2024 Michigan Sales Use Withholding Form – There are many reasons why someone might choose to fill out a form for withholding. These factors include documentation requirements and exemptions from withholding. There are some things you should remember regardless of the reason the person fills out a form.

Exemptions from withholding

Non-resident aliens are required to submit Form 1040 NR at least once per year. If the requirements are met, you may be eligible to request an exemption from withholding. This page will list all exclusions.

The first step to submitting Form 1040 – NR is to attach Form 1042 S. The form provides information about the withholding that is performed by the withholding agency to report federal income tax to be used for reporting purposes. Make sure you enter the correct information as you fill in the form. One person may be treated if this information is not supplied.

Non-resident aliens are subject to a 30% withholding tax. Tax burdens must not exceed 30% to be exempt from withholding. There are a variety of exclusions. Some of them are for spouses, dependents, or children.

In general, the chapter 4 withholding entitles you to a refund. Refunds are granted in accordance with Sections 1400 through 1474. These refunds are made by the withholding agent (the person who is responsible for withholding tax at the source).

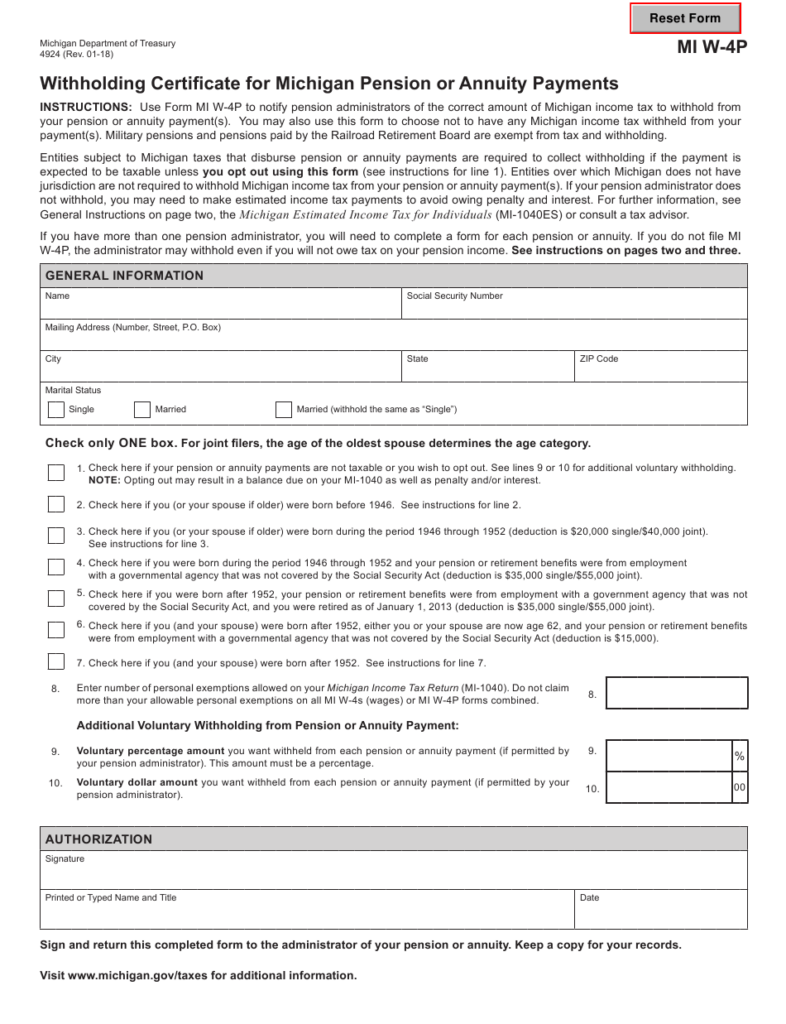

Status of relationships

An appropriate marital status that is withheld will make it easier for both of you to accomplish your job. Furthermore, the amount of money you can put in the bank will pleasantly be awestruck. The challenge is in deciding which of the numerous options to select. You should be careful with what you choose to do. It will be expensive to make the wrong decision. But if you adhere to the instructions and be alert for any pitfalls and pitfalls, you’ll be fine. If you’re fortunate, you