2024 State Tax Withholding Forms – There are many reasons why someone might choose to fill out a form for withholding form. These factors include documentation requirements and exemptions from withholding. No matter the reason for an individual to file a document it is important to remember certain points to keep in mind.

Withholding exemptions

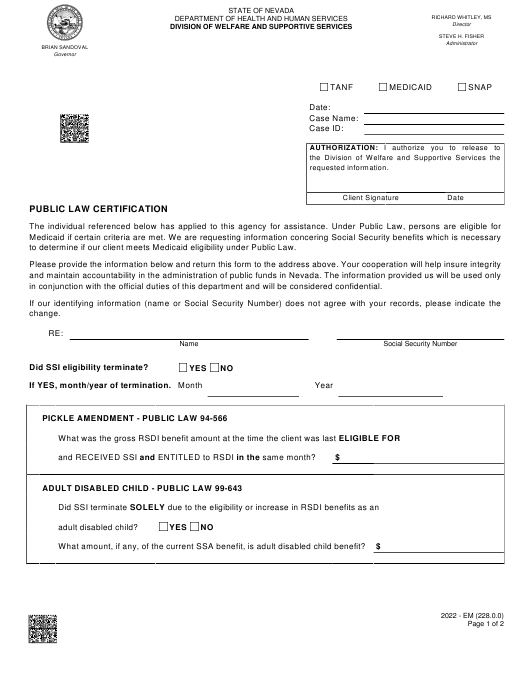

Non-resident aliens have to file Form 1040 NR once each year. If you satisfy the requirements, you could be eligible for an exemption to withholding. This page will provide all exclusions.

The first step in submitting Form 1040 – NR is attaching Form 1042 S. The form is used to report federal income tax. It details the amount of withholding that is imposed by the tax withholding agent. Make sure you fill out the form correctly. There is a possibility for one person to be treated differently if the information isn’t provided.

The tax withholding rate for non-resident aliens is 30 percent. The tax burden of your business is not to exceed 30% in order to be eligible for exemption from withholding. There are a variety of exclusions. Some are specifically designed to be used by spouses, while some are intended for use by dependents, such as children.

In general, the chapter 4 withholding allows you to receive the possibility of a refund. Refunds are granted in accordance with Sections 1400 through 1474. Refunds are given by the tax agent. The withholding agent is the individual responsible for withholding the tax at the point of origin.

Relational status

An appropriate marital status that is withheld can make it simpler for both of you to complete your tasks. Furthermore, the amount of money that you can deposit at the bank could be awestruck. It isn’t always easy to choose which of many choices is most appealing. Certain issues should be avoided. You will pay a lot when you make a bad choice. If you adhere to the rules and pay attention to the directions, you shouldn’t have any issues. If you’re lucky, you may even meet new friends while traveling. Today marks the anniversary. I’m hoping you’ll be able to take advantage of it to search for that one-of-a-kind wedding ring. If you want to get it right, you will need the aid of a qualified accountant. The small amount is well worthwhile for the life-long wealth. Fortunately, you can find plenty of information on the internet. TaxSlayer is a reputable tax preparation company.

