2024 Georgia Withholding Form – There are many reasons why one might decide to complete a withholding form. This includes the need for documentation, withholding exemptions and the amount of required withholding allowances. No matter the motive someone has to fill out the Form there are some things to remember.

Withholding exemptions

Non-resident aliens are required to submit Form1040-NR once every year to file Form1040-NR. However, if you satisfy the criteria, you may be eligible to submit an exemption from withholding form. There are exemptions that you can access on this page.

Attaching Form 1042-S is the first step in submitting Form 1040-NR. This form is used to declare federal income tax. It outlines the withholding of the withholding agent. It is crucial to enter correct information when you complete the form. You could be required to treat one person for not providing the correct information.

The withholding rate for nonresident aliens is 30%. An exemption from withholding may be possible if you’ve got a an income tax burden of lower than 30 percent. There are many exemptions. Some are specifically for spouses, or dependents, for example, children.

In general, refunds are available for chapter 4 withholding. Refunds can be claimed in accordance with Sections 1401, 1474, and 1475. Refunds are given by the tax agent. This is the person who is responsible for withholding tax at the point of origin.

relationship status

An official marriage status withholding forms will assist both of you make the most of your time. Furthermore, the amount of money you may deposit at the bank can surprise you. Choosing which of the possibilities you’re likely decide is the biggest challenge. Certain, there are that you shouldn’t do. Making the wrong decision will cost you a lot. It’s not a problem If you simply adhere to the instructions and be attentive. If you’re lucky you may even meet acquaintances while traveling. Today marks the day you celebrate your marriage. I’m hoping you can use it against them to secure that dream wedding ring. To complete the task correctly it is necessary to obtain the assistance of a tax professional who is certified. A modest amount of money could create a lifetime’s worth of wealth. There are a myriad of online resources that provide information. TaxSlayer and other reputable tax preparation companies are some of the most reliable.

