2024 Kansas Withholding Form – There are a variety of reasons why one could fill out the form to request withholding. These factors include the document requirements, exclusions from withholding as well as the withholding allowances. No matter the reason for an individual to file an application, there are certain things you must keep in mind.

Exemptions from withholding

Non-resident aliens are required to file Form 1040-NR at least once per year. However, if your requirements are met, you could be eligible for an exemption from withholding. There are exemptions accessible to you on this page.

To complete Form 1040-NR, add Form 1042-S. This form is a record of the withholdings that the agency makes. When filling out the form make sure you fill in the exact details. One individual may be treated if the information is not supplied.

The non-resident alien withholding tax is 30%. An exemption from withholding may be possible if you’ve got a the tax burden lower than 30 percent. There are many exemptions offered. Some are for spouses and dependents, like children.

Generally, you are entitled to a reimbursement in accordance with chapter 4. Refunds are granted under sections 1401, 1474, and 1475. Refunds are given to the withholding agent the person who withholds the tax from the source.

Relational status

Your and your spouse’s job can be made easier with a valid marriage status withholding form. You’ll be amazed by the amount you can deposit to the bank. It can be difficult to choose which of many choices is the most attractive. There are some things you should be aware of. Making the wrong choice could cost you dearly. However, if you adhere to the guidelines and be alert for any potential pitfalls, you won’t have problems. If you’re lucky enough, you might find some new friends while on the road. Today is your birthday. I’m sure you’ll be able to make use of it to find that perfect ring. In order to complete the job correctly it is necessary to get the help of a certified tax expert. A modest amount of money can create a lifetime of wealth. There are a myriad of online resources that provide information. Tax preparation firms that are reputable, such as TaxSlayer are among the most helpful.

