2024 Form Or-wr Oregon Annual Withholding Tax Reconciliation Report – There are many reasons someone could choose to submit an application for withholding. This includes documentation requirements as well as exemptions from withholding, as well as the quantity of requested withholding allowances. It doesn’t matter what reason someone chooses to file a Form There are a few points to be aware of.

Withholding exemptions

Non-resident aliens must submit Form 1040NR once every year. It is possible to apply for an exemption for withholding tax when you meet the conditions. This page will provide all exemptions.

For submitting Form 1040-NR attach Form 1042-S. This form lists the amount that is withheld by the tax withholding authorities to report federal income tax purposes. When filling out the form, ensure that you provide the exact details. A person could be treated if this information is not entered.

The rate of withholding for non-resident aliens is 30 percent. You may be eligible to get an exemption from withholding if the tax burden exceeds 30%. There are several different exclusions that are available. Some are specifically for spouses, and dependents, like children.

Generallyspeaking, withholding in Chapter 4 entitles you for an amount of money back. Refunds are made under Sections 471 through 474. The refunds are made by the agent who withholds tax. This is the person accountable for tax withholding at the point of origin.

Relational status

You and your spouse’s work is made simpler by a proper marriage status withholding form. You’ll be amazed at how much money you could make a deposit to the bank. It is difficult to decide which one of the options you’ll choose. There are some things you should avoid doing. Making the wrong decision will cost you a lot. If you stick to it and pay attention to instructions, you won’t have any issues. If you’re lucky, you might be able to make new friends as you travel. Today is the anniversary of your wedding. I hope you will utilize it against them to find that elusive wedding ring. If you want to get it right you’ll need the assistance of a certified accountant. A lifetime of wealth is worth the modest payment. There is a wealth of details online. TaxSlayer and other reputable tax preparation firms are some of the top.

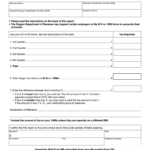

Amount of withholding allowances claimed

In submitting Form W-4 you need to specify how many withholdings allowances you would like to claim. This is important because the withholdings will have an effect on the amount of tax is taken from your pay checks.

Many factors affect the allowances requested.If you’re married, for instance, you may be able to apply for a head of household exemption. The amount you earn will affect the amount of allowances you can receive. If you have high income it could be possible to receive higher amounts.

It is possible to reduce the amount of your tax bill by selecting the correct amount of tax deductions. A refund could be possible if you file your tax return on income for the year. But , you have to choose the right method.

It is essential to do your homework, just like you would with any financial choice. Calculators can be utilized for determining how many allowances for withholding are required to be made. Alternate options include speaking to an expert.

