2024 Arkansas State Withholding Form – There are many reasons for a person to decide to fill out a form for withholding. These factors include documentation requirements and exemptions from withholding. There are some points to be aware of regardless of the reason the person fills out an application.

Exemptions from withholding

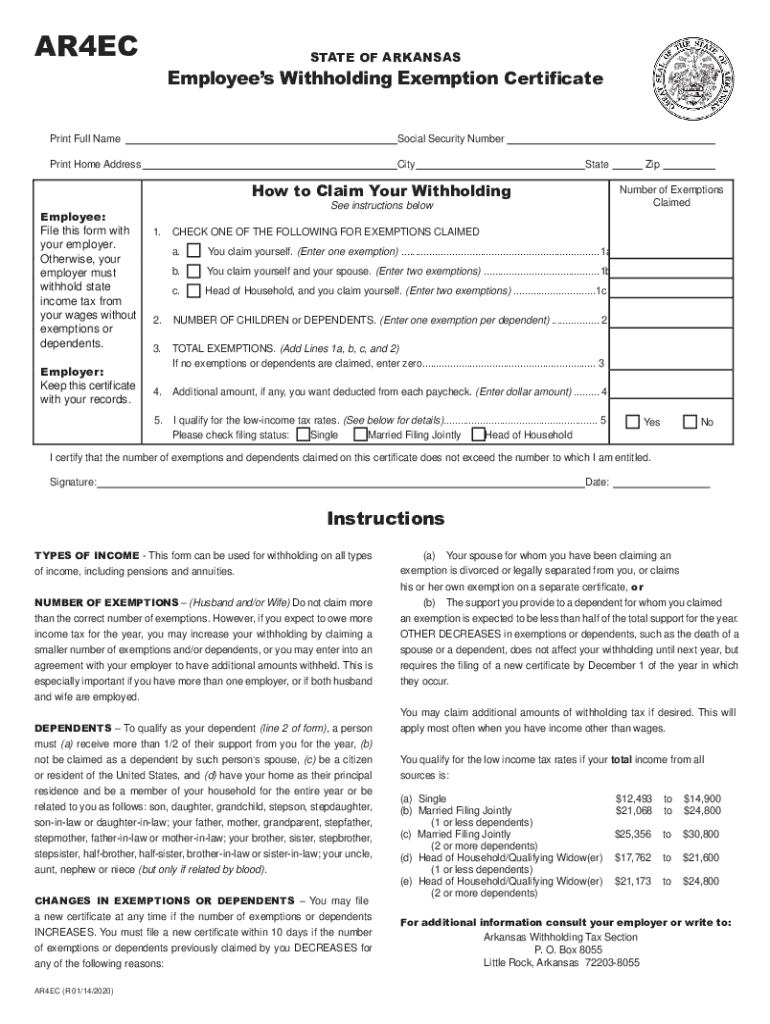

Non-resident aliens must submit Form 1040 NR once each year. If you meet the criteria, you may be eligible to be exempt from withholding. The exclusions you can find here are yours.

To submit Form 1040-NR The first step is attaching Form 1042S. The form is used to report federal income tax. It details the withholding by the withholding agent. Make sure you enter the right information when filling in this form. This information might not be disclosed and result in one person being treated differently.

Nonresident aliens have the option of paying a 30% tax on withholding. You may be eligible to be exempted from withholding tax if your tax burden exceeds 30%. There are many different exemptions. Some of them are intended to be used by spouses, while some are designed for use by dependents, such as children.

The majority of the time, a refund is accessible for Chapter 4 withholding. In accordance with Section 1471 through 1474, refunds are given. Refunds are given by the withholding agent. This is the person accountable for tax withholding at the point of origin.