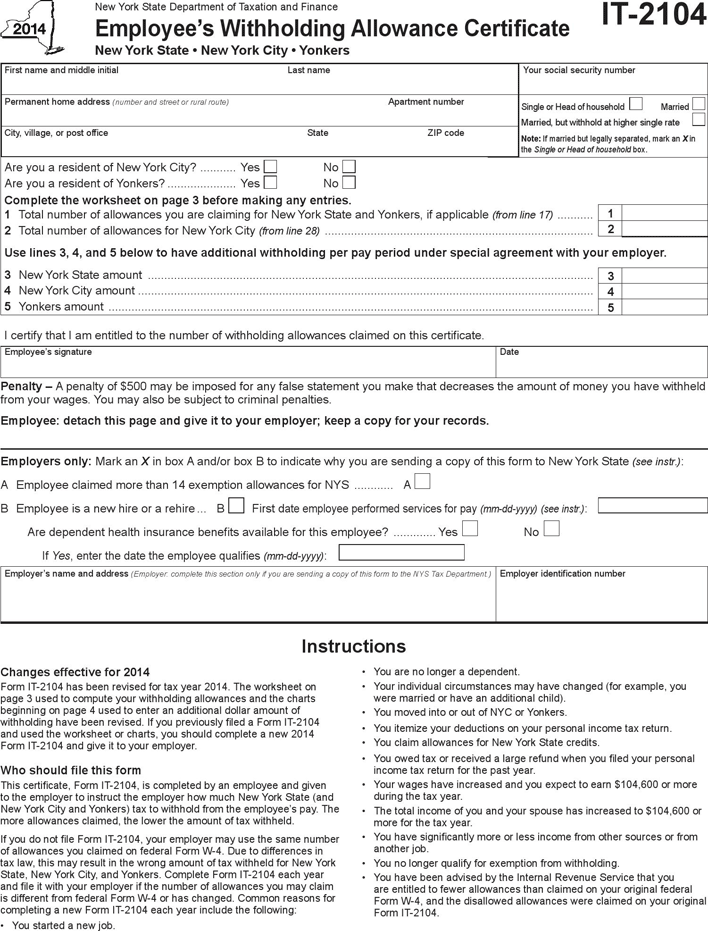

the number of claims for withholding allowances

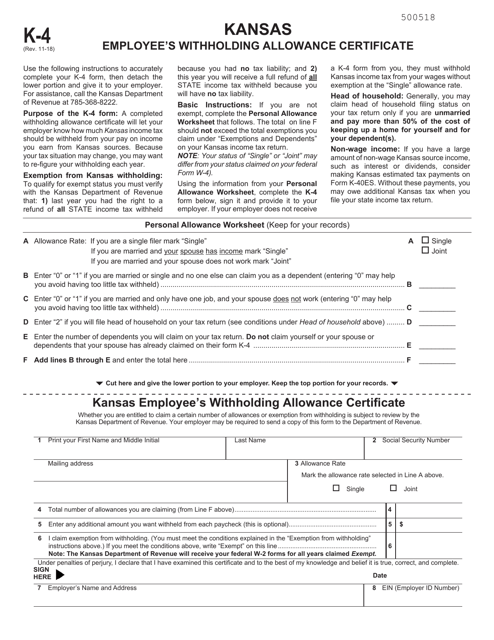

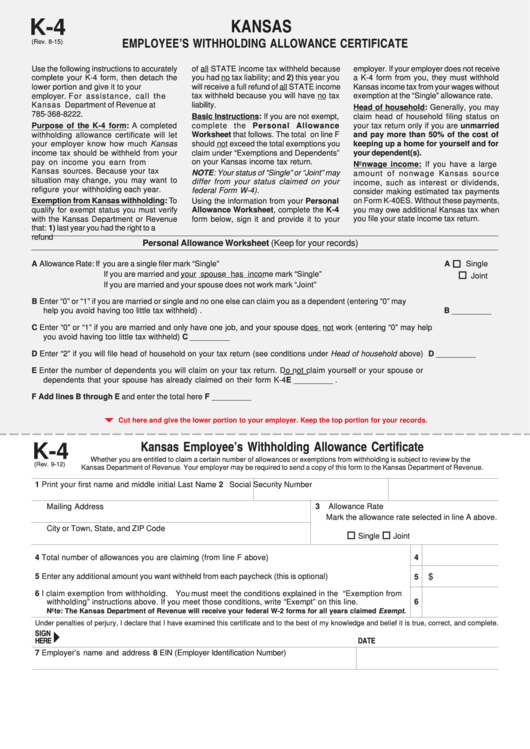

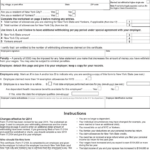

In submitting Form W-4 you should specify the number of withholding allowances you wish to claim. This is critical since your wages could be affected by the amount of tax you pay.

The amount of allowances you receive will depend on a variety of factors. For instance, if you are married, you might be qualified for an exemption for the head of household or for the household. The amount you earn will affect the amount of allowances you are entitled to. If you earn a higher income, you may be eligible for an increase in your allowance.

A tax deduction that is appropriate for your situation could help you avoid large tax payments. In reality, if you submit your annual income tax return, you could even be eligible for a tax refund. But you need to pick your strategy carefully.

As with any financial decision you make it is crucial to conduct your research. Calculators can be used to figure out how many withholding allowances must be requested. You may also talk to a specialist.

Filing specifications

Employers are required to report the company who withholds tax from their employees. A few of these taxes may be filed with the IRS by submitting paperwork. Other documents you might require to submit includes an withholding tax reconciliation and quarterly tax returns and the annual tax return. Here is some information on the different tax forms for withholding categories as well as the deadlines for the submission of these forms.

The salary, bonuses, commissions, and other earnings you earn from your employees could require you to submit withholding tax returns. If you make sure that your employees are paid on time, you could be eligible for the refund of taxes that you withheld. The fact that certain taxes are county taxes should be considered. In some situations the rules for withholding can be unique.

You must electronically submit tax withholding forms as per IRS regulations. The Federal Employer Identification Number should be included when you point your tax return for national revenue. If you don’t, you risk facing consequences.