2024 Mass Withholding Form – There are a variety of reasons one might choose to fill out withholding forms. These include documents required, the exclusion of withholding, and the requested withholding allowances. Whatever the reason behind a person to file a document, there are certain things you must keep in mind.

Withholding exemptions

Nonresident aliens are required once every year to file Form1040-NR. If the requirements meet, you may be eligible to apply for an exemption from withholding. You will discover the exclusions accessible to you on this page.

To submit Form 1040-NR, attach Form 1042-S. The form lists the amount that is withheld by the withholding agencies for federal income tax reporting to be used for reporting purposes. Complete the form in a timely manner. This information might not be given and result in one person being treated differently.

The rate of withholding for non-resident aliens is 30%. Your tax burden should not exceed 30% in order to be eligible for exemption from withholding. There are many exemptions. Some are only for spouses and dependents such as children.

You can claim a refund if you violate the terms of chapter 4. Refunds are granted under Sections 1400 to 1474. The person who is the withholding agent or the person who withholds the tax at source is the one responsible for distributing these refunds.

Relational status

The marital withholding form is a good way to make your life easier and assist your spouse. You’ll be amazed by the amount you can deposit at the bank. It is difficult to decide which of the many options you’ll pick. There are some things you must be aware of. There are a lot of costs when you make a bad decision. If you adhere to the directions and adhere to them, there won’t be any problems. If you’re lucky enough, you might find some new acquaintances while traveling. Today is the anniversary. I’m sure you’ll take advantage of it to locate that perfect wedding ring. You’ll want the assistance of a certified tax expert to finish it properly. The little amount is enough for a lifetime of wealth. There is a wealth of information on the internet. TaxSlayer is a trusted tax preparation firm.

