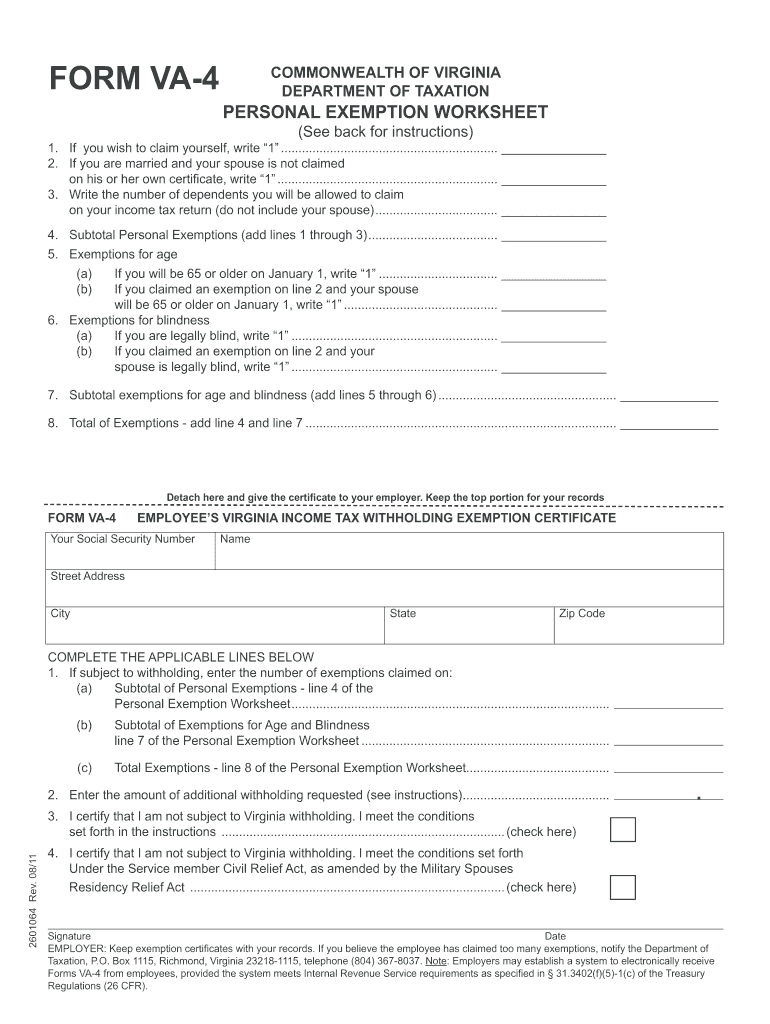

2024 Va4 Withholding Form – There are numerous reasons an individual could submit a form for withholding. Withholding exemptions, documentation requirements and the amount of the allowance required are just a few of the factors. You should be aware of these aspects regardless of your reason for choosing to submit a request form.

Exemptions from withholding

Nonresident aliens are required to submit Form 1040-NR once a year. It is possible to file an exemption form for withholding tax in the event that you meet all criteria. This page lists the exclusions.

To submit Form 1040-NR, the first step is to attach Form 1042S. The form lists the amount that is withheld by the withholding agencies for federal income tax reporting for tax reporting purposes. Make sure you enter the correct information as you fill out the form. This information may not be given and result in one person being treated differently.

The non-resident alien withholding rate is 30 percent. An exemption from withholding may be possible if you’ve got a an income tax burden of less than 30 percent. There are many exemptions. Some of them are only available to spouses or dependents such as children.

Generally, withholding under Chapter 4 gives you the right to the right to a refund. As per Sections 1471 to 1474, refunds are granted. These refunds are made by the withholding agent (the person who withholds tax at the source).

Relational status

An appropriate marital status that is withheld can help you and your spouse to complete your tasks. Additionally, the quantity of money you can put in the bank will pleasantly surprise you. It is difficult to decide which one of the options you’ll choose. There are some things you should avoid doing. There are a lot of costs when you make a bad choice. If you stick to it and follow the directions, you shouldn’t run into any problems. If you’re fortunate, you might even make acquaintances while traveling. Today is the anniversary. I’m hoping you’ll use it against them to secure that elusive diamond. To do this properly, you’ll require the assistance of a tax expert who is certified. It’s worthwhile to accumulate wealth over the course of your life. You can get a ton of information online. TaxSlayer and other reputable tax preparation companies are some of the best.

