Ga Federal Tax Withholding Form – There are many reasons someone could choose to submit an application for withholding. This is due to the requirement for documentation, withholding exemptions and the amount of withholding allowances. No matter the motive someone has to fill out a Form there are some aspects to keep in mind.

Withholding exemptions

Non-resident aliens must submit Form 1040–NR once a calendar year. If you fulfill the requirements, you might be able to submit an exemption form from withholding. This page you will find the exclusions available to you.

The application of Form 1042-S to Form 1042-S is a first step to file Form 1040-NR. For federal income tax reporting reasons, this form details the withholding made by the agency responsible for withholding. Complete the form in a timely manner. If the information you provide is not supplied, one person may be taken into custody.

The withholding rate for nonresident aliens is 30 percent. Nonresident aliens could be qualified for an exemption. This applies the case if your tax burden less than 30%. There are a variety of exclusions. Some are specifically for spouses, and dependents, like children.

You may be entitled to a refund if you violate the rules of chapter 4. Refunds are granted in accordance with Sections 1401, 1474 and 1475. The refunds are given by the tax agent (the person who collects tax at source).

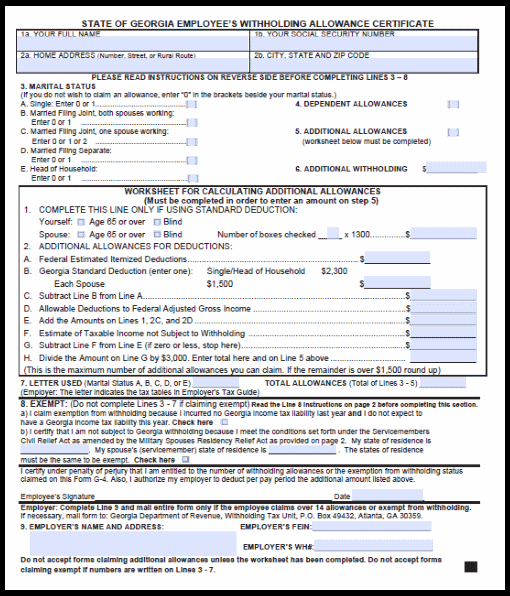

relational status

A marital withholding form can simplify your life and help your spouse. Furthermore, the amount of money you may deposit in the bank will pleasantly be awestruck. Knowing which of the many possibilities you’re most likely to decide is the biggest challenge. You must be cautious in when you make a decision. Making the wrong choice could cause you to pay a steep price. But if you follow it and pay attention to the directions, you shouldn’t run into any problems. If you’re fortunate, you might even make some new friends on your travels. Today is the anniversary date of your wedding. I’m sure you’ll be in a position to leverage this against them to obtain the elusive wedding ring. You’ll want the assistance from a certified tax expert to complete it correctly. A little amount can create a lifetime of wealth. Information on the internet is readily available. Trustworthy tax preparation companies like TaxSlayer are one of the most useful.

The number of withholding allowances claimed

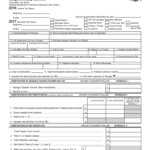

When you fill out Form W-4, you should specify the number of withholding allowances you want to claim. This is important because the tax withheld will affect how much is taken from your pay check.

There are a variety of factors that can determine the amount that you can claim for allowances. You may also be eligible for higher allowances, based on how much you earn. If you earn a high amount it could be possible to receive higher amounts.

It could save you a lot of money by choosing the correct amount of tax deductions. Additionally, you may even receive a tax refund if your tax return for income has been completed. But be sure to choose your method carefully.

In every financial decision, you should conduct your own research. Calculators are useful to figure out the amount of withholding allowances that are required to be made. You may also talk to an expert.

Sending specifications

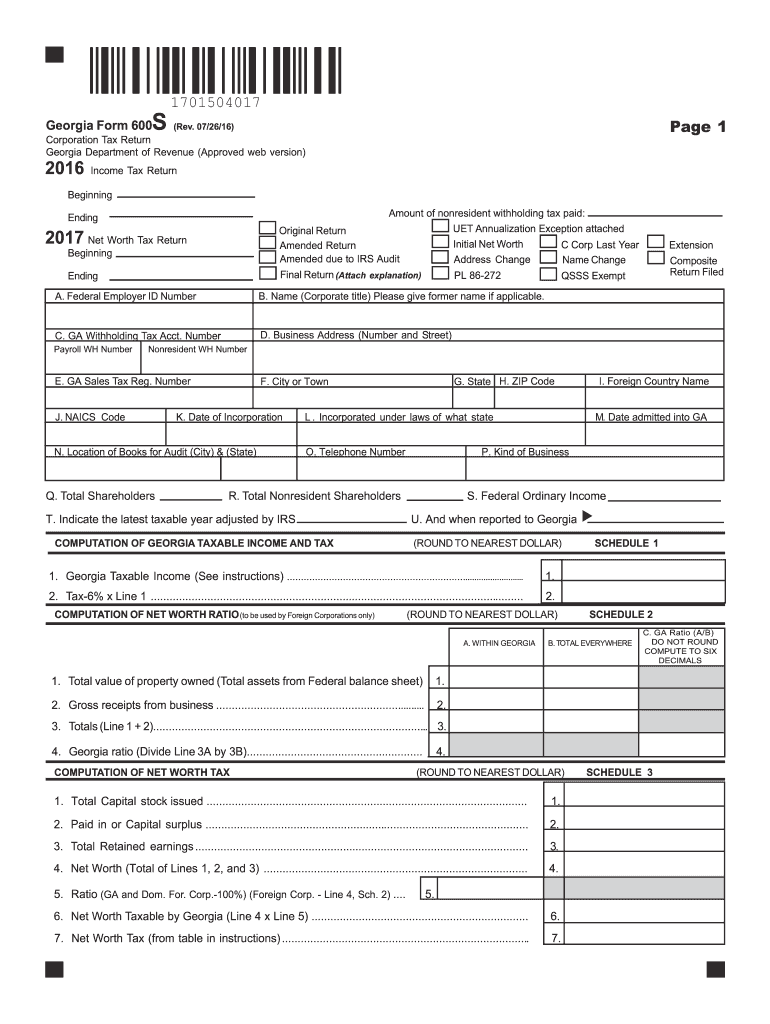

Employers are required to report the company who withholds tax from their employees. Some of these taxes may be filed with the IRS by submitting forms. A withholding tax reconciliation, an annual tax return for quarterly filing, as well as an annual tax return are all examples of other paperwork you may be required to submit. Here are some information on the different types of withholding tax forms as well as the filing deadlines.

Tax returns withholding may be required to prove income such as bonuses, salary, commissions and other income. You could also be eligible to receive reimbursement of taxes withheld if you’re employees received their wages on time. It is important to keep in mind that some of these taxes are local taxes. There are also unique withholding techniques that can be used under certain conditions.

According to IRS regulations Electronic filings of tax withholding forms are required. It is mandatory to include your Federal Employer ID Number when you file to your tax return for national income. If you don’t, you risk facing consequences.