2024 Louisiana Withholding Form – There are many reasons someone might decide to file a withholding application. Withholding exemptions, documentation requirements as well as the quantity of the allowance required are just a few of the factors. Whatever the motive someone has to fill out the Form there are some points to be aware of.

Withholding exemptions

Nonresident aliens are required to submit Form 1040-NR at least once per year. If you satisfy these requirements, you could be eligible to receive exemptions from the withholding form. The exclusions are available on this page.

For Form 1040-NR submission the first step is attaching Form 1042S. For federal income tax reporting purposes, this form provides the withholding made by the tax agency that handles withholding. Make sure you enter the right information when you fill in the form. You may have to treat a specific person for not providing this information.

Non-resident aliens are subjected to 30 percent withholding. The tax burden of your business is not to exceed 30% in order to be eligible for exemption from withholding. There are a variety of exclusions. Some are specifically for spouses, and dependents, like children.

In general, the chapter 4 withholding allows you to receive the possibility of a refund. Refunds can be made according to Sections 1400 through 1474. These refunds are provided by the withholding agent (the person who is responsible for withholding tax at source).

Relational status

An official marriage status withholding form will help both of you get the most out of your time. The bank might be shocked by the amount you’ve deposited. The problem is deciding which one of the many options to choose. Certain issues should be avoided. A bad decision could cause you to pay a steep price. If you adhere to the guidelines and adhere to them, there won’t be any issues. If you’re lucky enough to meet some new friends while on the road. Today marks the anniversary of your wedding. I’m hoping that you can leverage it to secure that dream wedding ring. It is best to seek the advice of a certified tax expert to ensure you’re doing it right. The small amount is well worth it for a lifetime of wealth. You can get a lot of information on the internet. TaxSlayer is a reputable tax preparation firm.