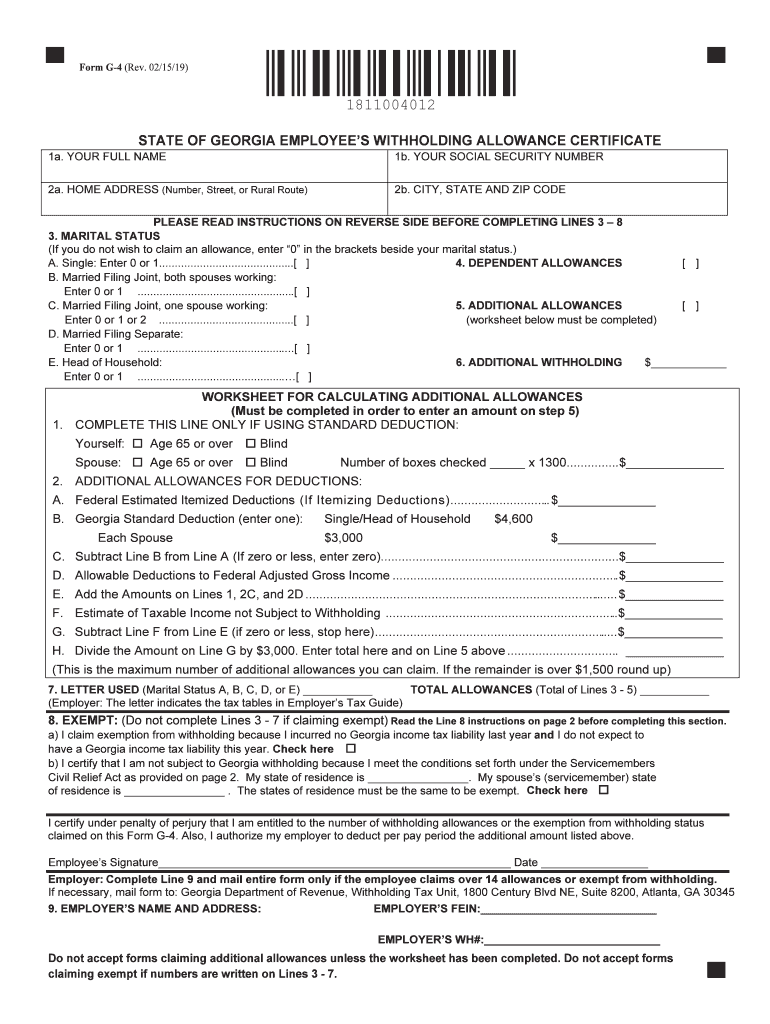

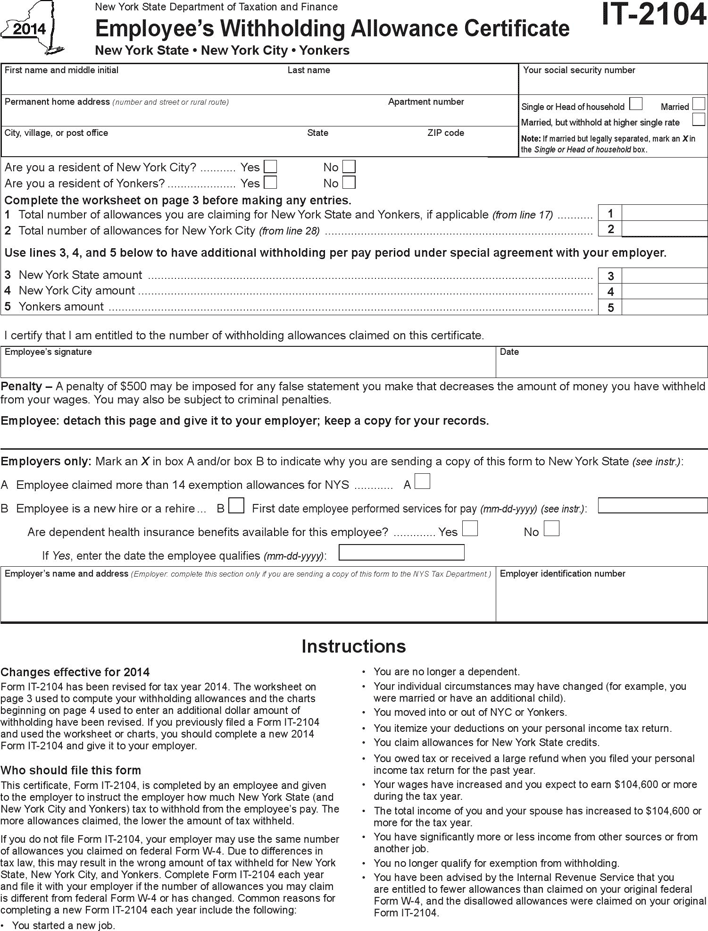

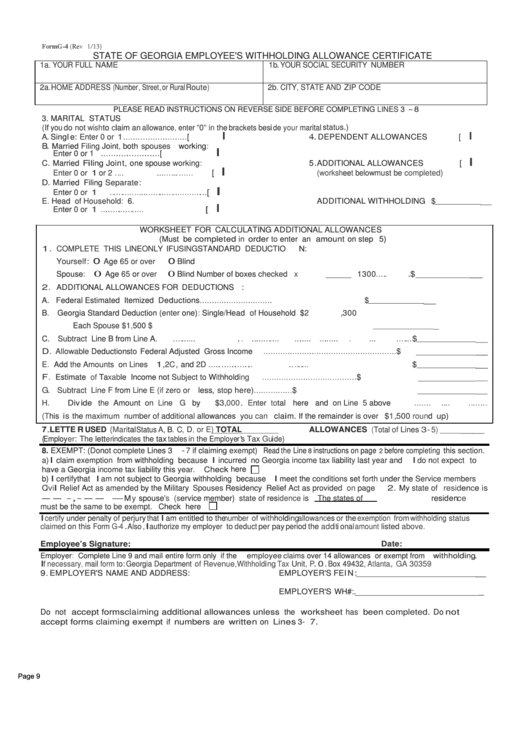

Number of claimed withholding allowances

It is crucial to indicate the amount of the withholding allowance you would like to claim on the form W-4. This is important because the tax withheld can affect the amount taken out of your paychecks.

There are many variables that affect the allowance amount that you can request. If you’re married you could be eligible for a head-of-household exemption. The amount you earn can affect the number of allowances accessible to you. If you have high income, you might be eligible to receive higher amounts.

Selecting the appropriate amount of tax deductions can help you avoid a hefty tax bill. If you submit the annual tax return for income, you may even be entitled to a refund. But , you have to choose your approach wisely.

Conduct your own research, just like you would with any other financial decision. Calculators are readily available to help you determine how much withholding allowances must be claimed. Another option is to talk with a specialist.

Formulating specifications

Employers are required to report any withholding taxes being paid by employees. The IRS may accept forms for certain taxes. There are other forms you may require like an annual tax return, or a withholding reconciliation. Here are the details on different tax forms that you can use for withholding as well as their deadlines.

You may have to file tax returns for withholding to claim the earnings you earn from employees, such as bonuses and commissions or salaries. You could also be eligible to receive reimbursement of taxes withheld if you’re employees were paid promptly. The fact that some of these taxes are county taxes ought to also be noted. In certain circumstances there are rules regarding withholding that can be unique.

You must electronically submit withholding forms in accordance with IRS regulations. If you are filing your national revenue tax returns, be sure to provide your Federal Employee Identification Number. If you don’t, you risk facing consequences.