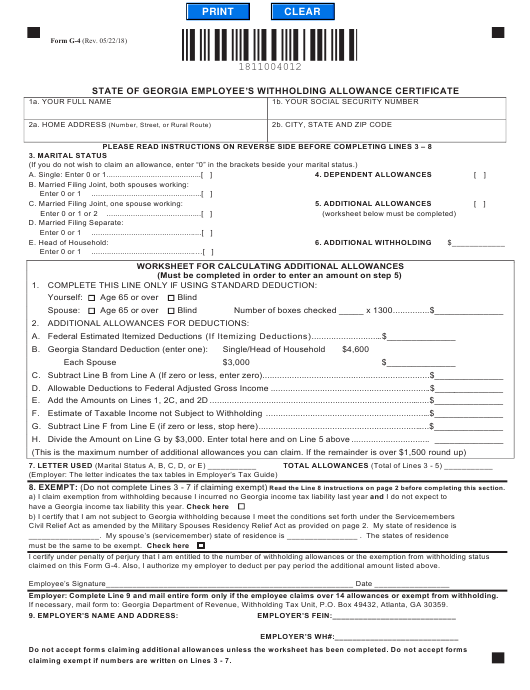

2024 Ga Withholding Form – There are a variety of reasons someone may choose to fill out withholding forms. This is due to the requirement for documentation, exemptions from withholding and also the amount of withholding allowances. You should be aware of these factors regardless of the reason you decide to fill out a form.

Withholding exemptions

Non-resident aliens are required to submit Form 1040NR once every year. You may be eligible to file an exemption form for withholding, if you meet all the conditions. The exclusions you can find here are yours.

To submit Form 1040-NR, the first step is attaching Form 1042S. The document lists the amount withheld by the tax authorities for federal tax reporting for tax reporting purposes. Make sure you fill out the form correctly. If the information you provide is not supplied, one person may be treated.

The rate of withholding for non-resident aliens is 30%. Nonresident aliens could be qualified for an exemption. This is the case if your tax burden less than 30 percent. There are several different exclusions that are available. Certain of them are applicable to spouses or dependents like children.

In general, chapter 4 withholding allows you to receive a refund. Refunds are made according to Sections 471 through 474. Refunds are given by the withholding agent. The withholding agent is the person who is responsible for withholding tax at the source.

Status of the relationship

The work of your spouse and you can be made easier by a proper marriage status withholding form. You’ll be amazed at how much money you can put in the bank. The challenge is picking the right bank from the multitude of options. There are certain aspects to avoid. A bad decision can cost you a lot. If the rules are followed and you pay attention, you should not have any problems. If you’re lucky enough to meet some new acquaintances while on the road. Today marks the anniversary. I’m hoping you’ll be able to take advantage of it to find that elusive wedding ring. For a successful approach, you will need the aid of a qualified accountant. It’s worthwhile to accumulate wealth over the course of your life. You can get plenty of information on the internet. TaxSlayer, a reputable tax preparation company is among the most helpful.