The amount of withholding allowances claimed

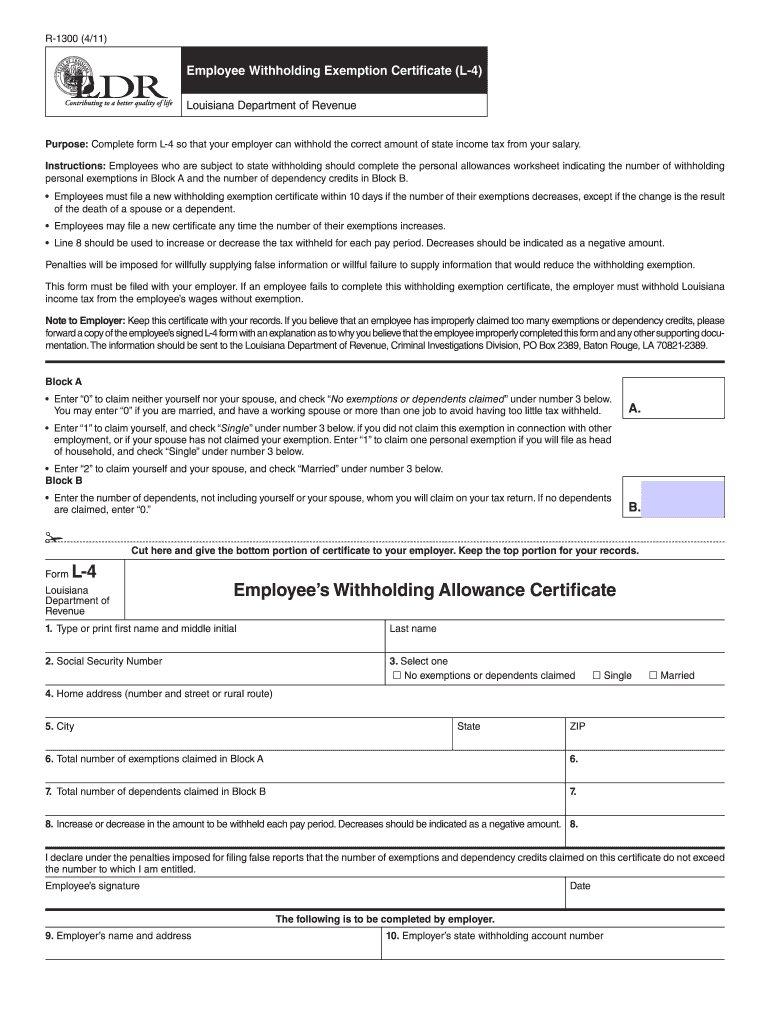

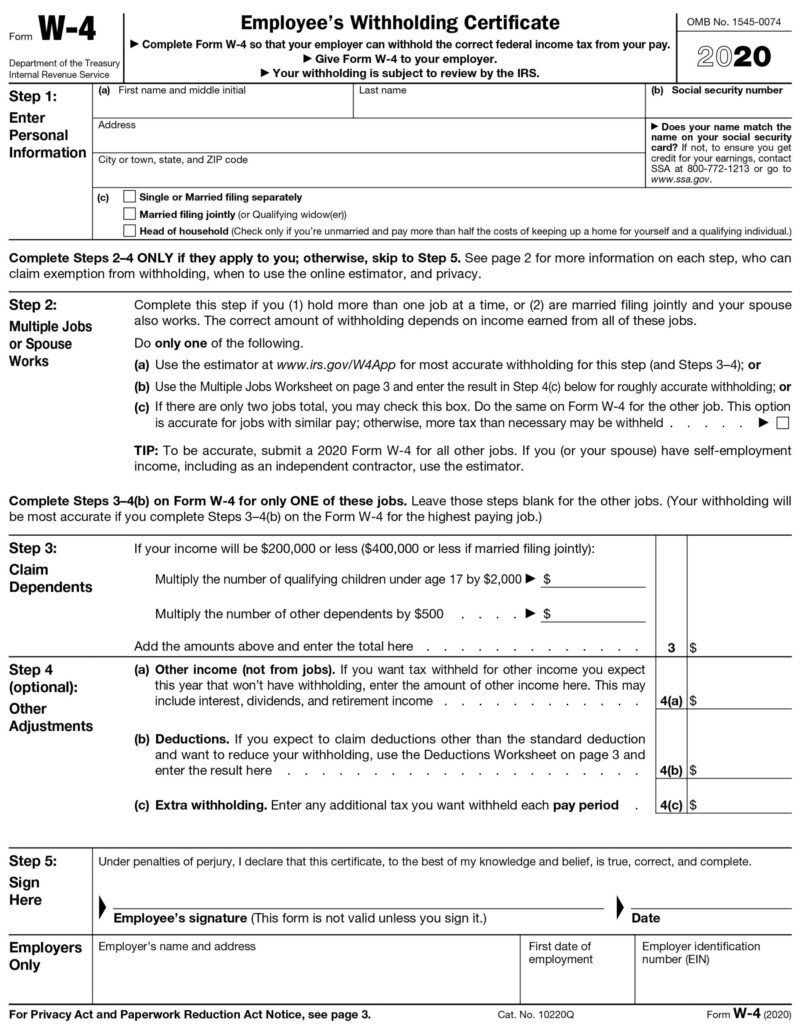

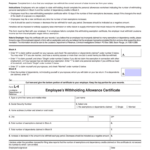

It is crucial to indicate the amount of withholding allowances you would like to claim on the form W-4. This is crucial because your pay will be affected by the amount of tax that you pay.

There are a variety of factors that affect the amount of allowances requested.If you’re married as an example, you might be eligible to claim a head of household exemption. Your income also determines how much allowances you’re eligible to claim. If you have high income, you might be eligible to receive higher amounts.

Tax deductions that are appropriate for your situation could allow you to avoid tax payments. In addition, you could be eligible for a refund when your tax return for income has been completed. But , you have to choose your strategy carefully.

In any financial decision, you should conduct your own research. Calculators can be utilized to determine how many withholding allowances must be made. In addition contact a specialist.

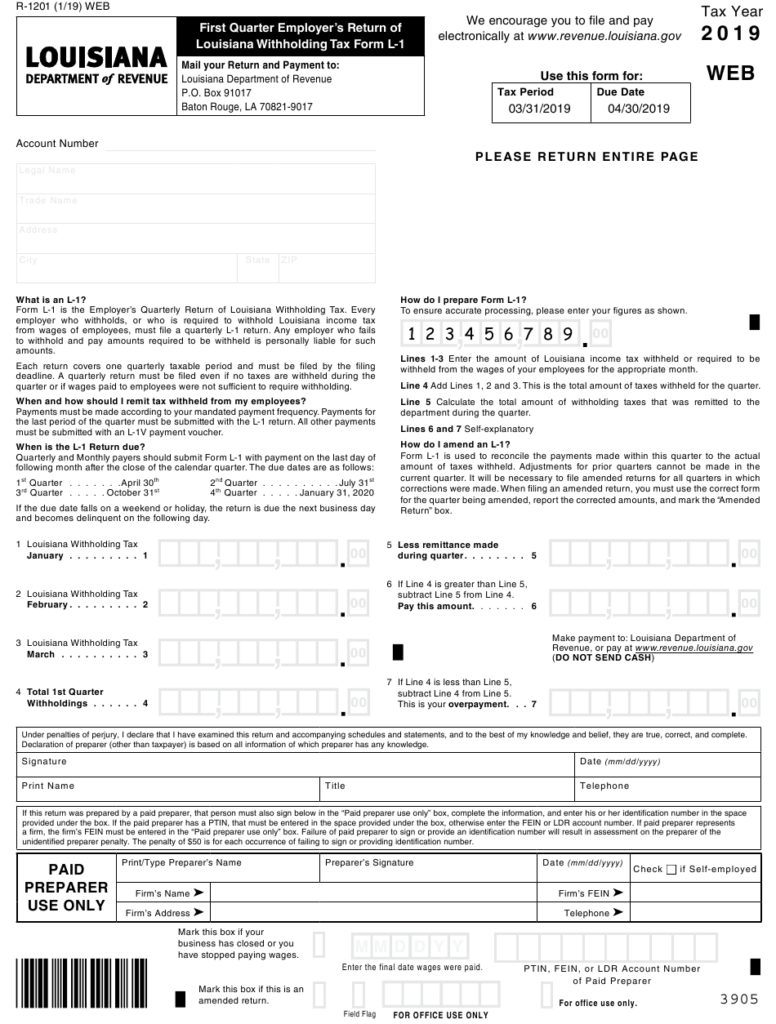

Specifications for filing

If you are an employer, you are required to collect and report withholding taxes on your employees. For a limited number of the taxes, you are able to submit paperwork to IRS. There are other forms you may require for example, the quarterly tax return or withholding reconciliation. Here’s some information about the various withholding tax form categories as well as the deadlines for the submission of these forms.

You might have to file tax returns withholding for the income you receive from employees, like bonuses and commissions or salaries. In addition, if you pay your employees on time you may be eligible to receive reimbursement for taxes taken out of your paycheck. Remember that these taxes could also be considered local taxes. There are special methods of withholding that are applicable in specific circumstances.

According to IRS regulations, electronic filing of forms for withholding are required. You must provide your Federal Employer Identification Number when you submit at your income tax return from the national tax system. If you don’t, you risk facing consequences.