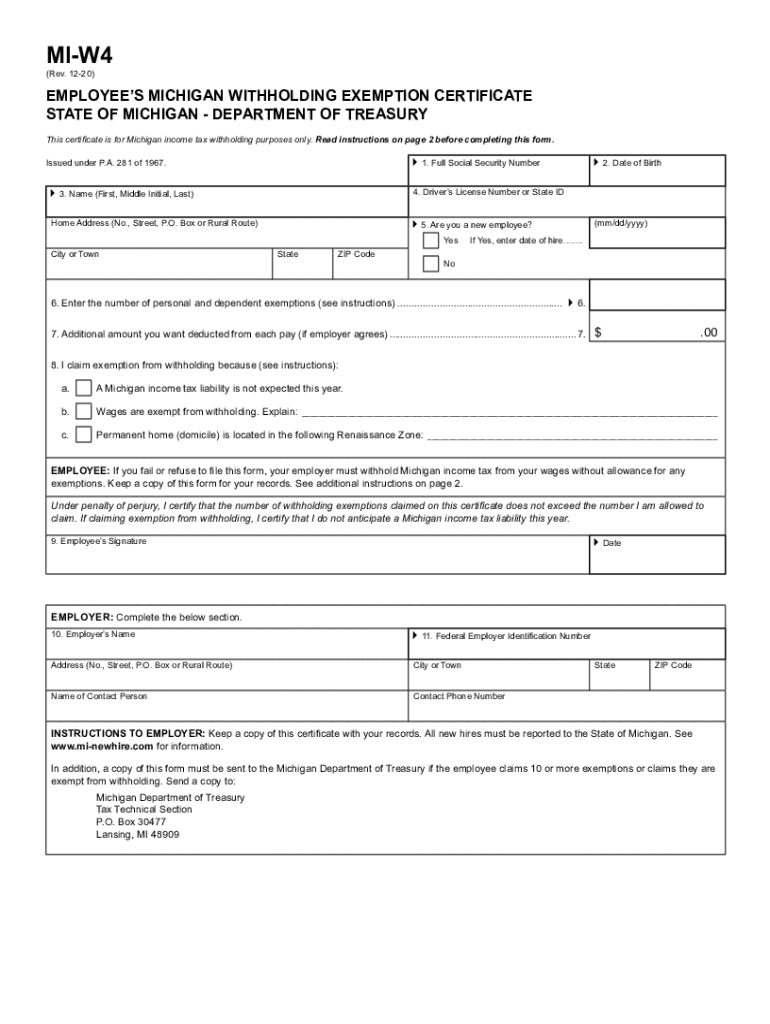

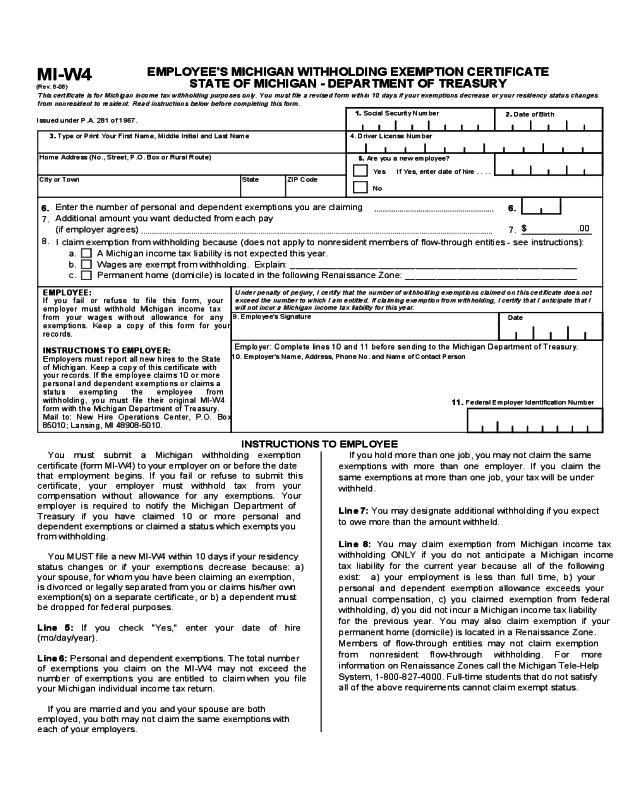

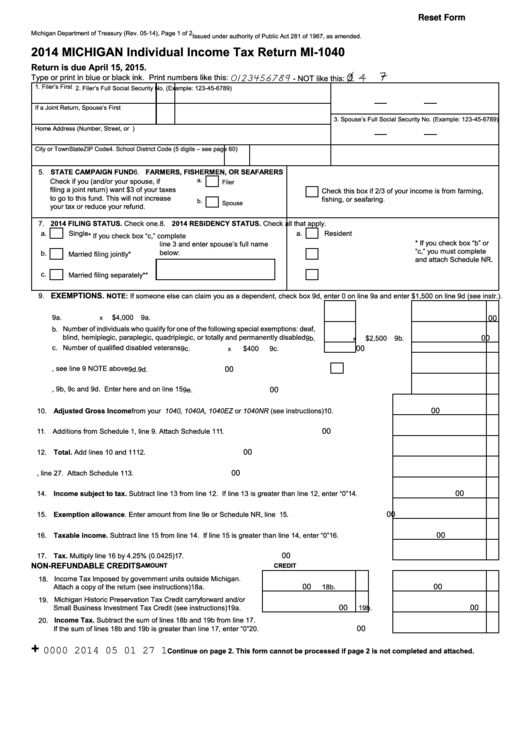

2024 Michigan Withholding Tax Forms – There are numerous reasons that a person may decide to submit a withholding application. This includes documentation requirements including withholding exemptions and the amount of withholding allowances. Whatever the reason one chooses to submit a form there are some things to keep in mind.

Withholding exemptions

Non-resident aliens are required to submit Form 1040 NR once every year. If the requirements are met, you could be eligible for an exemption from withholding. This page lists all exclusions.

When you submit Form1040-NR, attach Form 1042S. The form contains information on the withholding process carried out by the withholding agency for federal tax reporting to be used for reporting purposes. Complete the form in a timely manner. You may have to treat a specific individual if you do not provide this information.

The rate of withholding for non-resident aliens is 30%. If the tax you pay is less than 30 percent of your withholding you may qualify to receive an exemption from withholding. There are many exclusions. Certain of them apply to spouses and dependents such as children.

You may be entitled to refunds if you have violated the provisions of chapter 4. Refunds can be claimed in accordance with sections 1401, 1474 and 1475. The withholding agent, or the individual who is responsible for withholding the tax at source is responsible for making these refunds.

relational status

The work of your spouse and you is made simpler by the proper marital status withholding form. You will be pleasantly surprised at how much money you can deposit to the bank. Knowing which of the many possibilities you’re most likely to choose is the challenge. There are some things you should avoid doing. A bad decision could result in a costly loss. It’s not a problem If you simply follow the directions and be attentive. If you’re lucky, you might find some new acquaintances on the road. After all, today marks the date of your wedding anniversary. I’m hoping that you can utilize it to secure the elusive diamond. In order to complete the job correctly it is necessary to obtain the assistance from a qualified tax professional. It’s worth it to build wealth over the course of your life. You can get a lot of information online. TaxSlayer and other trusted tax preparation firms are a few of the most reliable.