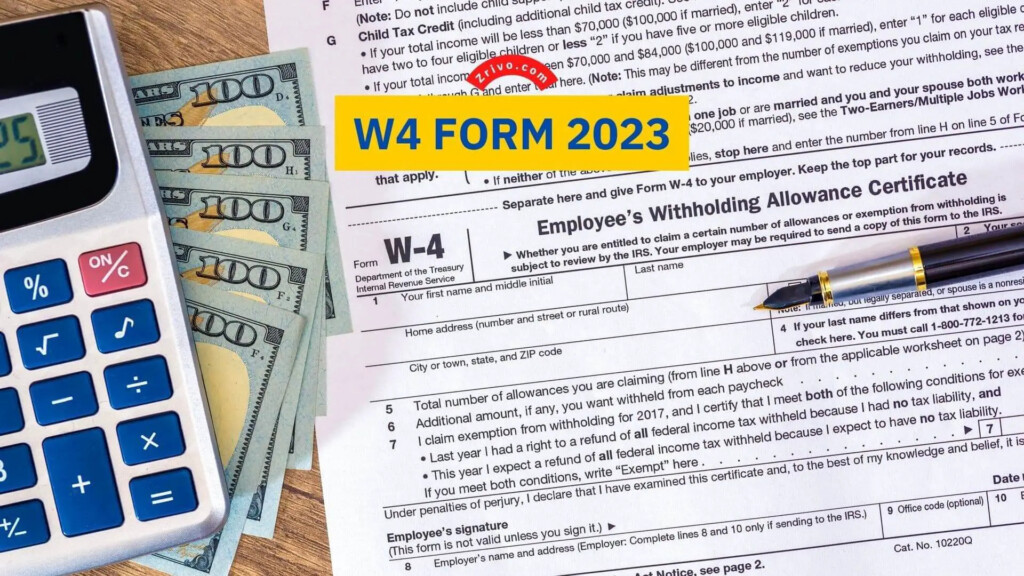

The number of withholding allowances claimed

It is important to specify the number of withholding allowances you want to claim on the form W-4 you fill out. This is crucial because your pay will be affected by the amount of tax you have to pay.

There are a variety of factors that affect the allowances requested.If you’re married as an example, you might be eligible to claim a head of household exemption. Additionally, you can claim additional allowances, based on how much you earn. If you have a high income, you may be eligible for an increased allowance.

The proper amount of tax deductions can aid you in avoiding a substantial tax cost. If you submit your annual income tax return, you may even receive a refund. But you need to pick the right method.

Conduct your own research, just as you would in any financial decision. Calculators can be utilized to figure out how many withholding allowances you should claim. In addition to a consultation with a specialist.

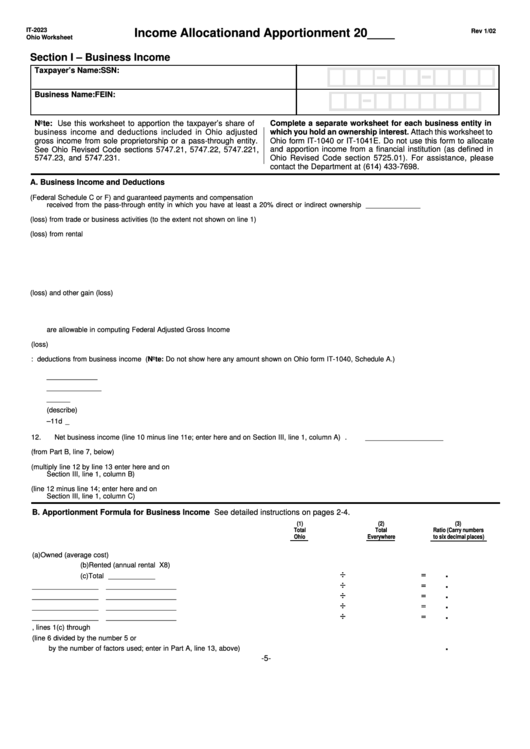

Specifications for filing

If you are an employer, you have to pay and report withholding tax from your employees. If you are taxed on a specific amount you might need to submit documentation to the IRS. You may also need additional forms that you may require for example, an annual tax return, or a withholding reconciliation. Here are the details on different withholding tax forms and the deadlines for each.

To be qualified for reimbursement of tax withholding on salary, bonus, commissions or other revenue received from your employees it is possible to submit a tax return withholding. In addition, if you pay your employees on-time it could be possible to qualify to receive reimbursement for taxes taken out of your paycheck. Remember that these taxes could be considered as local taxes. Additionally, there are unique withholding practices that can be applied under particular situations.

In accordance with IRS rules, you must electronically submit withholding forms. It is mandatory to provide your Federal Employer Identification Number when you point at your income tax return from the national tax system. If you don’t, you risk facing consequences.