might even make some new friends while traveling. Today is your birthday. I’m hoping you’ll be able to utilize it against them to locate that perfect engagement ring. To complete the task correctly it is necessary to obtain the assistance of a certified tax expert. A lifetime of wealth is worth that tiny amount. You can get plenty of information on the internet. TaxSlayer is a trusted tax preparation business is one of the most useful.

Number of withholding allowances that are claimed

In submitting Form W-4 you should specify the number of withholdings allowances you would like to claim. This is essential since the amount of tax taken from your paychecks will be affected by how much you withhold.

You may be eligible to claim an exemption for your spouse in the event that you are married. You may also be eligible for higher allowances depending on how much you earn. If you earn a high amount you may be eligible to receive a higher allowance.

Selecting the appropriate amount of tax deductions could help you avoid a hefty tax bill. The possibility of a refund is feasible if you submit your tax return on income for the year. You need to be careful when it comes to preparing this.

As with any financial decision you make, it is important to research the subject thoroughly. To figure out the amount of withholding allowances to be claimed, you can use calculators. You can also speak to a specialist.

Specifications to be filed

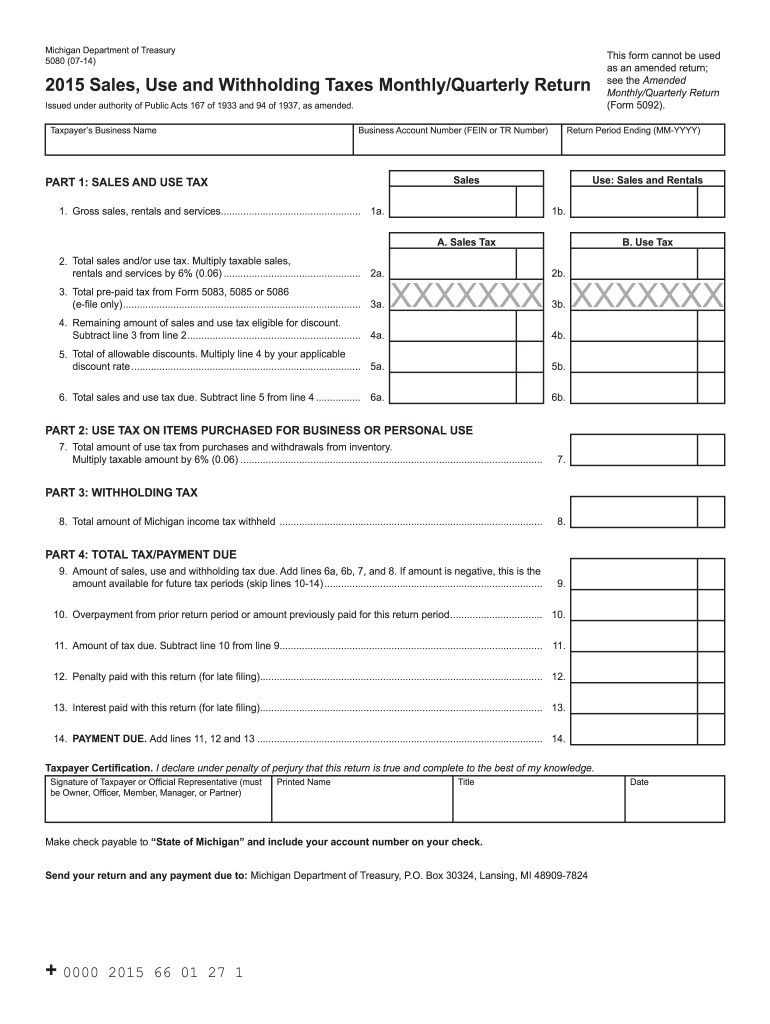

If you’re an employer, you must collect and report withholding taxes on your employees. Some of these taxes can be reported to the IRS by submitting forms. Additional documents that you could be required to file include an withholding tax reconciliation and quarterly tax returns and the annual tax return. Here’s some information about the different forms of withholding tax categories as well as the deadlines for filing them.