Status of relationships

Your and your spouse’s job is made simpler by the proper marriage status withholding form. You’ll be amazed at the amount you can deposit at the bank. Knowing which of the many possibilities you’re likely choose is the challenge. There are certain things you should avoid doing. Making the wrong choice could cost you a lot. You won’t have any issues if you just follow the directions and be attentive. If you’re lucky enough, you might find some new acquaintances while driving. Today is your anniversary. I’m sure you’ll be able to make use of it to secure that dream engagement ring. It’s a difficult job that requires the knowledge of a tax professional. The small amount is well worth it for a life-long wealth. You can find tons of information on the internet. TaxSlayer is a reputable tax preparation firm.

number of claimed withholding allowances

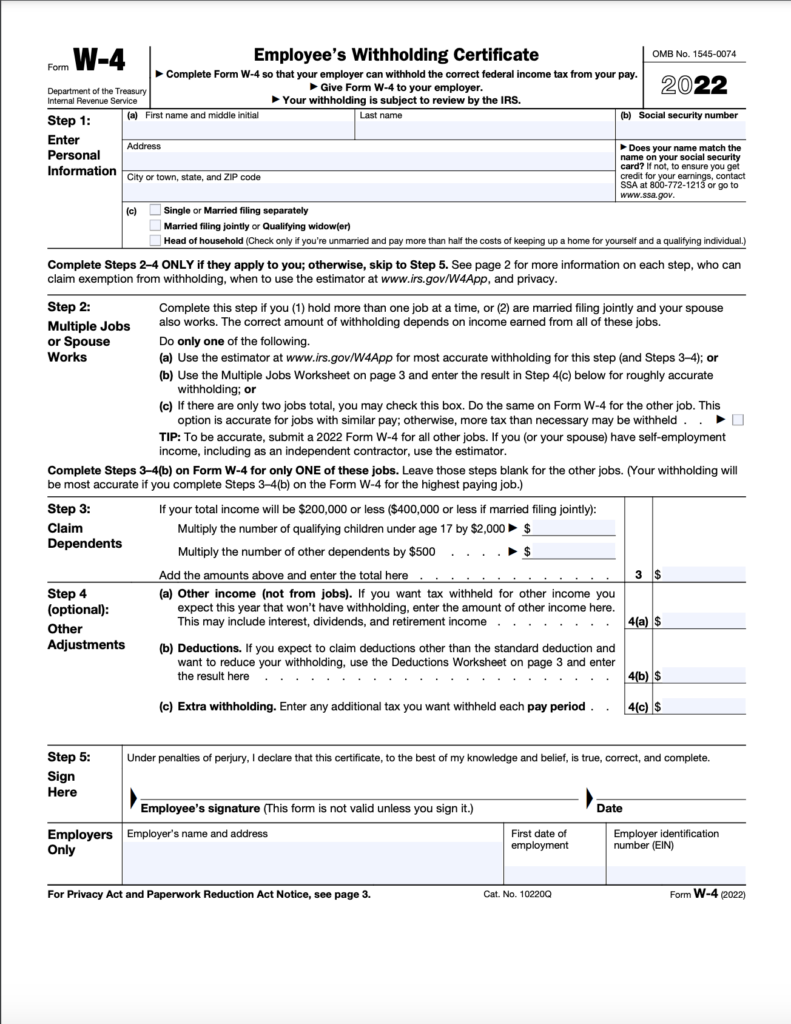

The W-4 form must be filled in with the amount of withholding allowances you would like to be able to claim. This is crucial since the tax withheld can affect the amount taken out of your paycheck.

There are a variety of factors that affect the amount of allowances you are able to claim. If you’re married, you could be eligible for a head-of-household exemption. Your income level also affects the amount of allowances you’re entitled to. If you have high income, you might be eligible to receive a higher allowance.

It is possible to avoid paying a large tax bill by selecting the right amount of tax deductions. If you submit your annual income tax return, you could even be eligible for a tax refund. It is essential to pick the right method.

Just like with any financial decision it is crucial to do your homework. Calculators can be used to figure out how many withholding allowances you should claim. An alternative is to speak to a professional.

Filing requirements

Withholding tax from employees need to be collected and reported when you are an employer. For a limited number of the taxes, you are able to provide documentation to the IRS. A tax return for the year and quarterly tax returns, or tax withholding reconciliations are just a few types of documents you could require. Here are some specifics on the different types of tax forms for withholding as well as the filing deadlines.

The bonuses, salary, commissions, and other earnings you earn from your employees may require you to submit withholding tax returns. If you paid your employees on time, you could be eligible to receive reimbursement for taxes that you withheld. Be aware that these taxes can be considered to be taxation by the county. In some situations the rules for withholding can be different.

In accordance with IRS rules, you are required to electronically submit withholding forms. It is mandatory to include your Federal Employer Identification Number when you file your national income tax return. If you don’t, you risk facing consequences.