the number of claims for withholding allowances

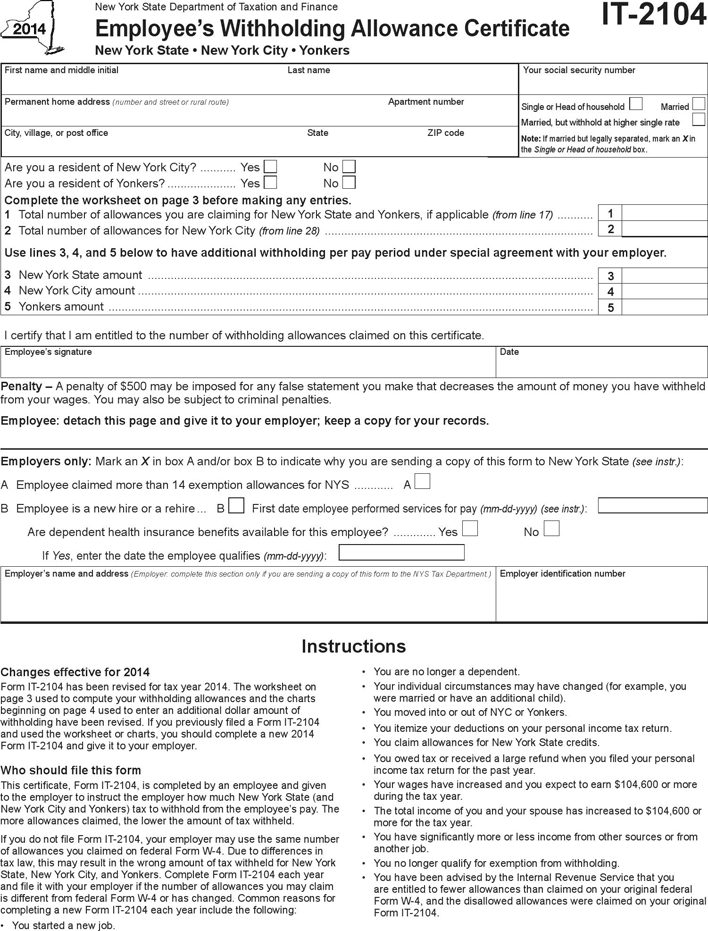

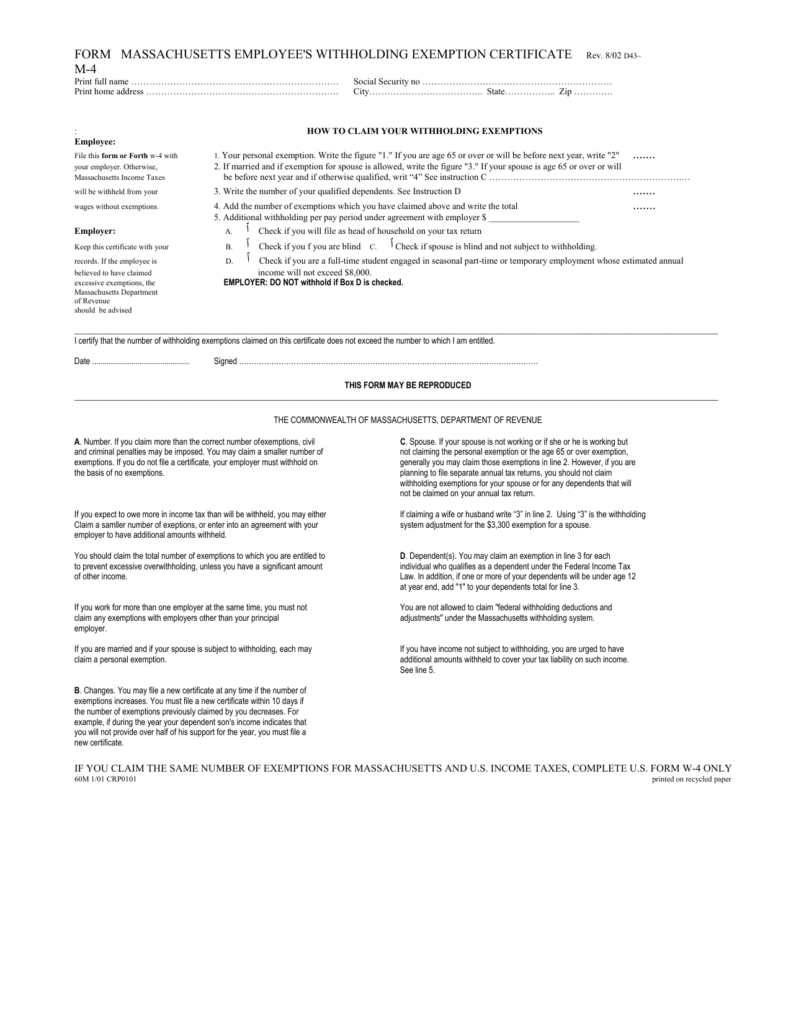

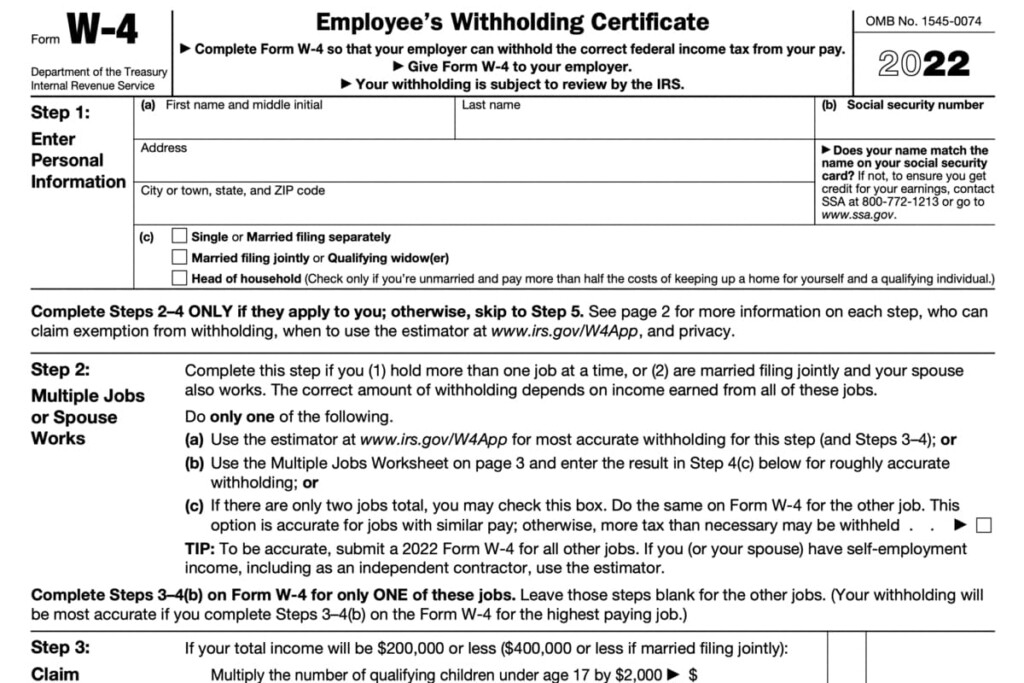

On the W-4 form you fill out, you need to declare how many withholding allowances are you seeking. This is essential as the tax withheld will affect how much is taken from your paychecks.

A variety of factors influence the allowances requested.If you’re married, for instance, you might be eligible for an exemption for head of household. You can also claim more allowances based on the amount you earn. If you make a lot of money, you could be eligible for a higher allowance.

You could save a lot of money by selecting the appropriate amount of tax deductions. It is possible to receive a refund if you file the annual tax return. You need to be careful when it comes to preparing this.

You must do your homework the same way you would for any financial decision. To figure out the amount of tax withholding allowances that need to be claimed, you can utilize calculators. As an alternative to a consultation with an expert.

Sending specifications

If you’re an employer, you have to collect and report withholding taxes on your employees. In the case of a small amount of these taxes, you may submit paperwork to IRS. There are other forms you may require, such as a quarterly tax return or withholding reconciliation. Here are some details on the different types of tax withholding forms and the filing deadlines.

To be eligible to receive reimbursement for withholding taxes on the compensation, bonuses, salary or other income that your employees receive it is possible to submit withholding tax return. You may also be eligible to be reimbursed for tax withholding if your employees received their wages on time. Remember that these taxes may be considered to be taxation by the county. There are also unique withholding rules that can be utilized in certain situations.

The IRS regulations require you to electronically file withholding documents. If you are submitting your tax return for national revenue be sure to include the Federal Employer Identification number. If you don’t, you risk facing consequences.