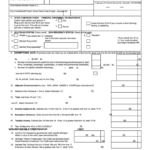

Number of claimed withholding allowances

It is important to specify the number of withholding allowances you wish to be able to claim on the form W-4 you fill out. This is important because the amount of tax you are able to deduct from your pay will be affected by how much you withhold.

The amount of allowances you are entitled to will be determined by the various aspects. For example If you’re married, you could be eligible for a head or household exemption. The amount you earn will also impact the amount of allowances you’re entitled to. If you earn a high amount you may be eligible to receive higher amounts.

A tax deduction that is appropriate for your situation could aid you in avoiding large tax obligations. A refund could be feasible if you submit your tax return on income for the current year. Be cautious when it comes to preparing this.

In any financial decision, it is important to be aware of the facts. Calculators can help determine the amount of withholding that should be requested. Alternative options include speaking with an expert.

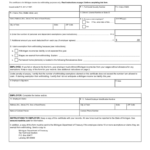

filing specifications

Withholding tax from employees need to be reported and collected if you are an employer. The IRS will accept documents to pay certain taxes. You may also need additional forms that you might need like an annual tax return, or a withholding reconciliation. Below are information on the different withholding tax forms and their deadlines.

The bonuses, salary, commissions, and other income that you receive from your employees could require you to submit tax returns withholding. Additionally, if you paid your employees in time, you may be eligible for reimbursement of taxes that were withheld. It is important to note that not all of these taxes are local taxes. There are also unique withholding strategies that can be used in specific situations.

You are required to electronically submit tax withholding forms as per IRS regulations. You must include your Federal Employer Identification Number when you submit at your income tax return from the national tax system. If you don’t, you risk facing consequences.