In order to be qualified for reimbursement of withholding tax on the compensation, bonuses, salary or other income earned by your employees You may be required to submit a tax return withholding. You may also be eligible to get reimbursements of taxes withheld if you’re employees received their wages on time. Be aware that certain taxes are taxes imposed by the county, is important. Furthermore, there are special withholding practices that can be implemented in specific situations.

In accordance with IRS rules, you have to electronically file withholding forms. When filing your national revenue tax returns ensure that you provide the Federal Employee Identification Number. If you don’t, you risk facing consequences.

Gallery of 2024 Michigan Sales Use Withholding Form

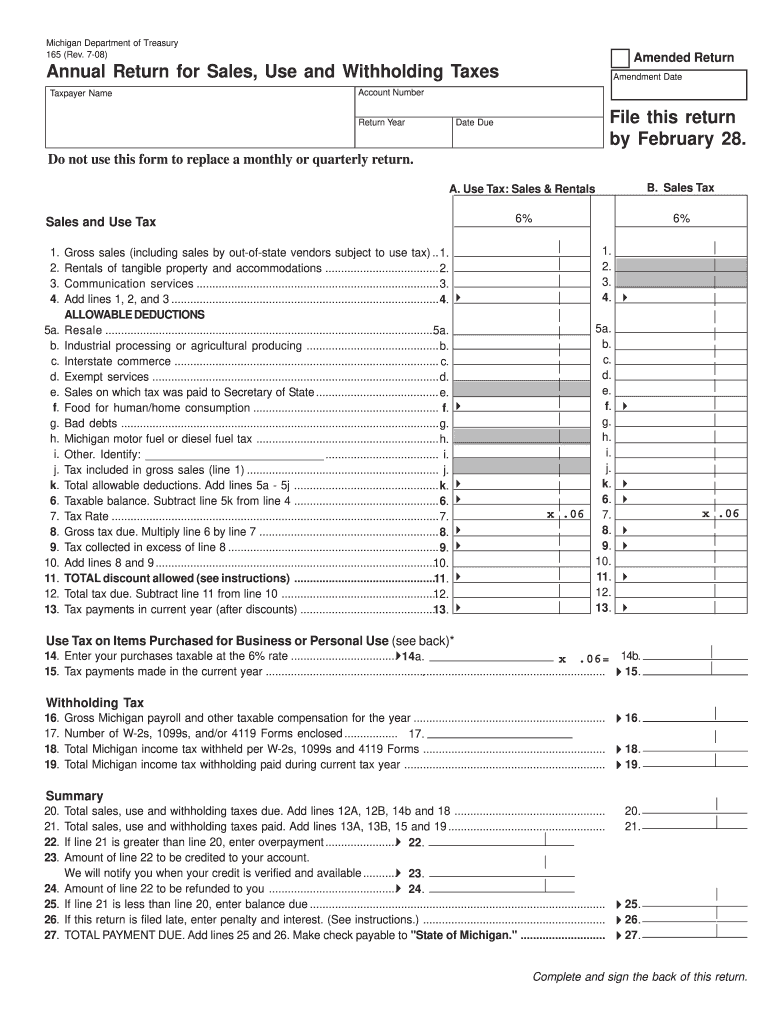

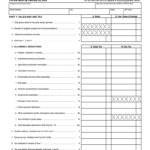

Michigan Sales Use And Withholding Tax Form 5081 WithholdingForm

Michigan Sales Use And Withholding Tax Forms And Instructions 2022