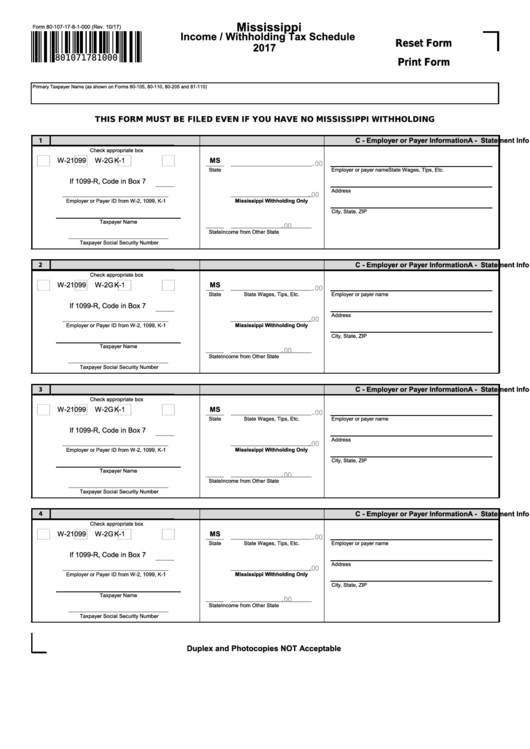

Withholding Tax Forms For Mississippi – There are many reasons someone might decide to file an application for withholding. The reasons include the need for documentation as well as exemptions from withholding, as well as the amount of requested withholding allowances. There are a few important things to keep in mind regardless of why the person fills out a form.

Exemptions from withholding

Non-resident aliens are required to file Form 1040–NR at least once per calendar year. You could be eligible to submit an exemption form from withholding if you meet all the criteria. The exemptions you will find here are yours.

The first step in submitting Form 1040 – NR is to attach Form 1042 S. The form lists the amount that is withheld by the tax authorities for federal income tax reporting for tax reporting purposes. It is important to enter the correct information when filling out the form. The information you provide may not be disclosed and result in one person being treated differently.

The non-resident alien tax withholding rate is 30 percent. Non-resident aliens may be qualified for an exemption. This happens if your tax burden is less than 30%. There are numerous exemptions. Some of them are intended to be used by spouses, while some are intended to be used by dependents such as children.

The majority of the time, a refund is offered for the chapter 4 withholding. Refunds are permitted under Sections 1471-1474. Refunds are provided by the withholding agent. This is the person responsible for withholding the tax at the source.

Relational status

A valid marital status withholding can make it simpler for you and your spouse to complete your tasks. The bank may be surprised by the amount of money you’ve deposited. The problem is deciding what option to choose. There are some things you should not do. It can be expensive to make the wrong decision. You won’t have any issues If you simply adhere to the instructions and pay attention. If you’re lucky, you may be able to make new friends during your trip. Since today is the date of your wedding anniversary. I’m sure you’ll be in a position to leverage this against them in order to acquire that wedding ring you’ve been looking for. To do this properly, you’ll require assistance of a certified Tax Expert. The tiny amount is worth it for a life-long wealth. It is a good thing that you can access plenty of information on the internet. TaxSlayer is a trusted tax preparation company.

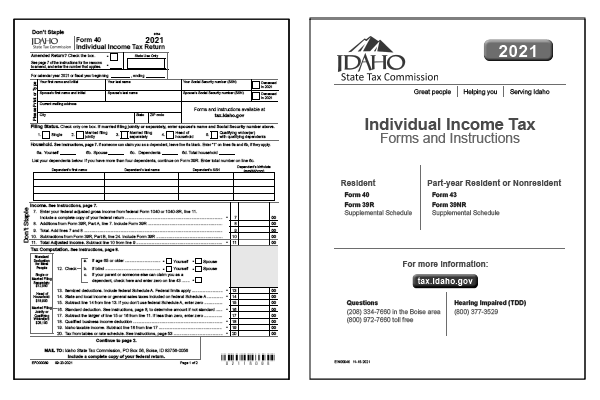

Amount of withholding allowances claimed

The Form W-4 must be filled in with the amount of withholding allowances that you wish to be able to claim. This is critical since your wages could be affected by the amount of tax you pay.