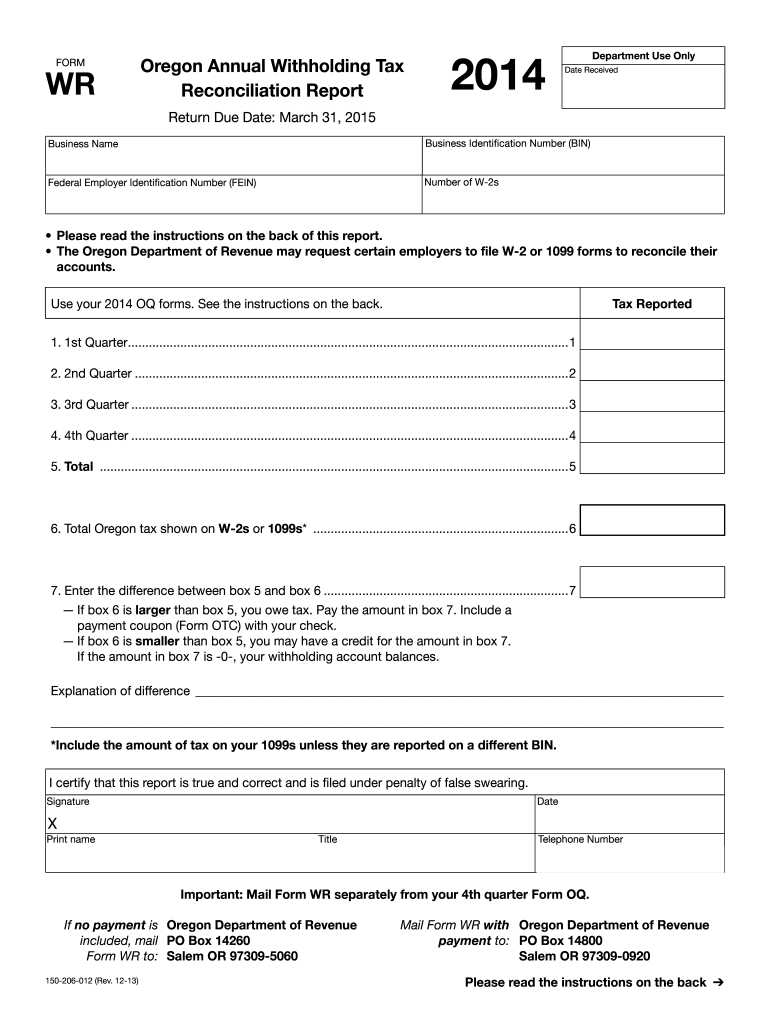

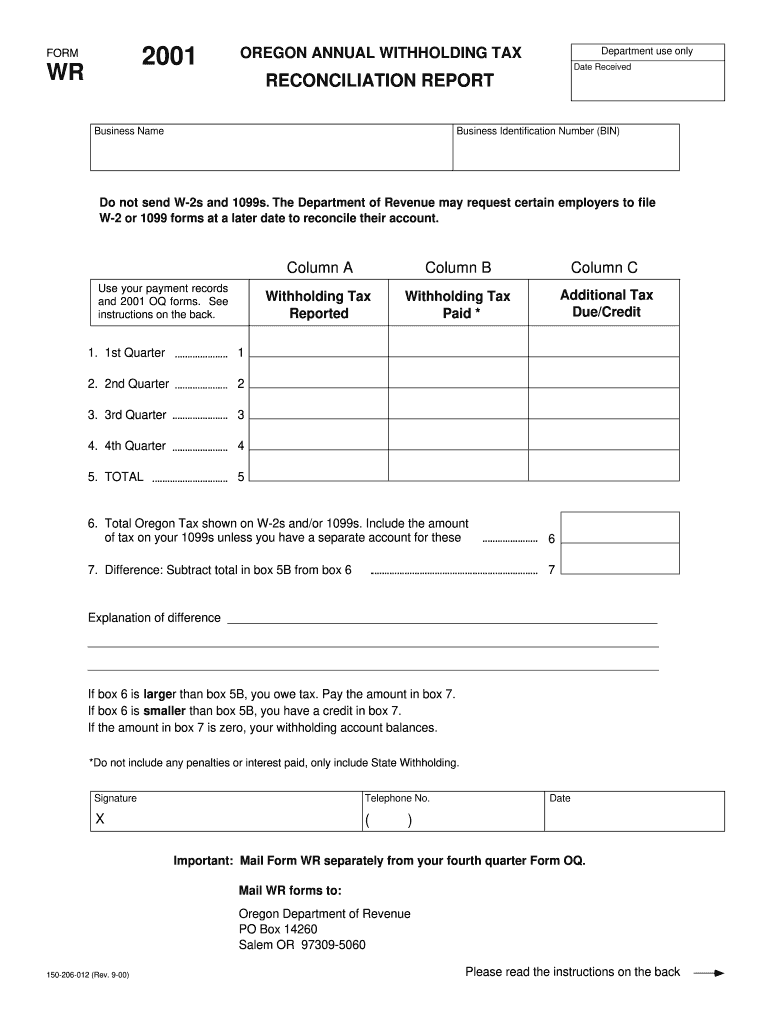

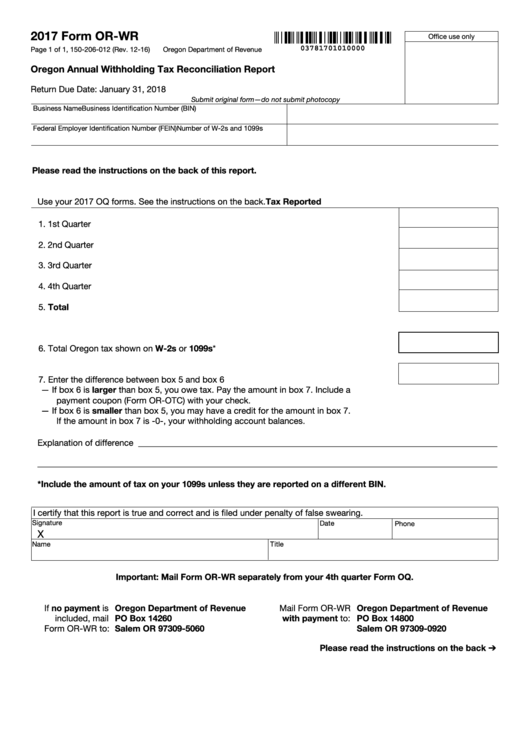

Filing specifications

Employers must report the employer who withholds taxes from their employees. For a limited number of these taxes, you can send paperwork to IRS. A tax return that is annually filed and quarterly tax returns as well as withholding tax reconciliation are all examples of paperwork you might need. Here’s some details on the various withholding tax form categories as well as the deadlines for filing them.

Your employees might require the submission of withholding tax returns in order to receive their wages, bonuses and commissions. You could also be eligible to be reimbursed for taxes withheld if your employees received their wages in time. Be aware that these taxes could be considered to be local taxes. In some situations the rules for withholding can be different.

In accordance with IRS rules, you must electronically file withholding forms. Your Federal Employer Identification Number should be listed when you submit to your national tax return. If you don’t, you risk facing consequences.