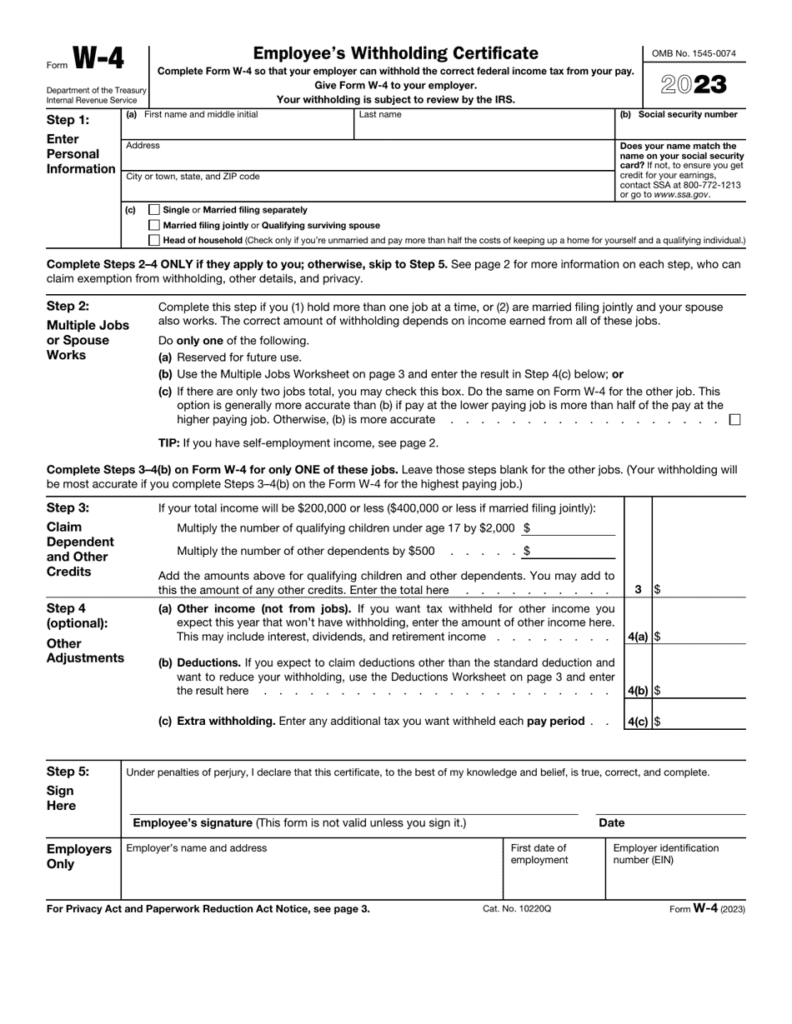

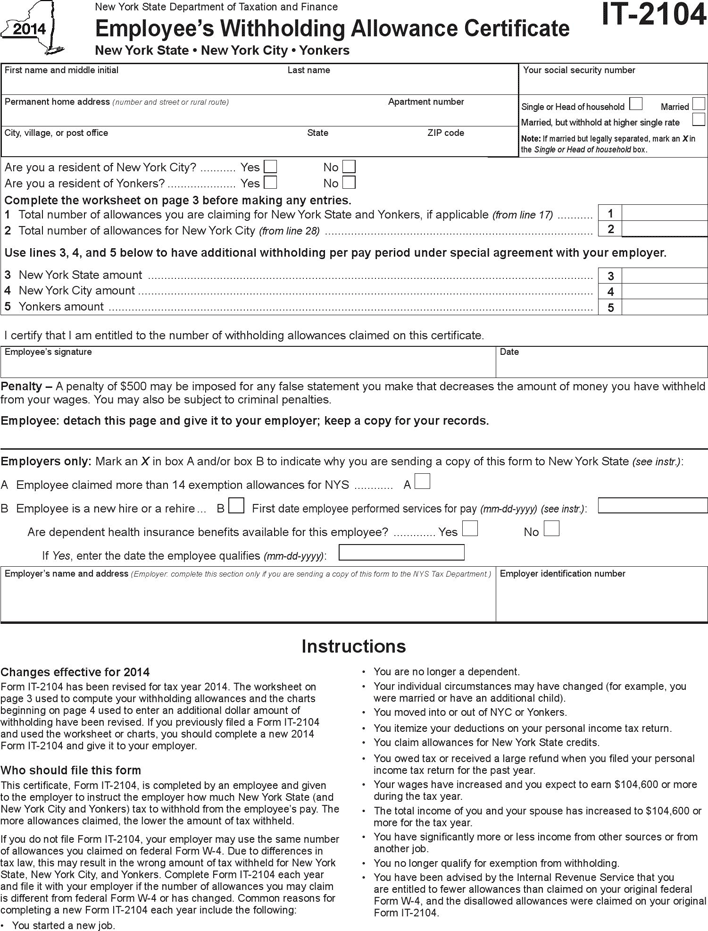

The amount of withholding allowances claimed

The Form W-4 must be filled in with the amount of withholding allowances you wish to be able to claim. This is crucial as it will impact the amount of tax you get from your wages.

You could be eligible to request an exemption for your head of household if you are married. Your income also determines how much allowances you’re entitled to. You can apply for a greater allowance if you earn a significant amount of money.

Making the right choice of tax deductions might save you from a large tax payment. In reality, if you submit your annual income tax return, you may even receive a refund. However, be careful about how you approach the tax return.

Similar to any financial decision, you must do your research. Calculators can assist you in determining the amount of withholding that should be requested. A specialist might be a viable option.

Specifications to be filed

Employers must take withholding tax from their employees and report it. For some taxes you can submit paperwork to the IRS. You might also need additional documentation such as the reconciliation of your withholding tax or a quarterly tax return. Here’s some details about the various tax forms and when they need to be filed.

To be qualified for reimbursement of withholding taxes on the pay, bonuses, commissions or any other earnings received from your employees You may be required to file a tax return for withholding. In addition, if you pay your employees on-time it could be possible to qualify for reimbursement for any taxes taken out of your paycheck. It is important to note that some of these taxes are also county taxes ought to be taken into consideration. There are also unique withholding techniques which can be utilized under certain conditions.

According to IRS rules, you have to electronically file withholding forms. When you file your national revenue tax returns, be sure to include your Federal Employee Identification Number. If you don’t, you risk facing consequences.