2024 Nc Withholding Form – There are numerous reasons one could fill out a form for withholding. These include the need for documentation and withholding exemptions. However, if one chooses to submit a form it is important to remember a few things to keep in mind.

Exemptions from withholding

Nonresident aliens need to submit Form 1040–NR at least once per calendar year. If you fulfill the criteria, you may be able to submit an exemption from withholding form. The exemptions listed here are yours.

To submit Form 1040-NR, the first step is to attach Form 1042S. This form lists the amount that is withheld by the tax withholding authorities for federal income tax reporting purposes. It is essential to fill in exact information when you fill out the form. There is a possibility for one individual to be treated in a manner that is not correct if the information is not given.

Non-resident aliens have to pay the 30% tax withholding rate. The tax burden of your business is not to exceed 30% in order to be eligible for exemption from withholding. There are many different exemptions. Certain of them are designed for spouses, while others are meant for use by dependents like children.

Generally, withholding under Chapter 4 gives you the right to an amount of money back. Refunds are granted in accordance with Sections 1400 through 1474. Refunds are provided by the withholding agent. This is the individual responsible for withholding the tax at the point of origin.

Relational status

The work of your spouse and you is made simpler by a proper marriage status withholding form. You’ll be amazed at with the amount of money you can deposit at the bank. Choosing which of the options you’re likely to choose is the challenge. There are some things you must be aware of. Unwise decisions could lead to expensive consequences. If the rules are adhered to and you are attentive to the rules, you shouldn’t have any problems. If you’re lucky, you could meet some new friends on your trip. Today marks the anniversary of your wedding. I’m hoping they make it work against you to get you the perfect engagement ring. For a successful approach, you will need the help of a certified accountant. The little amount is enough for a life-long wealth. There are tons of online resources that can provide you with information. Trustworthy tax preparation companies like TaxSlayer are one of the most useful.

There are many withholding allowances that are being claimed

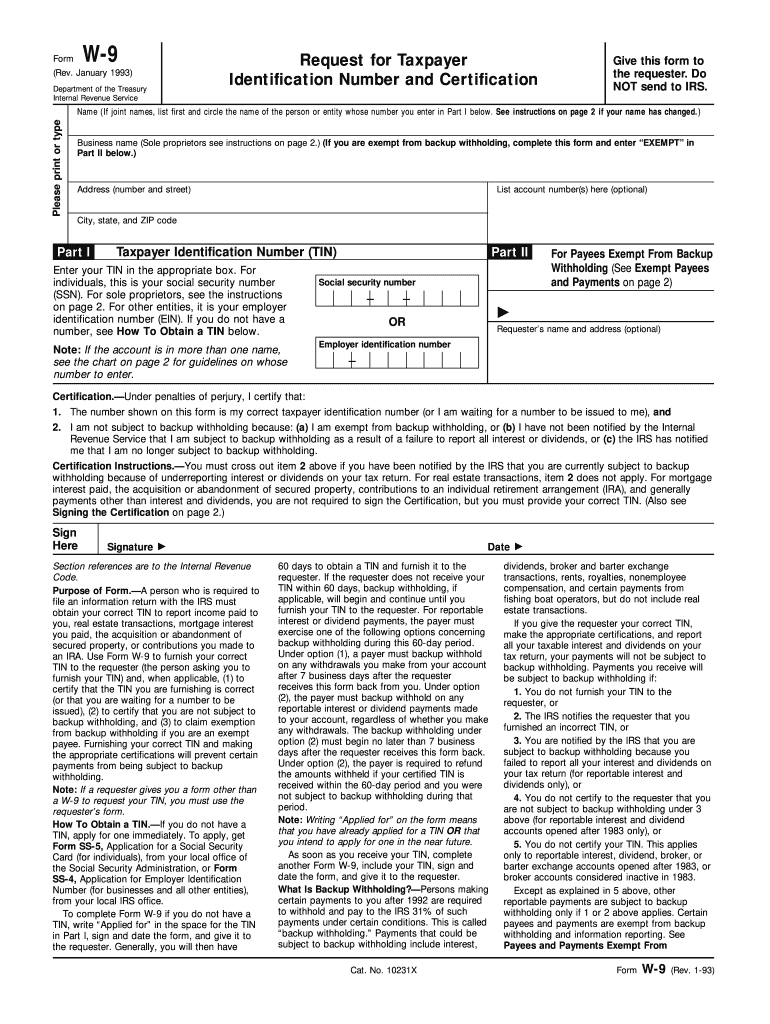

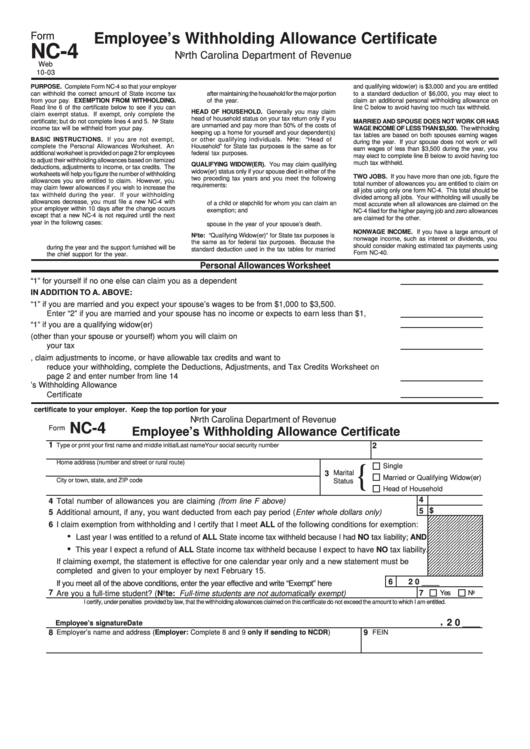

The form W-4 should be filled in with the amount of withholding allowances that you want to take advantage of. This is crucial since the tax withheld will affect the amount taken out of your paychecks.

You may be eligible to apply for an exemption on behalf of your head of household in the event that you are married. Your income can affect the number of allowances offered to you. If you earn a high amount, you might be eligible to receive more allowances.

Selecting the appropriate amount of tax deductions can allow you to avoid a significant tax payment. If you file your annual income tax return, you may even receive a refund. However, you must choose your strategy carefully.

Similar to any other financial decision, you should do your homework. Calculators can assist you in determining the number of withholdings that need to be claimed. An alternative is to speak to a professional.

Filing requirements

Withholding taxes from your employees have to be reported and collected when you’re an employer. The IRS will accept documents for some of these taxes. A tax return for the year, quarterly tax returns or tax withholding reconciliations are just a few types of documents you could require. Here are some details on the different types of tax withholding forms and the filing deadlines.

Tax returns withholding may be required for certain incomes such as bonuses, salary, commissions and other income. Additionally, if you pay your employees in time, you may be eligible to receive reimbursement for taxes withheld. Be aware that certain taxes could be considered to be local taxes. Furthermore, there are special methods of withholding that are applied under particular conditions.

Electronic submission of withholding forms is required under IRS regulations. The Federal Employer identification number should be included when you submit at your national tax return. If you don’t, you risk facing consequences.