You could be eligible to apply for an exemption on behalf of the head of your household if you are married. Your income can impact how many allowances are available to you. If you earn a high amount it could be possible to receive more allowances.

It could save you lots of money by determining the right amount of tax deductions. Refunds could be possible if you file your tax return on income for the year. You need to be careful when it comes to preparing this.

Do your research the same way you would with any other financial choice. Calculators are available to aid you in determining the amount of withholding allowances must be claimed. A specialist could be a good alternative.

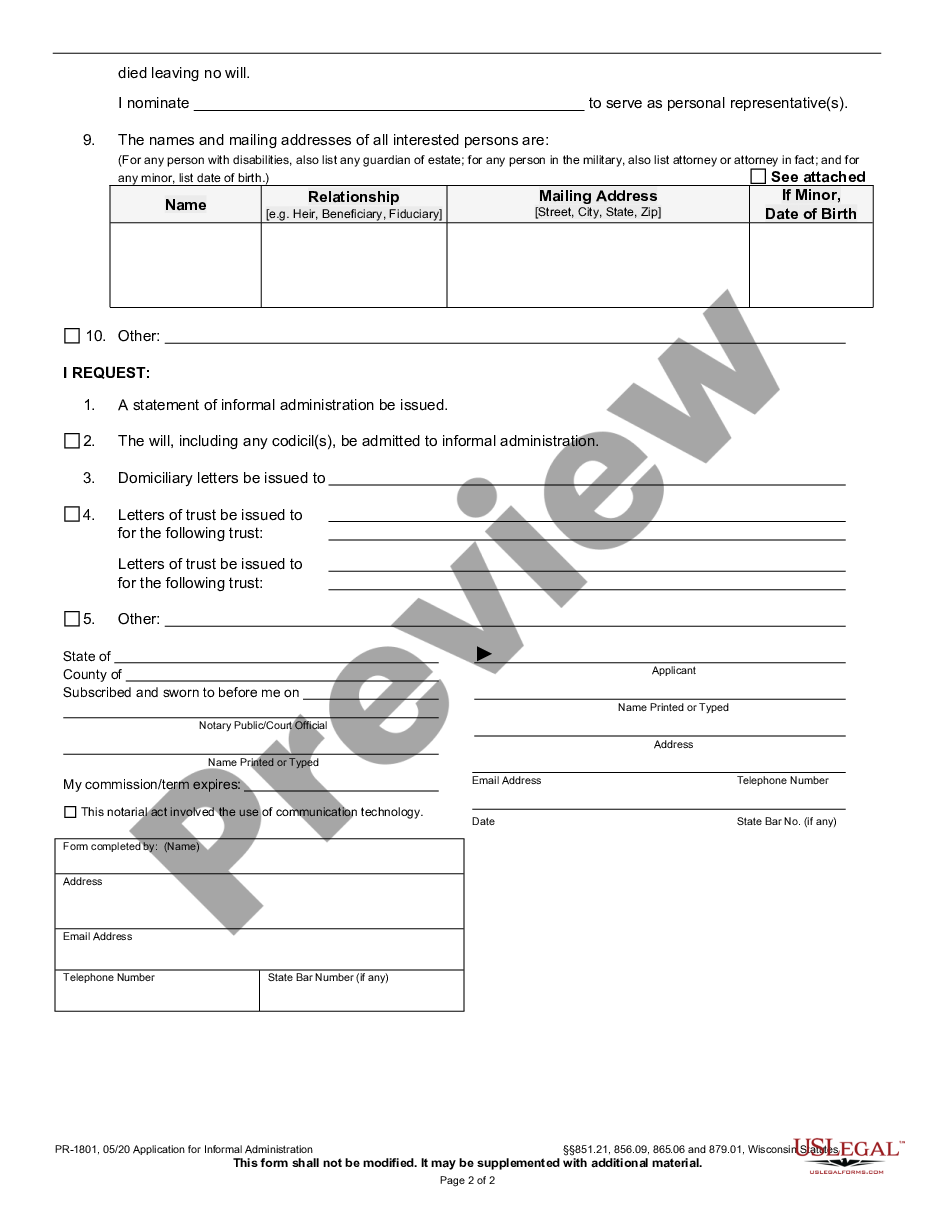

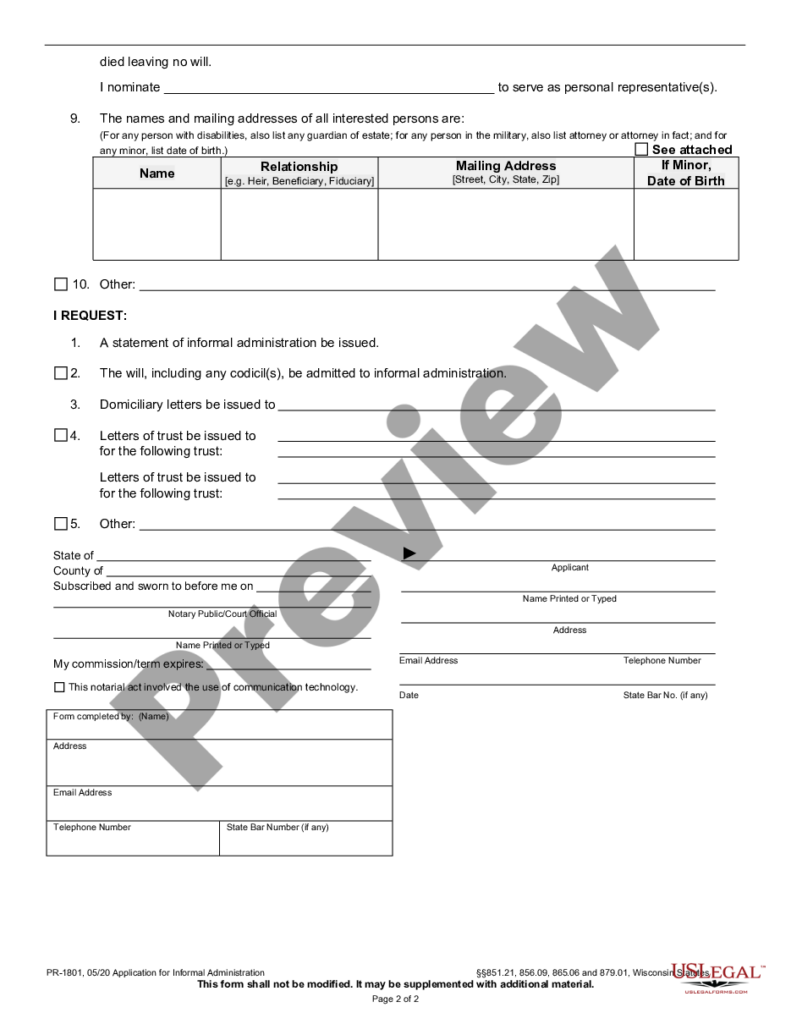

Specifications for filing

Employers are required to pay withholding taxes to their employees and then report the amount. In the case of a small amount of these taxes, you can provide documentation to the IRS. There are additional forms you might need for example, the quarterly tax return or withholding reconciliation. Below are information on the various tax forms for withholding and the deadlines for each.

To be eligible to receive reimbursement for tax withholding on pay, bonuses, commissions or other revenue received from your employees, you may need to submit withholding tax return. In addition, if you paid your employees on time, you could be eligible to receive reimbursement for taxes withheld. The fact that some of these taxes are county taxes must also be noted. There are also unique withholding methods that are used in specific circumstances.

Electronic filing of withholding forms is mandatory according to IRS regulations. The Federal Employer Identification Number should be included when you point your national revenue tax return. If you don’t, you risk facing consequences.