2024 Federal Withholding Forms – There are many reasons someone might choose to complete a form for withholding form. This is due to the requirement for documentation, exemptions to withholding and the amount of withholding allowances. You should be aware of these things regardless of your reason for choosing to file a request form.

Withholding exemptions

Nonresident aliens need to submit Form 1040–NR at least once per calendar year. If the requirements are met, you could be eligible for an exemption from withholding. The exclusions are that you can access on this page.

The application of Form 1042-S to Form 1042-S is a first step in submitting Form 1040-NR. This form provides details about the withholding process carried out by the agency responsible for withholding for federal tax reporting for tax reporting purposes. Make sure you enter the right information when filling in this form. It is possible for a individual to be treated in a manner that is not correct if the correct information is not provided.

Nonresident aliens have the option of paying a 30% tax on withholding. Non-resident aliens may be eligible for an exemption. This applies the case if your tax burden lower than 30%. There are a variety of exclusions. Some are specifically designed for spouses, whereas others are designed to be used by dependents like children.

Generally, you are entitled to a reimbursement under chapter 4. Refunds are made under Sections 471 through 474. These refunds must be made by the tax withholding agents who is the person who withholds taxes at source.

Relational status

The work of your spouse and you is made simpler with a valid marriage status withholding form. You’ll also be surprised by how much money you could deposit at the bank. The difficulty lies in picking the right bank out of the many options. Certain aspects should be avoided. Making the wrong choice could cost you dearly. But if you adhere to the instructions and be alert for any potential pitfalls You won’t face any issues. It is possible to make new friends if you are fortunate. Today is the anniversary date of your wedding. I hope you are able to use this against them to obtain that elusive wedding ring. To do it right, you will need the assistance of a certified accountant. The accumulation of wealth over time is more than that small amount. You can get a ton of information online. Reputable tax preparation firms like TaxSlayer are among the most efficient.

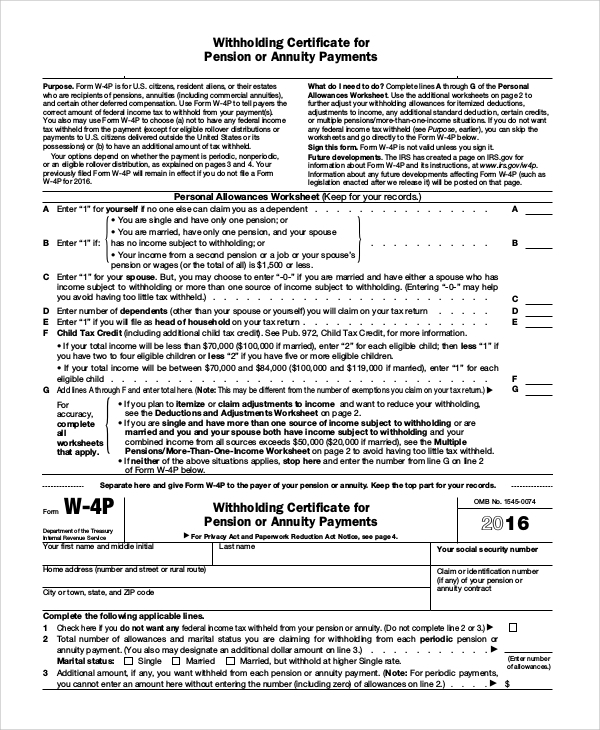

The amount of withholding allowances claimed

On the Form W-4 that you file, you should indicate how many withholding allowances are you seeking. This is important because the amount of tax withdrawn from your paycheck will be affected by how much you withhold.

The amount of allowances that you are entitled to will be determined by the various aspects. For example If you’re married, you might be qualified for an exemption for the head of household or for the household. Your income level also affects the amount of allowances you’re entitled to. If you earn a substantial income, you can request a higher allowance.

You may be able to save money on a tax bill by deciding on the correct amount of tax deductions. In reality, if you file your annual income tax return, you may even be eligible for a tax refund. But be sure to choose the right method.

Similar to any other financial decision, you should conduct your homework. Calculators can aid you in determining the amount of withholding allowances must be claimed. A professional could be a good alternative.

Specifications for filing

Employers must report the employer who withholds tax from employees. If you are unable to collect the taxes, you are able to provide documentation to the IRS. There are additional forms you could require, such as the quarterly tax return or withholding reconciliation. Here are the details on different tax forms that you can use for withholding as well as the deadlines for each.

In order to be qualified for reimbursement of tax withholding on salary, bonus, commissions or any other earnings earned by your employees You may be required to file a tax return for withholding. If you also pay your employees on time it could be possible to qualify to receive reimbursement for taxes that were withheld. Be aware that these taxes may be considered to be taxation by the county. Furthermore, there are special withholding practices that can be implemented in specific circumstances.

As per IRS regulations the IRS regulations, electronic submissions of withholding forms are required. It is mandatory to provide your Federal Employer ID Number when you file your national income tax return. If you don’t, you risk facing consequences.