Amount of withholding allowances claimed

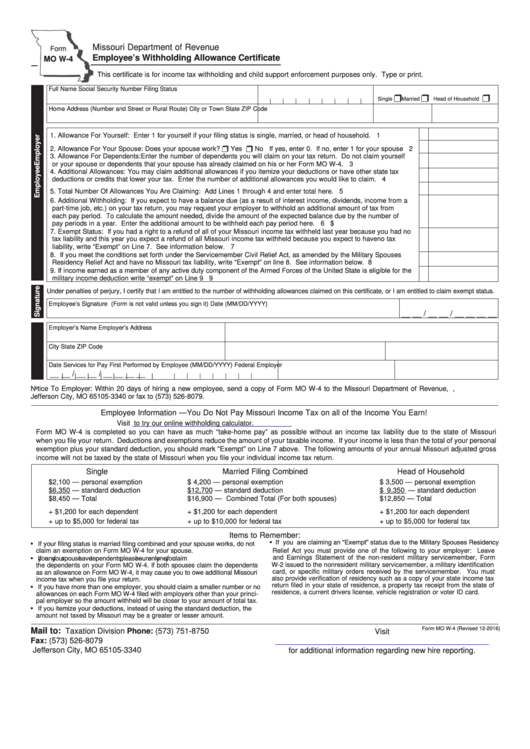

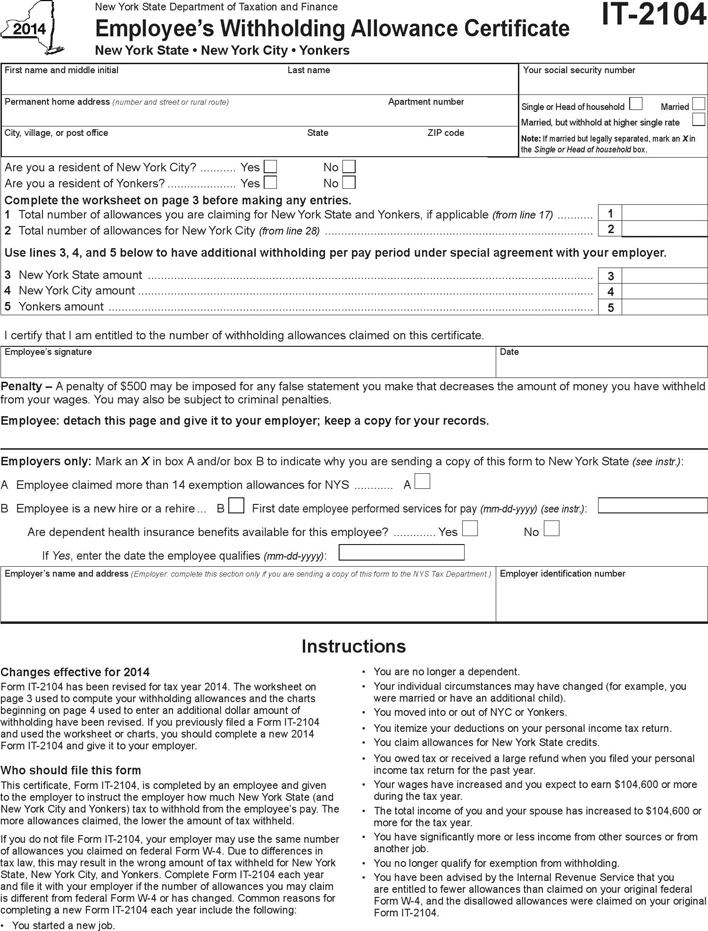

The W-4 form must be completed with the amount of withholding allowances you want to claim. This is important since your wages could depend on the tax amount you have to pay.

There are many variables that affect the allowance amount you can request. If you’re married, you might be qualified for an exemption for head of household. The amount you’re eligible to claim will depend on your income. If you earn a high amount you may be eligible to receive more allowances.

A tax deduction suitable for you can aid you in avoiding large tax payments. Refunds could be possible if you file your income tax return for the previous year. However, you must choose your approach wisely.

As with any financial decision, you should conduct your homework. Calculators are a great tool to determine the amount of withholding allowances you should claim. A better option is to consult with a professional.

filing specifications

Employers are required to report any withholding taxes that are being taken from employees. In the case of a small amount of the taxes, you are able to provide documentation to the IRS. There are additional forms you could require, such as a quarterly tax return or withholding reconciliation. Here’s a brief overview of the different tax forms and when they must be filed.

To be eligible to receive reimbursement for withholding taxes on the compensation, bonuses, salary or any other earnings that your employees receive it is possible to file a tax return for withholding. You could also be eligible to receive reimbursement for tax withholding if your employees received their wages in time. Be aware that certain taxes may be county taxes. There are also unique withholding techniques that can be used in specific situations.

The IRS regulations require that you electronically submit withholding documents. When filing your tax returns for national revenue ensure that you provide the Federal Employee Identification Number. If you don’t, you risk facing consequences.

Gallery of 2024 Ga Withholding Form

2022 Ga Tax Withholding Form WithholdingForm