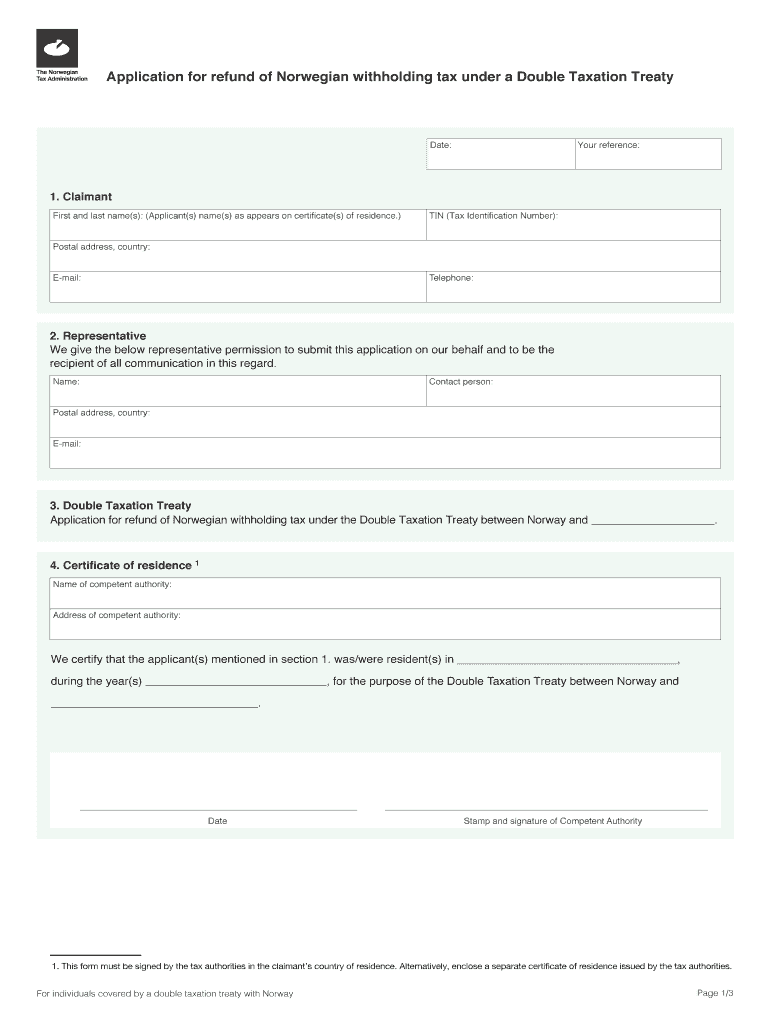

Non-resident aliens must submit Form 1040 NR once each year. If you meet the conditions, you could be eligible for an exemption from the withholding form. There are exemptions that you can access on this page.

The application of Form 1042-S to Form 1042-S is a first step to file Form 1040-NR. This document lists the amount withheld by the tax withholding authorities for federal income tax reporting purposes. When filling out the form make sure you fill in the exact information. One person may be treated if the information is not entered.

The 30% tax withholding rate for non-resident aliens is 30. The tax burden of your business is not to exceed 30% in order to be exempt from withholding. There are a variety of exemptions. Some are specifically designed for spouses, whereas others are meant to be used by dependents like children.

In general, chapter 4 withholding gives you the right to a refund. Refunds are granted in accordance with sections 1401, 1474, and 1475. Refunds will be made to the withholding agent, the person who withholds the tax at the source.

Status of relationships

A proper marital status withholding can make it simpler for you and your spouse to do your work. You’ll also be surprised by how much money you could make a deposit to the bank. It isn’t easy to choose which of the options most appealing. Certain aspects should be avoided. Making the wrong choice could cost you a lot. If you stick to it and pay attention to directions, you shouldn’t run into any problems. If you’re fortunate you may even meet a few new pals when you travel. Today marks the anniversary of your marriage. I hope you will take advantage of it to search for that one-of-a-kind ring. To do it right you’ll need the aid of a qualified accountant. It’s worth it to build wealth over the course of your life. Information on the internet is easily accessible. TaxSlayer is a trusted tax preparation firm.

Number of claimed withholding allowances

When filling out the form W-4 you submit, you must declare the amount of withholding allowances you seeking. This is crucial since it will affect the amount of tax you get from your paychecks.

There are a variety of factors that can determine the amount that you can claim for allowances. You can also claim more allowances, based on how much you earn. If you earn a substantial income, you can request a higher allowance.

The right amount of tax deductions can aid you in avoiding a substantial tax charge. You may even get a refund if you file your annual tax return. But you need to pick your strategy carefully.

In every financial decision, you should do your research. To determine the amount of tax withholding allowances to be claimed, you can utilize calculators. An expert might be a viable alternative.

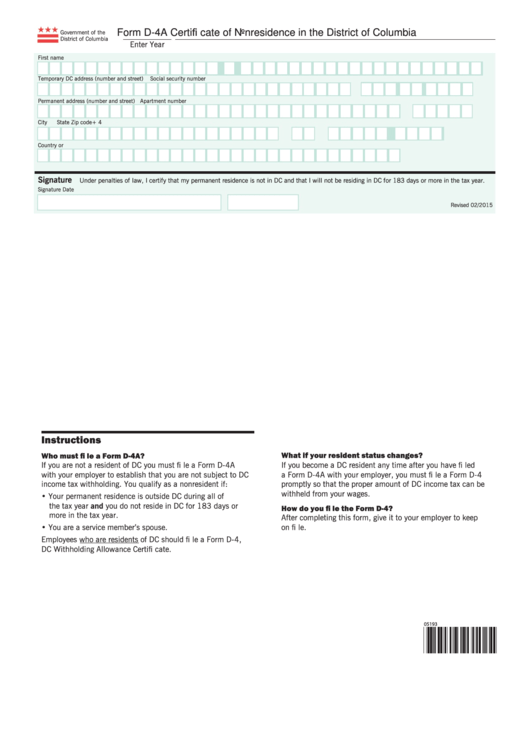

Filing requirements

Employers should report the employer who withholds tax from employees. It is possible to submit documents to the IRS for a few of these taxation. An annual tax return and quarterly tax returns, or withholding tax reconciliation are all examples of paperwork you might require. Here are the details on various tax forms for withholding and the deadlines for each.

The compensation, bonuses commissions, other income you get from employees might necessitate you to file withholding tax returns. You could also be eligible to get reimbursements of taxes withheld if you’re employees were paid in time. Noting that certain of these taxes may be taxes imposed by the county, is crucial. In some situations, withholding rules can also be unique.

In accordance with IRS rules, you must electronically submit forms for withholding. When you file your tax returns for the national income tax ensure that you include the Federal Employee Identification Number. If you don’t, you risk facing consequences.